Better times loom for Japan logistics

Japan’s logistics market is set for recovery, driven by stabilising vacancy, strong demand, tech adoption, and record investor interest in 2024.

After several years of subdued performance and oversupply in the greater Tokyo markets, the Japan logistics market looks set for a stabilisation and recovery.

The Tokyo market will see vacancy rates stabilise this year for the first time since 2020 and will be followed by the Osaka market in 2026, once the market digests the record supply which is due this year. Last year, prime logistics rents still rose in both Tokyo and Osaka, demonstrating strong demand.

“The logistics sector has been resilient despite challenges in recent years and is poised to reap the benefits in the midterm,” says Tetsuya Kaneko, Managing Director and Head of Research & Consultancy at Savills Japan.

He points to declining supply, strong tenant demand, investor interest in the sector, the growth of data centres and continued evolution of the Japan logistics sector as positive signals for the future.

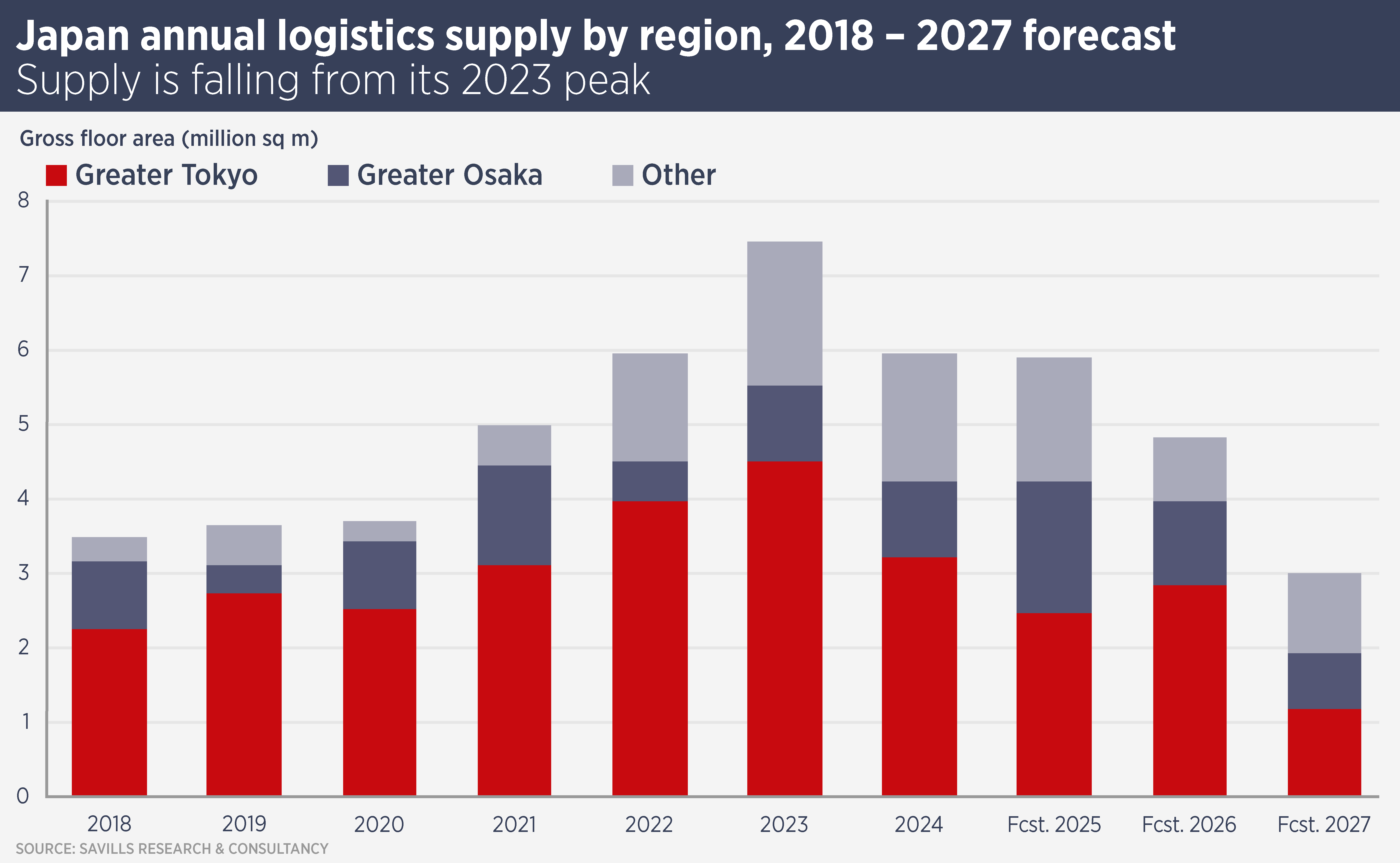

Savills data show Japan logistics supply peaked in 2023 and is expected to fall sharply from 2026. Supply will grow in Osaka this year, with a record 1.7m sq ft set to be delivered this year but will fall from 2026.

Supply will decline as developers and investors digest recent rises in construction costs and Japan’s ongoing labour shortages. Rising interest rates make life more difficult for developers but suggest the likelihood of inflation-driven rental growth. Reduced supply from 2026 should help with vacancy in secondary assets, although there are investors acquiring such properties for value add upgrades.

Investor interest in Japan logistics/industrial continues to be strong, with the sector accounting for 27% of transactions last year, according to MSCI data, a record for the sector partly supported by Air Trunk transaction. Foreign investors accounted for 40% of logistics transactions, demonstrating the commitment of specialist players such as ESR, GLP and Prologis, as well as groups such as Brookfield.

Interest in data centres means that industrial and logistics sites with access to power are on the radar of data centre developers and operators. For example, in March Softbank completed the acquisition of a Sharp factory in Sakai, Osaka (pictured top), where it will build a 150MW AI data centre.

New regulations regarding the hours which truck drivers can work came into force in 2024, restricting the ability of logistics companies to carry out long-distance deliveries. However, the new rules have led to the development of regional “relay bases” between cities and this has potential to become a thriving sub-sector of the market.

The driver shortage caused by the new rules has also driven efficiencies in the logistics business and investment in technologies such as drones, AI-controlled hubs and automated vehicles.

“As these adaptations continue to progress, the logistics sector should gradually overcome a myriad of constraints, boosting the longer-term prospects of the sector,” says Kaneko.

Further reading:

Japan Logistics Report

Contact us:

Tetsuya Kaneko