Challenging times ahead for Japan logistics

Discover the current state of Japan's logistics warehousing market and the challenges it faces. Read on to learn about increased supply, low yields, and rising costs for occupiers.

The growth of modern logistics warehousing has been a great success for Japanese real estate, however the market faces a number of challenges.

Demand from both tenants and investors has been strong thanks to the continued growth of e-commerce, but is under pressure from increased supply, low yields and rising costs for occupiers.

Tetsuya Kaneko, Head of Research & Consultancy at Savills Japan, says: “The fundamentals of the logistics sector are strong, and confidence appears to be high. However, there are some dark clouds on the horizon, and future growth in the sector will likely be constrained by structural factors.”

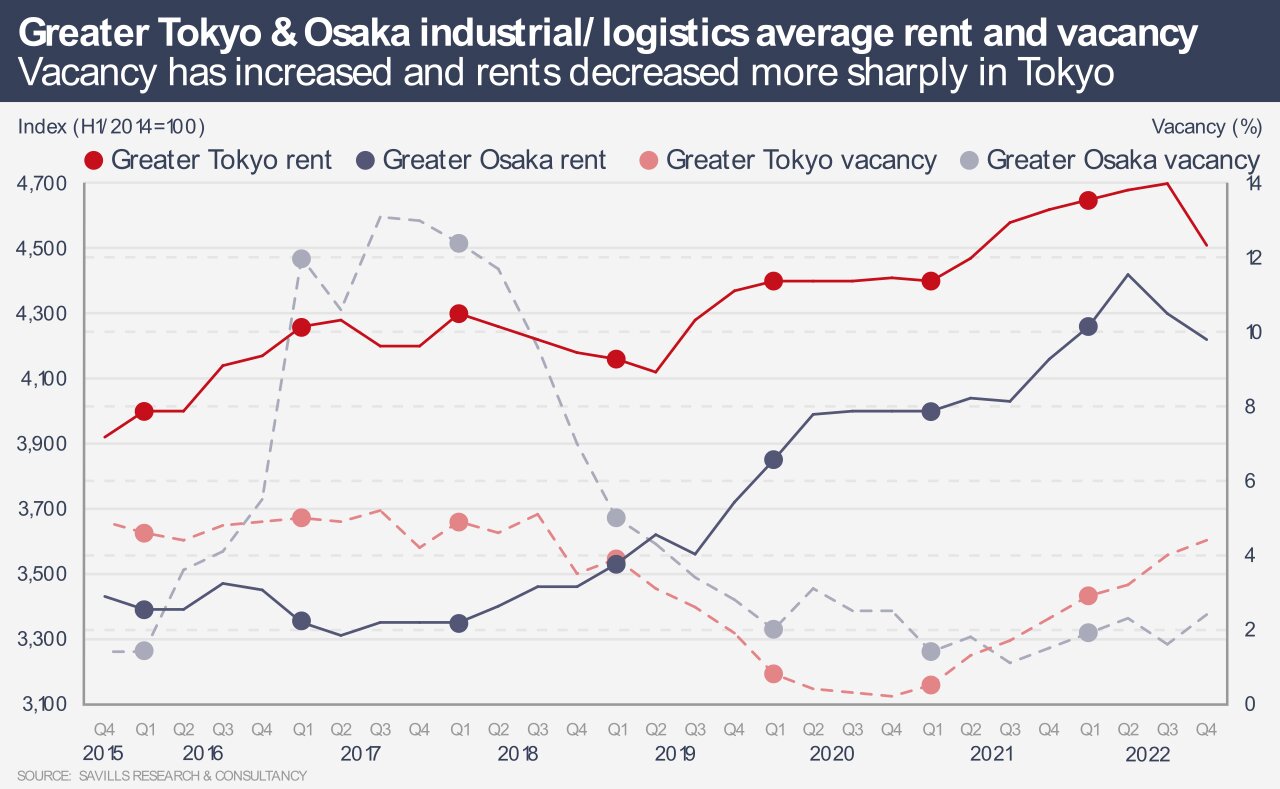

The Tokyo logistics market saw supply exceed take-up in 2021 and 2022, with 3.9m sq m added to the market last year, sending the vacancy rate to 4.4% and rents down 2.4% in 2022. This year, new supply will be even higher at 4.3m sq m.

Supply in Osaka has been better balanced with demand, leading to a rental increase of 1.4%, even though the vacancy rate crept above 2%. However, Osaka will see 960,000 sq m of new logistics space this year, well above the average of the previous five years.

Kaneko says: “Although the appetite for logistics space remains high overall, pre-leasing has been weak in some new facilities, and potential tenants are becoming increasingly selective.”

Furthermore, logistics tenants face rising costs, particularly wages, and a shortage of labour due to Japan’s ageing population and because of poor conditions in the industry. Logistics companies are investing in automation and better facilities for workers. This will add to pressure on rents and make older facilities particularly vulnerable to vacancy and falls in rents.

The investment market for logistics has been strong, with more than ¥1 trillion of deals every year for the past five years, although 2022 saw the lowest annual transaction total since 2018. Japanese real estate investment trusts, logistics real estate specialists and overseas private equity players have been keen buyers of the sector. For example, Hong Kong’s Gaw Capital entered the market for the first time last year.

However, competition for assets has pushed yields as low as 3.5% or below, which means the positive spread between increased borrowing costs and property yields is tighter now. Economists are predicting only minor additional interest rate rises in Japan, however even small increases in borrowing costs could lead to yields softening.

The sector could also be impacted by the long lease agreements typically signed by tenants, as these are less appealing to investors in a more inflationary environment.

Investors are less confident about the logistics real estate market’s prospects, the annual survey by Ichigo Real Estate Service found. More than 60% of respondents do not anticipate any further capital appreciation, while a similar proportion expect rents to remain flat.

Nonetheless, Kaneko says: “We predict the sector will continue its strong performance; the growth of e-commerce will require the development of modern logistics facilities which will attract further investment. That said, the rate of growth in the future may be limited and tenants will likely be drawn to new developments with good accessibility, modern facilities, and reasonable rental levels.”

Further reading:

Savills Japan logistics report

Contact Us:

Tetsuya Kaneko