Asia dominates luxury retail openings

Discover the latest trends in luxury retail across Asia as China maintains its dominance in new store openings. Uncover the changing landscape as developing markets in Southeast Asia surge ahead.

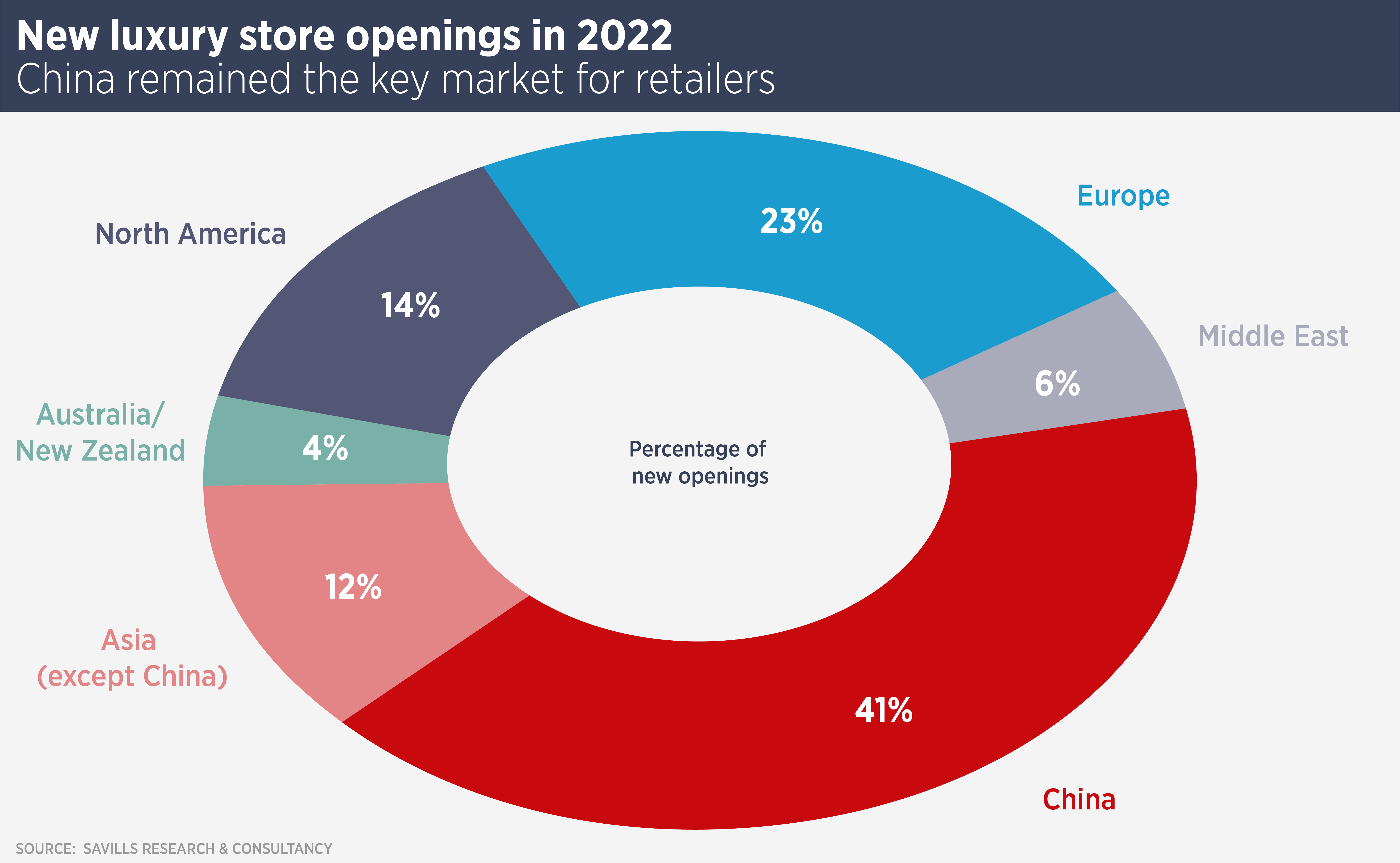

Luxury retailers are still focused on Asia, with China seeing more new store openings last year than Europe and North America combined.

However, the picture is changing as China recovers sluggishly from the pandemic and developing markets in Southeast Asia keep growing. Meanwhile, Savills is predicting a strong recovery for Hong Kong in 2024, after several difficult years.

Savills 2023 luxury retail outlook reports that China accounted for 44% of new luxury stores opened worldwide last year, more than North America (14%) and Europe (23%) combined. However in 2021, more than half the global total of new openings came in China.

“Concerns have been raised about the impact of slower economic growth and youth unemployment (now over 20%) on the longer-term outlook for the retail sector,” says James Macdonald, Head of China Research at Savills. “However, while the overall retail sales recovery has been underwhelming, luxury seems to be holding up well with brands continuing to invest in operations and roll out new stores. We are also seeing some new international brands enter the market for the first time,” he says.

Morgan Stanley analysts have taken a bullish stance on China luxury retail, saying the sector will benefit both at home and abroad from a recovery in spending and travel by wealthy Chinese. “Chinese nationals are likely to account for 60% of total spending growth on personal luxury goods through 2030,” analysts said in a recent report.

Since the end of pandemic restrictions, Chinese tourists have mainly stayed at home or travelled within Asia, which has been a boost for markets such as Japan and Thailand. Luxury retail in Japan “continued to perform strongly because of the heightened demand from high-net-worth individuals who fared better throughout the pandemic,” says Tetsuya Kaneko, Head of Japan Research at Savills.

Asia ex-China accounted for 12% of global luxury retail openings last year, up from 10% in 2021, and Southeast Asia offers further growth potential, says Nick Bradstreet, Head of Asia Pacific Retail at Savills.

“Stand out markets in this region include Singapore, Thailand and Vietnam. They all share growing economies and expanding high net worth populations, including a widening profile of luxury hotels and members clubs. As a result, a number of luxury retailers are focusing their attention on them.”

Hong Kong has long been a major focus for luxury spending in Asia, thanks to its wealthy local population and visitors from Mainland China. Since the 2019 protests and the pandemic, visitor numbers have fallen and the luxury sector has been weaker. Now Savills predicts the decline in Mainland visitors will reverse this year and that 2024 will see 55 million visitors to the city, a return to pre-protest and covid levels.

Bradstreet says: “Improving sales, and the fact that prime headline rents in key luxury locations are still 10% below pre-covid levels, means that for luxury brands not represented yet in Hong Kong, now may be a good time to take a position.”

Further reading:

Global luxury retail outlook 2023

Contact Us:

James Macdonald | Tetsuya Kaneko | Nick Bradstreet