Asia’s uneven office recovery

Learn about the current state of the office sectors in Asia Pacific cities post-pandemic, including trends in prime office rents, vacancy rates, and supply. Savills data shows how some cities are recovering well while others are struggling to bounce back.

Asia Pacific cities have emerged from the pandemic, but their office sectors are still struggling with cyclical and structural challenges. Some cities appear well into their recovery, while others are struggling to shake off the covid hangover.

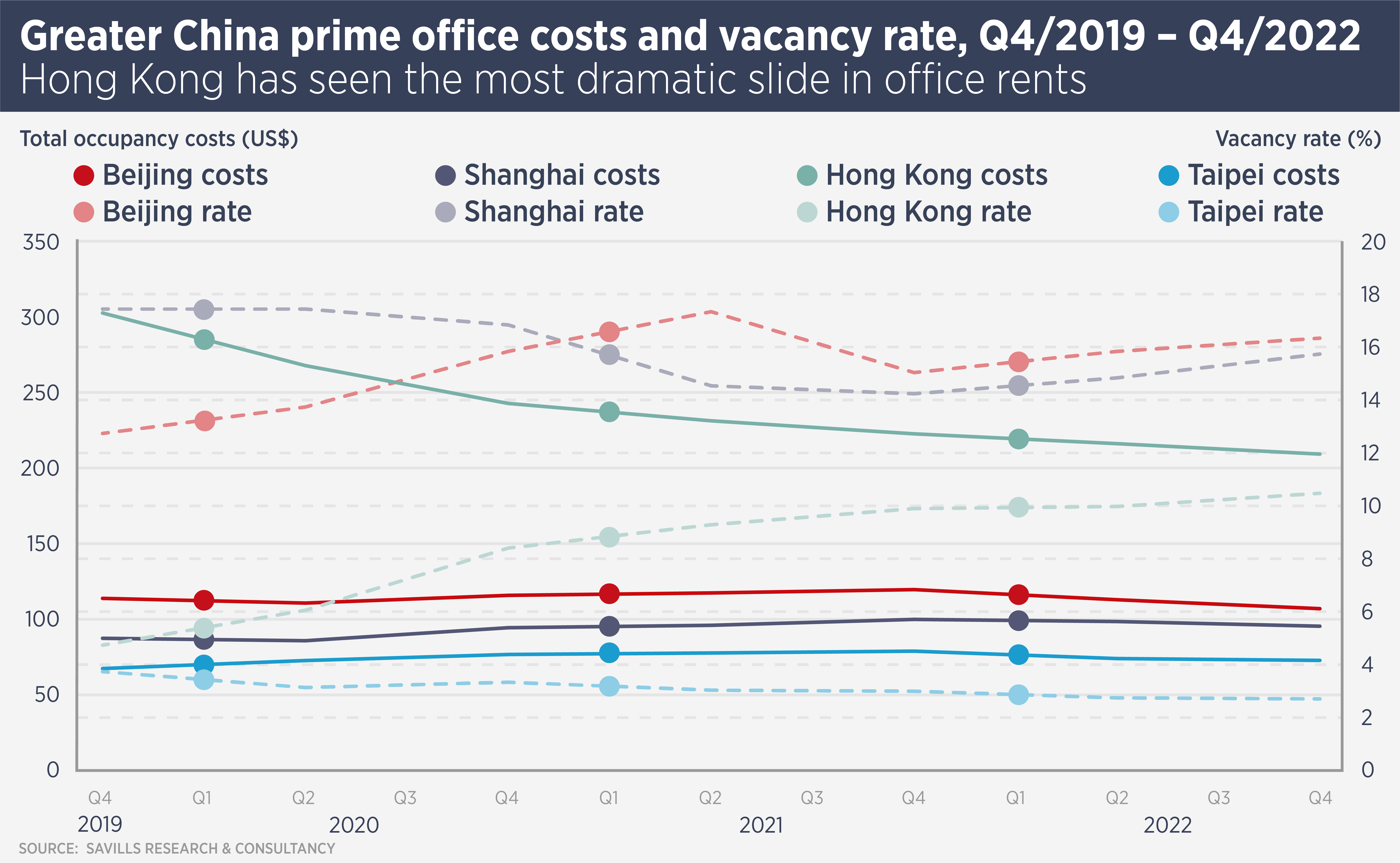

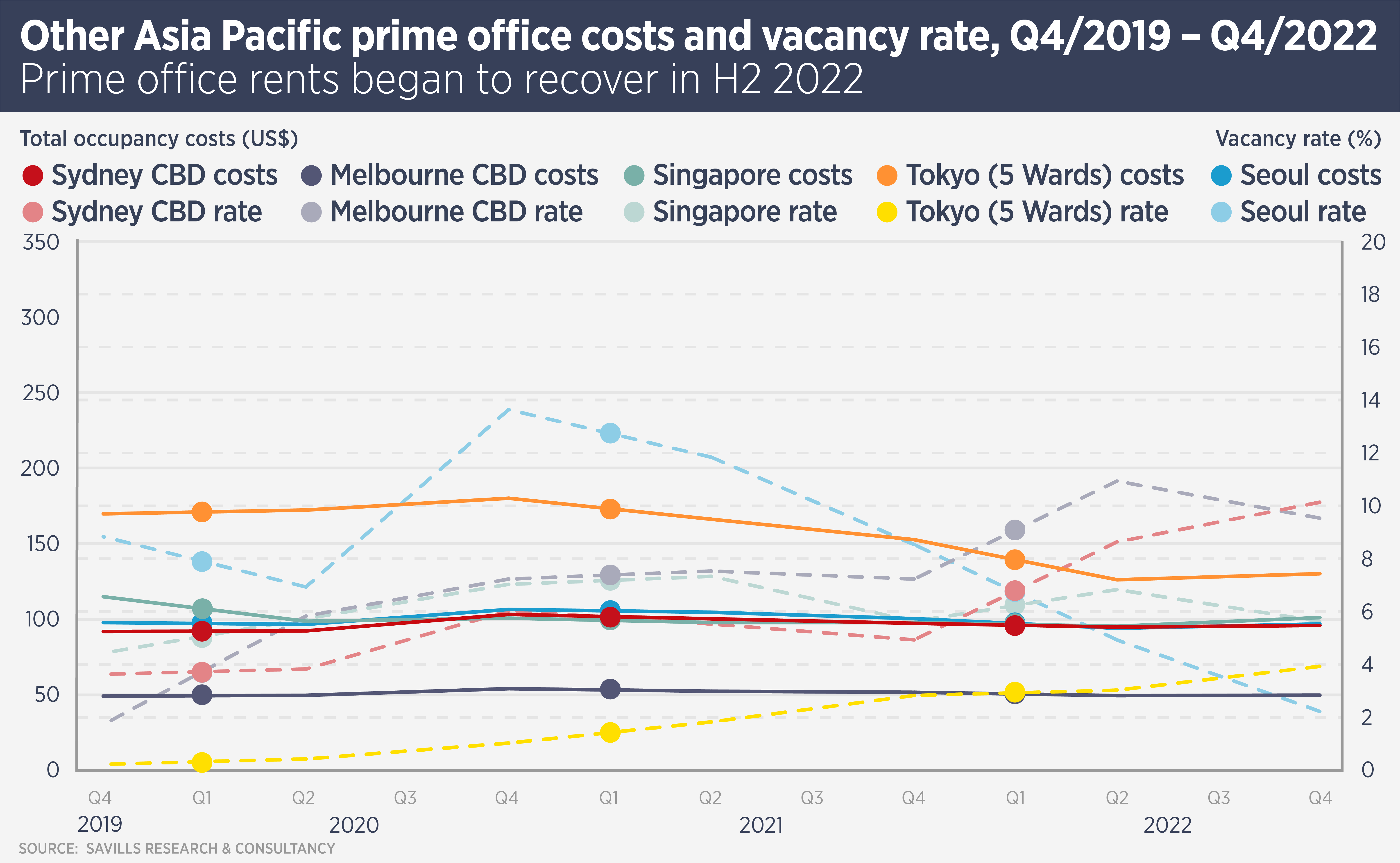

Savills data show prime office sector performance in the region’s developed cities varied widely throughout the pandemic. Singapore recovered sharply in the second half of last year, after it lifted restrictions, while Tokyo, Seoul, Sydney and Melbourne also saw rents increase somewhat in the same period. However, Greater China cities which maintained covid restrictions longer than anywhere else in the world continued to see rents decline.

“Early emergence from covid restrictions clearly benefitted office markets,” says Simon Smith, Head of Research & Consultancy, Asia Pacific at Savills, “however there are many underlying stories which vary across the markets.

“Furthermore, Asia’s cities have emerged from covid into a much more difficult economy than that which prevailed in 2019. Interest rates are rising, although the scale of hikes varies, while construction and fit out costs are also on the way up.

“Landlords must also accommodate the changing requirements of the multinational occupiers who take up much of the region’s prime office space. These occupiers are in the midst of a flight to quality, seeking space which is sustainable, healthy and suits flexible working.”

Mainland China office markets took an early hit from covid then had something of a honeymoon period until the zero covid restrictions began to bite last year. Savills predicts a return of demand in both Beijing and Shanghai this year, but both markets are also expecting significant supply which will continue to put pressure on rents and vacancy rates.

Taipei’s prime office rents were still rising in late 2021, but the effect of some of the region’s strictest anti-covid measures began to bite last year and rents were still falling in the second half of 2022. The Taiwanese capital is also set for considerable supply this year and next. Savills is predicting a jump in vacancy of nearly eight percentage points, which will impact rents.

Covid was just the latest in a series of afflictions for Hong Kong, sending prime office rents down by nearly a third between Q4 2019 and Q4 2022. With almost all restrictions removed in the first quarter of this year and the opening of the border with the Mainland, Hong Kong has received a significant boost, however it is still trying to absorb the 3.8 million sq ft of new space which was completed in 2022. Only 19% of that space was pre-let and Savills is predicting a further 10% drop in office rents.

Australia’s main office markets saw rents rise slightly in the second half of last year and Melbourne saw a drop in vacancy too, in contrast to Sydney. However, both markets are witnessing a flight to quality from office occupiers, along with an ever-increasing emphasis on environmental and sustainability credentials. This is not a pandemic-driven trend, however, prime Australian offices have outperformed the rest in terms of take-up for the past decade.

Flexible working is more ingrained in Australia than in Asian office markets, which means rising demand for central locations with strong transport links and for higher quality office space which caters to changes in working patterns.

Singapore suffered a sharp early drop in rents due to the pandemic but recovered well in the second half of last year. Despite an uncertain global economy, Savills Research expects low supply, inflationary effects on service charges and the continued flow of family offices to the city will keep rental growth positive, as will demand for new, ESG-compliant offices.

Seoul office rents held fairly steady throughout the pandemic, with a peak to trough fall of around 12% and a 3% rise in the second half of 2022. However, vacancy has been falling sharply since late 2020 and now stands at only 2.2%, the lowest in the region. However, even with low supply, vacancy is expected to rise this year due to a sluggish economy.

Prime office rents in Tokyo’s Central 5 Wards fell by 30% between Q4 2020 and Q2 2022, but recovered slightly in the second half of last year. Between Q4 2019 and Q4 2022, the vacancy rate rose from 0.2% to 3.9%. While the market has shown signs of bottoming out and Japan is once more welcoming travellers, it remains vulnerable to the weak global economy. There is significant new supply expected this year, however half of this is already pre-leased.

Further reading:

Savills Prime Benchmark

Contact Us:

Simon Smith