City lowdown: Sapporo

Discover Sapporo, the largest city in northern Japan, where a thriving office market, rising rents, and a recovering tourism sector are shaping a prosperous future.

The largest city in northern Japan is seeing a booming office market and recovering tourism but is suffering delays to its high speed rail link to the rest of the nation.

Sapporo is the largest city in Hokkaido, the northernmost of Japan’s main islands, and has a population of just under two million. It is perhaps best known for its winter snow festival, which attracts more than two million visitors and the eponymous brewery, which exports worldwide. It has also been a host city for winter sports events, such as the Asian Winter Games.

Key industries include health, education, IT and tourism. The local government has a programme to encourage startups and subsidies to encourage the establishment of IT, content and biotech businesses. There are also subsidies available for BPO operations and for firms which move their headquarters to Sapporo.

Sapporo lacks a high speed rail connection to the rest of Japan; the nearest Shinkansen station is 250 km away in Hakodate. An extension was slated to open in 2031, however press stories earlier this year suggested it will be postponed due to construction delays and rising costs.

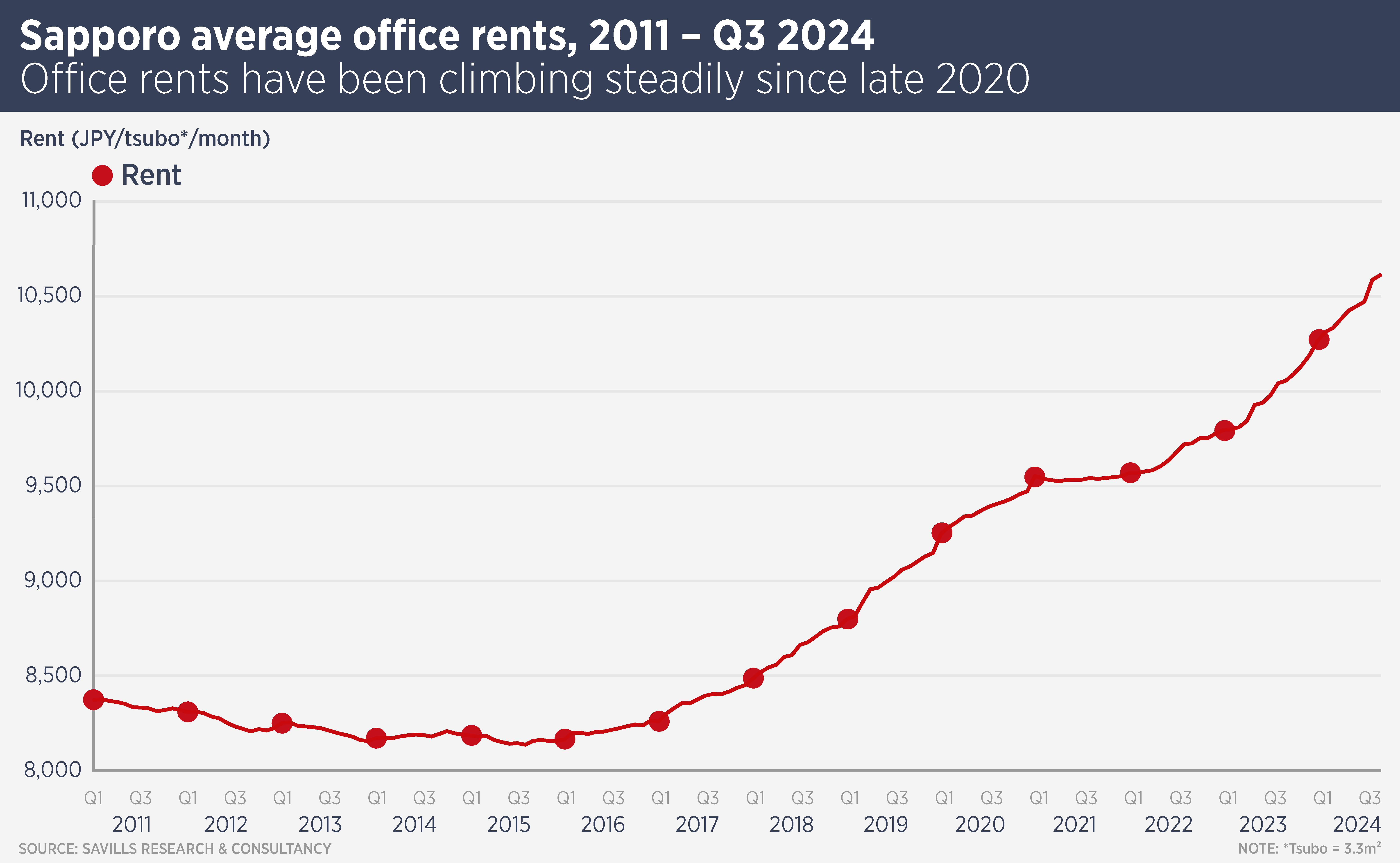

Some of the success of Sapporo’s real estate market may be attributable to expectations of the new rail line. The city saw around 11,000 tsubo (391,414 sq ft) of office space delivered in 2023 and more than 10,000 tsubo is slated for 2024 and 2025. Take-up has been strong and office rents have continued to rise, indeed office rents have been rising steadily across the city for the past decade.

Tetsuya Kaneko, Head of Research and Consultancy at Savills Japan, says: “Asking rents in Sapporo remain on an upward trajectory after breaking the ¥10,000 per tsubo level for the first time in 2023, increasing by 2.8% in the half year, reaching ¥10,300 per tsubo. Sapporo’s submarkets have enjoyed consistent improvements. The market appears to respond well to new additions despite higher asking rents.

“It’s unfortunate that the Shinkansen extension has been delayed, but this could also provide some breathing room and potentially allow for large office absorption without any major disruptions. Together with the increase in construction costs, it seems development plans in front of the station are being reconsidered, which may lead to further stabilisation in the future.”

Sapporo receives around 15 million domestic and foreign tourists a year. Overseas visitor numbers have recovered since the pandemic but have still not quite hit 2019 levels, although spending has increased beyond pre-pandemic levels.

Kaneko says: “While overall Japan visitor numbers have exceeded 2019 levels and there are complaints of overtourism in some cities, it is noteworthy that cities such as Sapporo would welcome more tourists and have the capacity to accommodate them.”

Sapporo’s tourism sector is attracting interest from overseas hotel companies and real estate investors. For example Hong Kong-based AB Capital’s Japan Hospitality Fund II is targeting hotels in major tourist cities including Sapporo. Meanwhile last year, an investment vehicle owned by a consortium led by Singapore’s Heeton Holdings bought the Red Planet Sapporo Susukino South hotel.

Meanwhile in August, Hyatt Hotels Corporation announced that it would open an upscale Park Hyatt hotel in Sapporo, as part of a mixed-use development in the city centre. It will also open a Hyatt Centric hotel in Sapporo in 2026.

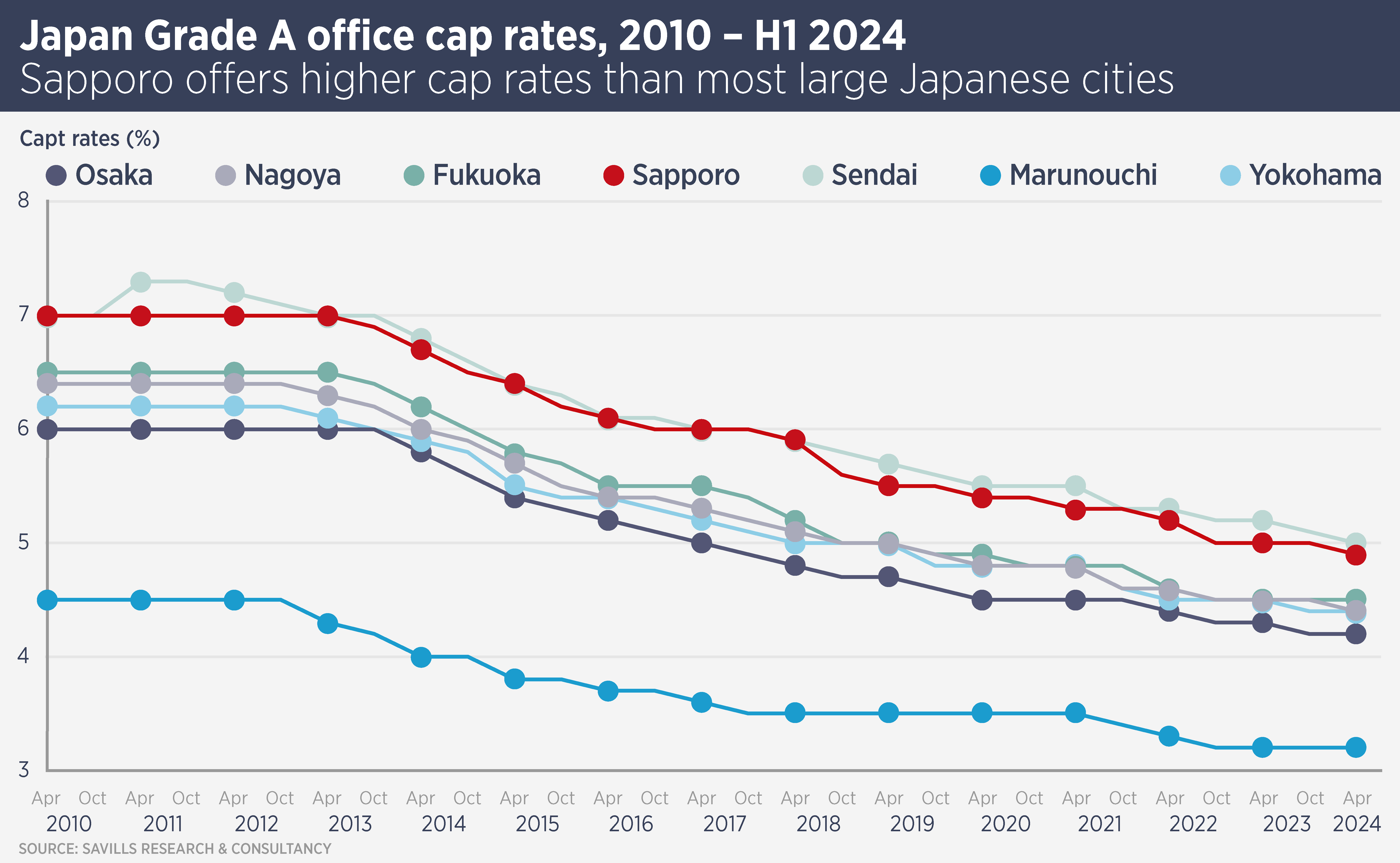

Overseas real estate investors have also shown interest in the Sapporo multifamily residential and office markets, which offer higher yields than the same sectors in Tokyo. For example, a Sapporo property was part of a 21-asset Japan multifamily portfolio bought by Gaw Capital Partners on behalf of the Qatari Investment Authority in 2022.

Kaneko says: “Sapporo’s real estate market is relatively small and illiquid compared to Tokyo and Osaka, nevertheless it is a prosperous city with potential opportunities for foreign real estate investors in a number of sectors.”

Further reading:

Savills Japan research

Contact us:

Tetsuya Kaneko