Clicks, bricks and China’s shopping fix

Retail landlords need to think quickly and laterally to thrive in China’s diverse and innovative retail market.

Savills China 20 Retail Cities report examines the state of the retail market across 20 major cities and ranks them according to macroeconomic and store openings by international brands. The mature markets of Shanghai, Beijing, Shenzhen and Chengdu remain at the top of the rankings, while Hangzhou, Xi’an and Changsha moved up the ranking.

China’s retail landscape is incredibly diverse, with varying consumer habits across regions and cities; moreover it is the world’s most dynamic e-commerce market with the most adventurous consumers. Tech giants such as Alibaba and Tencent are now playing a role in physical retail.

Innovation is widespread. Recent new ideas include branded hotels opened by Japanese retailer Muji, sports brands New Balance and Puma opening gyms in their stores, while Kerr & Kroes offer virtual reality dressing rooms.

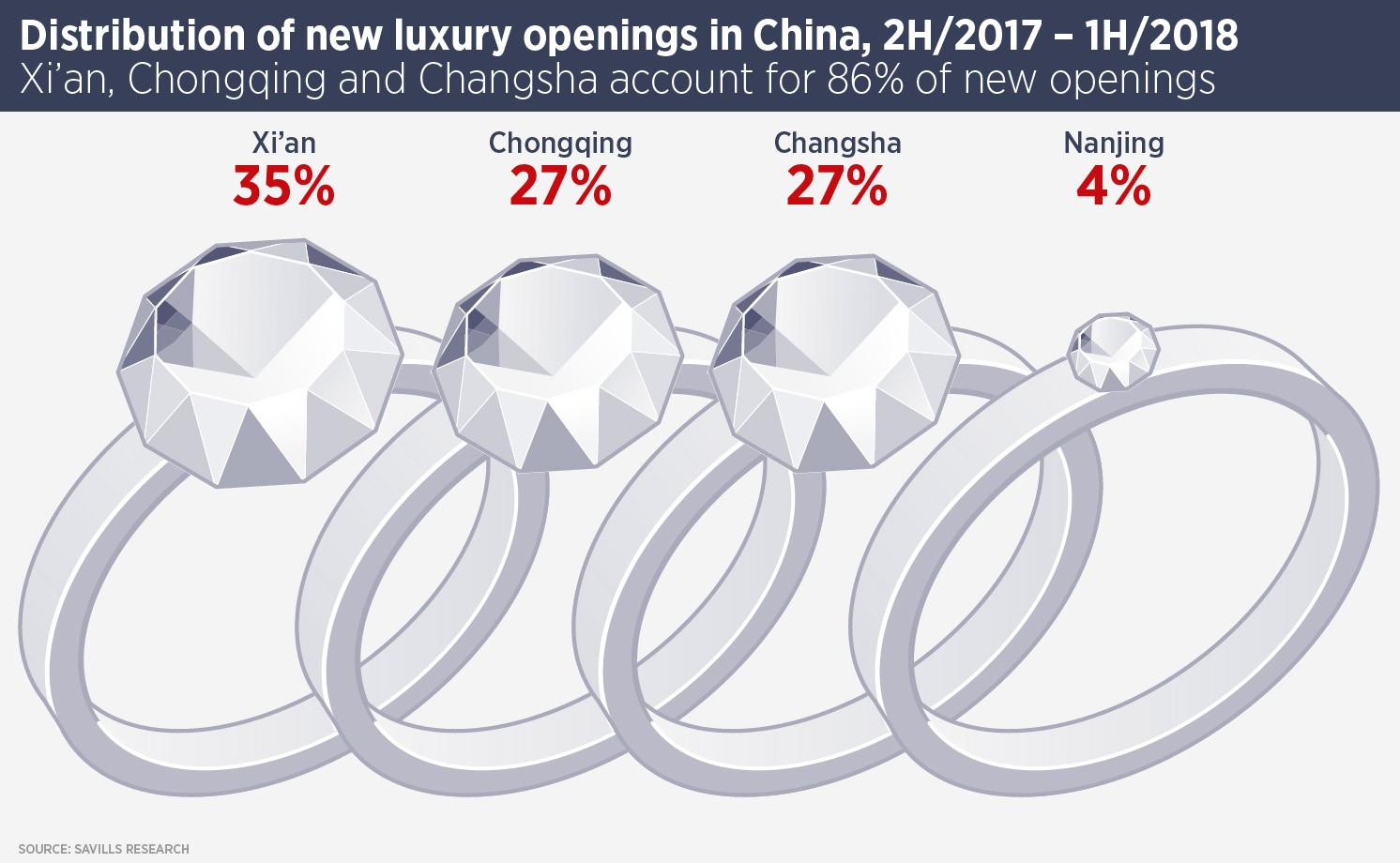

Luxury retail sales have been improving since 2016 and luxury retail sales in China rose 20% to $26bn last year according to Bain & Co, which is predicting similar growth for this year. This increased spending has encouraged brands to look further afield: Xi’an, Chongqing and Changsha accounted for nearly 90% of new luxury openings in the 12 months to June, out of the brands and cities which were surveyed. More generally, however, luxury retailers are upgrading their best stores, rather than opening new ones.

A fresh challenge for landlords of high-end malls is that luxury goods spending is moving online; McKinsey predicts that 11% of China’s luxury goods shopping will be online by 2020. Younger consumers in particular connect with brands online and are more likely to buy high-end goods outside a store.

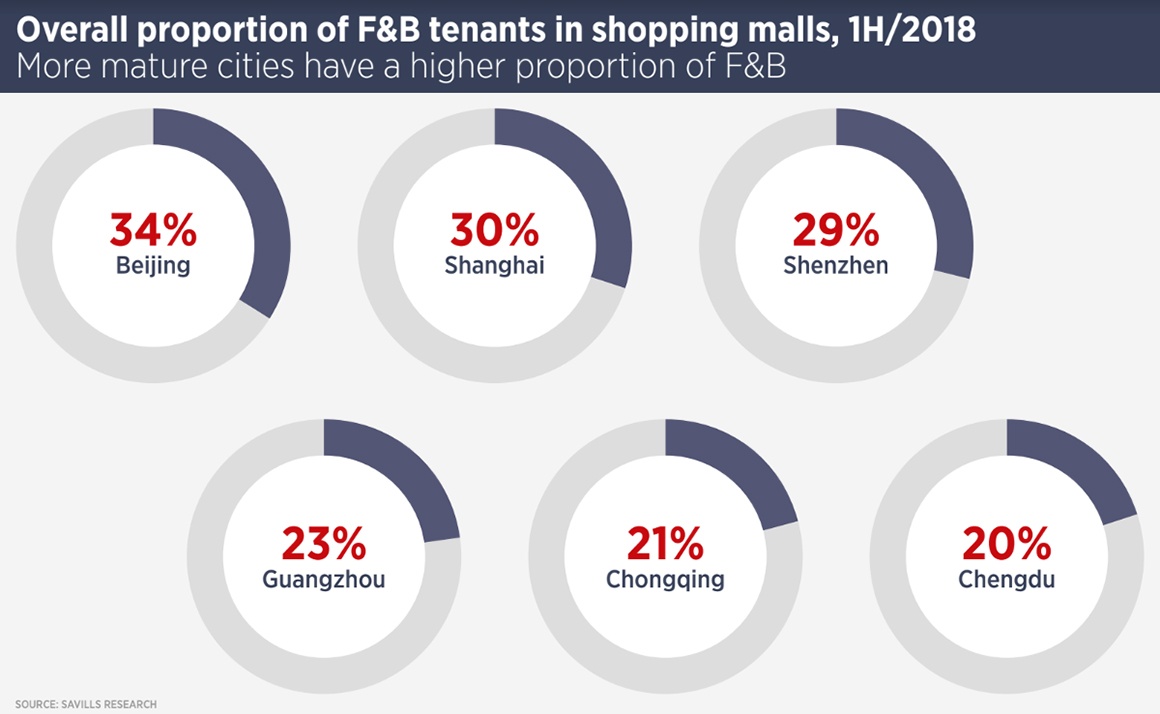

The importance of food and beverage outlets to retail malls has never been greater and China is arguably ahead of the curve in recognising this. Shopping centres increasingly rely upon restaurants and other eateries to attract crowds. F&B now accounts for roughly 29% of a shopping mall’s net leasable area (NLA) on average in the four first-tier cities. Recently completed malls have generally allocated more space to F&B tenants, taking as much space as half of total NLA for some malls.

Significant regional differences in palates and spending power have made it difficult for national operators to emerge; the 100 largest F&B retailers account for only 7% of the market. With over 5,000 restaurants, KFC is now the largest foreign fast food chain in China, while Starbucks has 2,800 stores, making China the company’s second largest market after the US.

Shanghai and Beijing are diverse F&B markets with regular new entries from foreign brands. In contrast, 40% of F&B retailers in Changsha sell local food.

Further reading:

Savills China

Contact Us:

Simon Smith