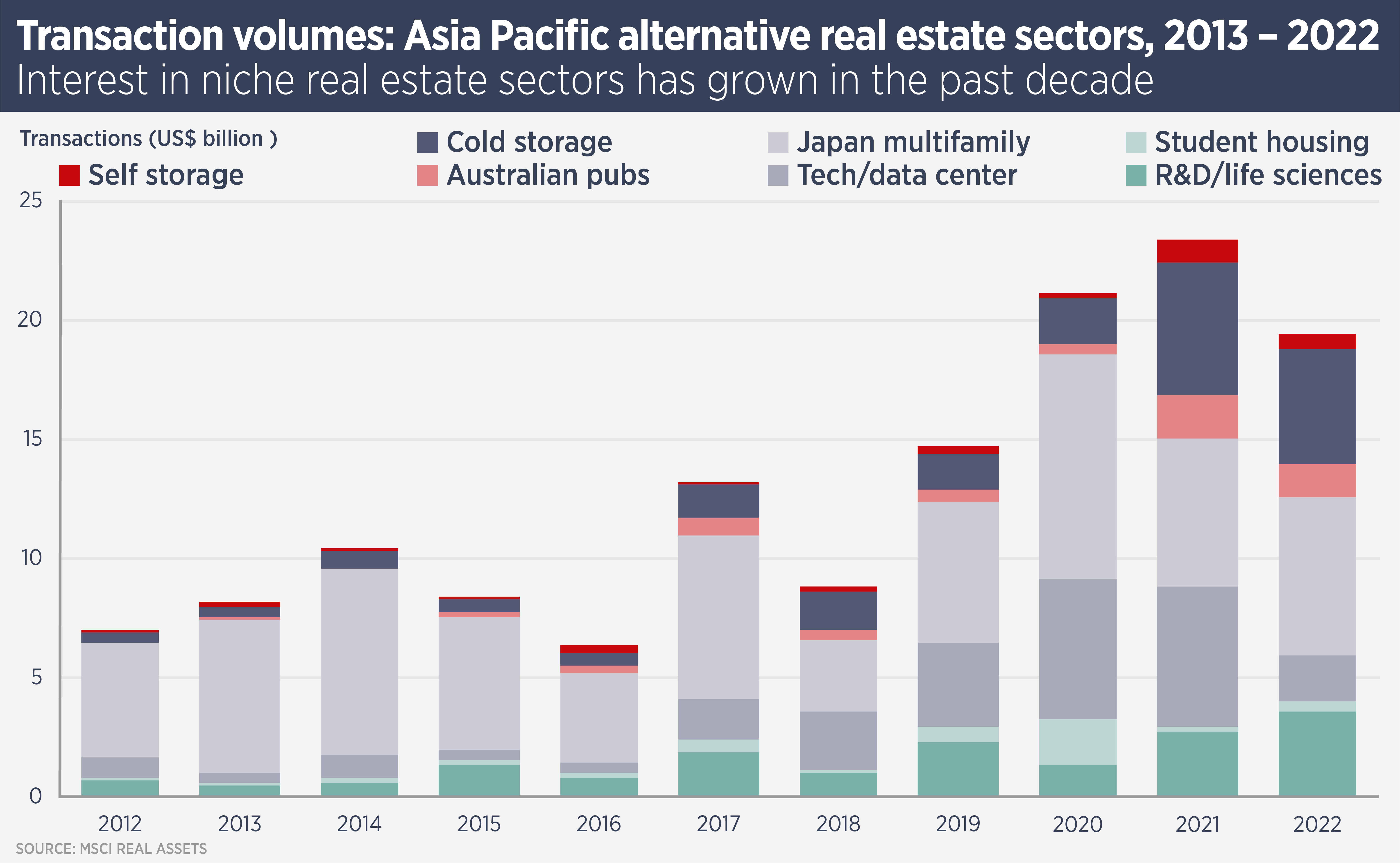

Sectors

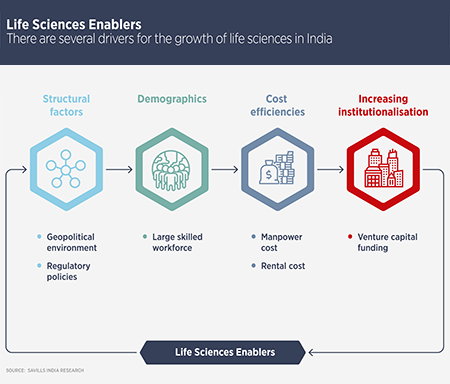

Insights into the multiplicity of Asia Pacific real estate sectors, from well-established investor favourites to burgeoning niches driven by the forces of the new economy; here you can find intelligence on sectors including residential, logistics, offices, data centres, luxury retail and real estate debt.