Japan hospitality set for rapid recovery in 2023

The Japanese tourism market continues to show potential for the hospitality real estate sector, attracting overseas investment despite increasing construction costs and a shortage of labor. Learn more from Savills.

Japan’s rebounding tourism market signals an opportunity in the hospitality real estate sector, however there are still challenges from inflation and the nations’ tight labour market.

The nation reopened to foreign tourism in October 2022 and visitors began to return immediately. December saw 1.4 million visitors, more than half the total seen that month in 2019, which was a record year for Japanese tourism. Numbers rose again in January to nearly 1.5 million. This was achieved without the presence of Chinese tourists, who made up nearly a third of foreign visitors in 2019.

JTB Corporation, the largest travel agency in Japan, predicts that 21.1 million inbound visits will be made to Japan in 2023, approximately two-thirds of 2019 levels and more than four times the total visits in 2022.

“Moreover, because the average economic profile of current inbound travellers appears to be much higher than the pre- pandemic average, spending by inbound tourists should see much stronger recovery,” says Tetsuya Kaneko, Head of Research and Consultancy at Savills Japan.

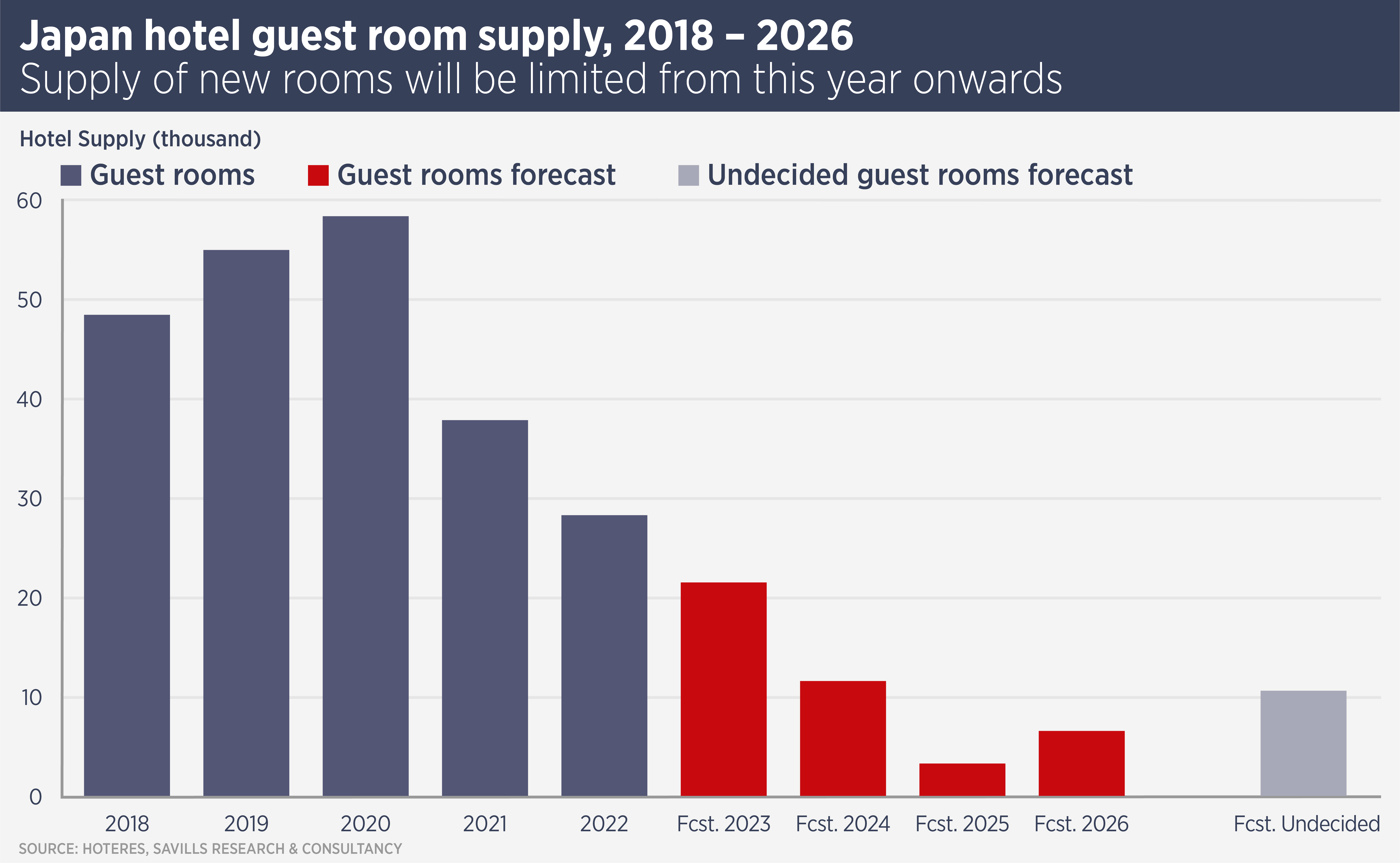

Hotel supply, which peaked in 2020, has fallen sharply and there are fewer new rooms in the pipeline than were supplied that year. Meanwhile, average daily rates and revenue per available room have recovered to pre-pandemic levels and increased for higher-end properties.

The sector’s outlook has further encouraged overseas investment in Japanese hotels. Overseas investors remained keen on hotel assets in Japan in 2022, with cross-border transactions accounting for 42% of the total. Recently, private equity group Bentall GreenOak bought the Rihga Royal Hotel in Osaka (pictured above) for ¥55 billion ($400 million) and intends to spend a further ¥15 billion on improvements.

Other international private equity investors are understood to be targeting the sector and the transaction pipeline is growing, as improving prices are persuading more owners of hotels to sell.

Nonetheless, Japanese hospitality’s recovery is likely to be bifurcated, says Kaneko. “Wealthier travellers were relatively unaffected by the pandemic and will likely continue to comprise an outsized proportion of inbound tourism demand in 2023. By contrast, budget tourism may see lukewarm growth, and some limited-service hotels in over-supplied areas may continue to struggle.”

Further challenges to growth include rising costs for energy, food and air travel, as well as a shortage of labour, which is already preventing some hotels from operating at full capacity.

The return of Chinese visitors, which may be impacted by political tensions, will be an important factor in the strength of the hospitality sector’s recovery.

Kaneko says: “Hotel operating performance is likely to remain strong and see further improvement, which should continue to be encouraging for market participants.”

Further reading:

Savills Japan hospitality report

Contact Us:

Tetsuya Kaneko