Sydney offices to thrive in flight to quality

Changing working patterns and an uncertain global economy are pushing office tenants and investors to the best buildings, which is proving beneficial for Sydney’s prime office market.

Changing working patterns and an uncertain global economy are pushing office tenants and investors to the best buildings, which is proving beneficial for Sydney’s prime office market.

The Sydney central business district is structurally undersupplied with prime office space, so number of large domestic and foreign investors are poised to take advantage with new developments and site acquisitions.

Paul Craig, CEO at Savills Australia & New Zealand, says: “The Sydney prime office market is seeing shifting patterns in demand and now seems more resilient due to the flight to quality by tenants and investors. There is a sharper focus on high quality assets in core locations, supported by upgraded transport infrastructure and demand for newer, more efficient employment floor space.”

The covid-19 pandemic has, as elsewhere, accelerated a number of changes in the workplace, such as the demand for hybrid working, the office being seen primarily as collaboration space and demand for healthy workspace with strong ESG characteristics.

The rental and value gap between prime and secondary properties is predicted to increase over the coming years, especially for the office sector, where older assets without sustainability and wellness characteristics could left stranded.

With enthusiasm for commuting waning, well-connected office markets are performing better and Sydney is in the process of upgrading its public transport with new metro lines. When complete, the rail infrastructure boom will expand Sydney’s network to 338 stations. The new metro lines will bring a larger highly-skilled workforce within easy reach of the city’s CBD.

Moreover, metro construction is also taking stock out of the market; for example construction of the Metro West line will see over 42,000sqm of stock withdrawn along Hunter Street between 2022 and 2024.

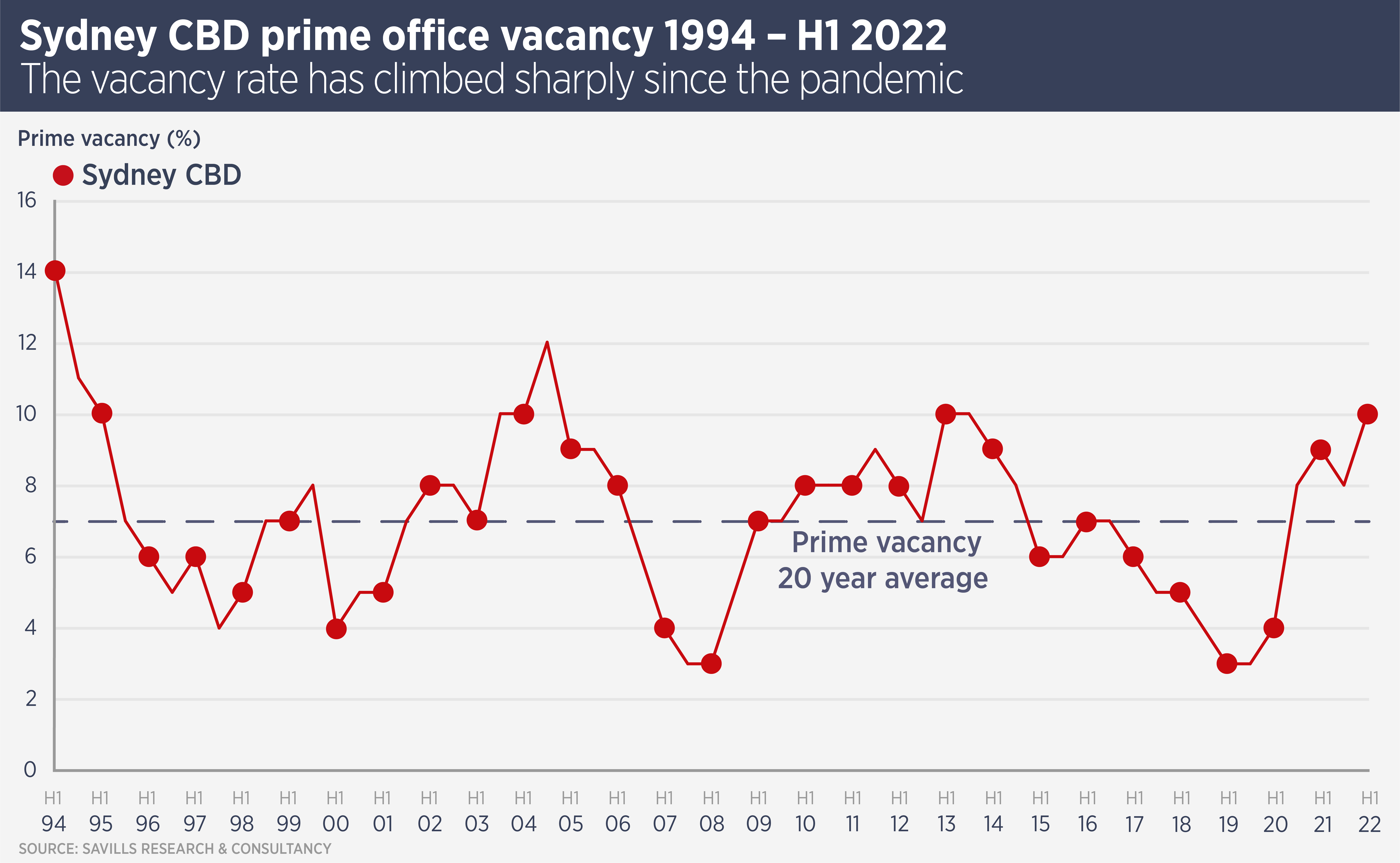

Sydney’s prime vacancy rate has risen since the pandemic (see chart above), however supply is limited in the near future. Katy Dean, head of national research at Savills Australia, says: “Sydney has been undersupplied in high quality space for years, resulting in low vacancy rates and sustained demand. Nearly 80% of the space set to launch in the next two years is already leased.”

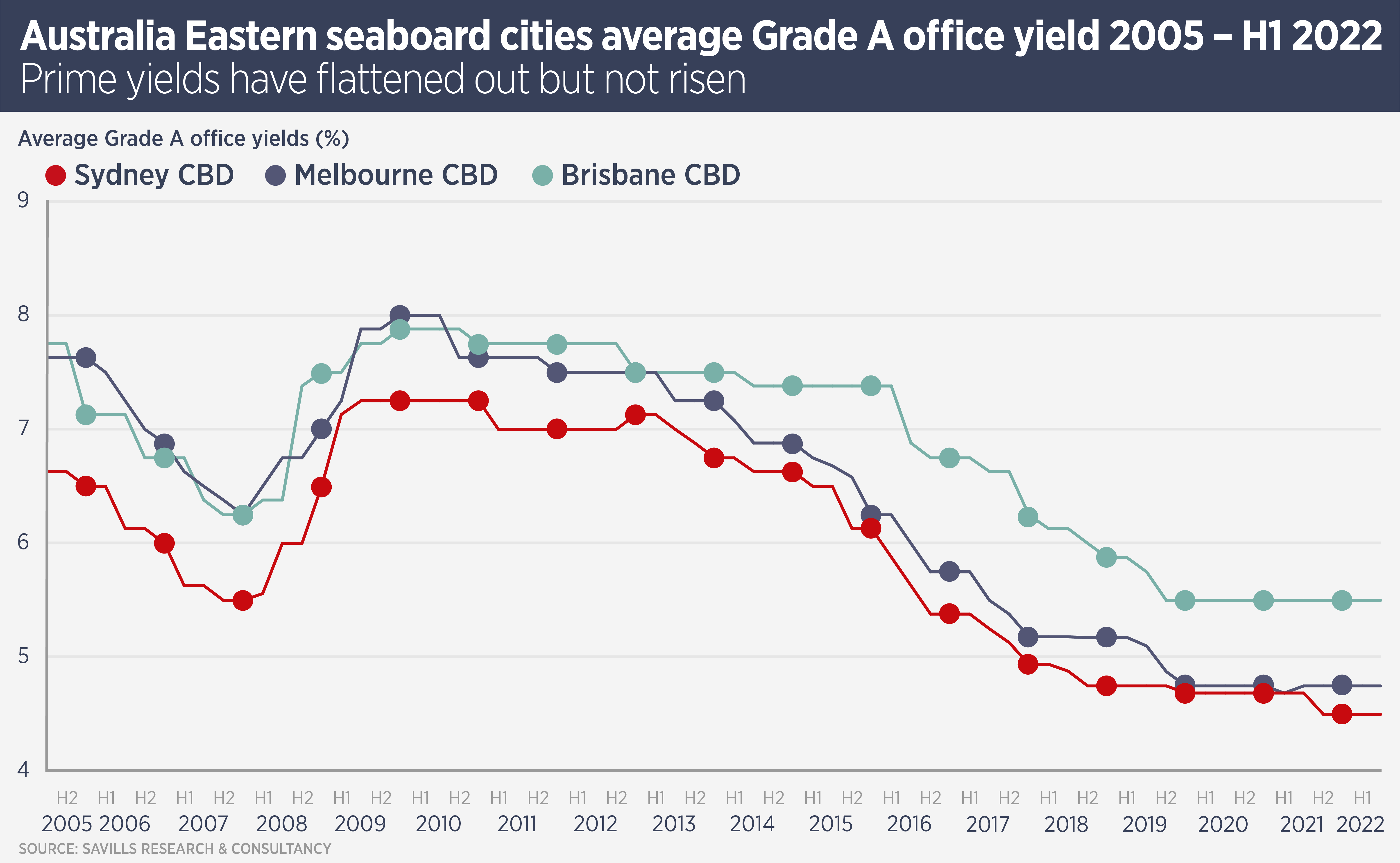

The investment market for prime office stock has remained firm, with cap rates flat (see chart below), despite rising interest rates. MSCI data show Sydney investment transaction rose 26% in the first half of this year, with offices as the most popular sector. Worldwide, demand for offices has focused on gateway cities such as London and New York.

Craig says: “Uncertainty and geopolitical tensions have reduced the pool of attractive deals, so there is an increasing pressure on investors to identify value creation opportunities. Portfolios can be future proofed by targeting centralised cities with large talent pools.”

A number of groups, including Dexus, Lendlease and sustainable investment firm TrueGreen Positive Impact Group have assembled sites near transport hubs for future projects. Dean says: “The development of ‘supersites’ by Lendlease and Dexus will also take a further 60,000 sq m of stock out of the market between 2026 and 2028. The development pipeline suggests that the office market is much closer to recovery than expected.”

In August, Dexus began construction of Atlassian Central, a 70,000 sq m A$1.4 billion office tower next to Sydney Central Station, which will be the Australian headquarters for software company Atlassian, which owns a stake in the project.

Dean says: “It is interesting that Atlassian, which operates a distributed work policy known as ‘team anywhere’, remains committed to this project. CEO Scott Farquhar says the main purpose of the office to bring people together in a central location. This demonstrates occupiers are committed to CBD hubs with great connectivity, even in an age of hybrid working.”

Shortly after work began on Atlassian Central, the New South Wales government announced plans to build a 24 ha deck over Central Station, suggesting long-term state confidence in the location.

Craig says: “The preference of tenants and investors for modern and efficient stock in connected locations reinforces the attractiveness and resilience of Sydney’s prime office market in the long term.”

Further reading:

Savills Sydney

Contact us:

Paul Craig