Growing demand pushes Asia Pacific data centres into new areas

Growing demand for data centre space means developers are looking for new markets and innovative locations to supply customer appetite.

Growing demand for data centre space means developers are looking for new markets and innovative locations to supply customer appetite.

New uses such as generative AI, the technology behind applications such as ChatGPT, 5G networks and the Internet of Things are driving demand, as are regulatory pressures: many jurisdictions require that their citizens’ data is held locally.

Structure Research estimates the region’s colocation data centre market size was around 10,233MW of critical IT capacity in 2023. It is projected to grow at a five-year compound annual growth rate (CAGR) of 13.3%, nearly doubling to 19,069MW by 2028.

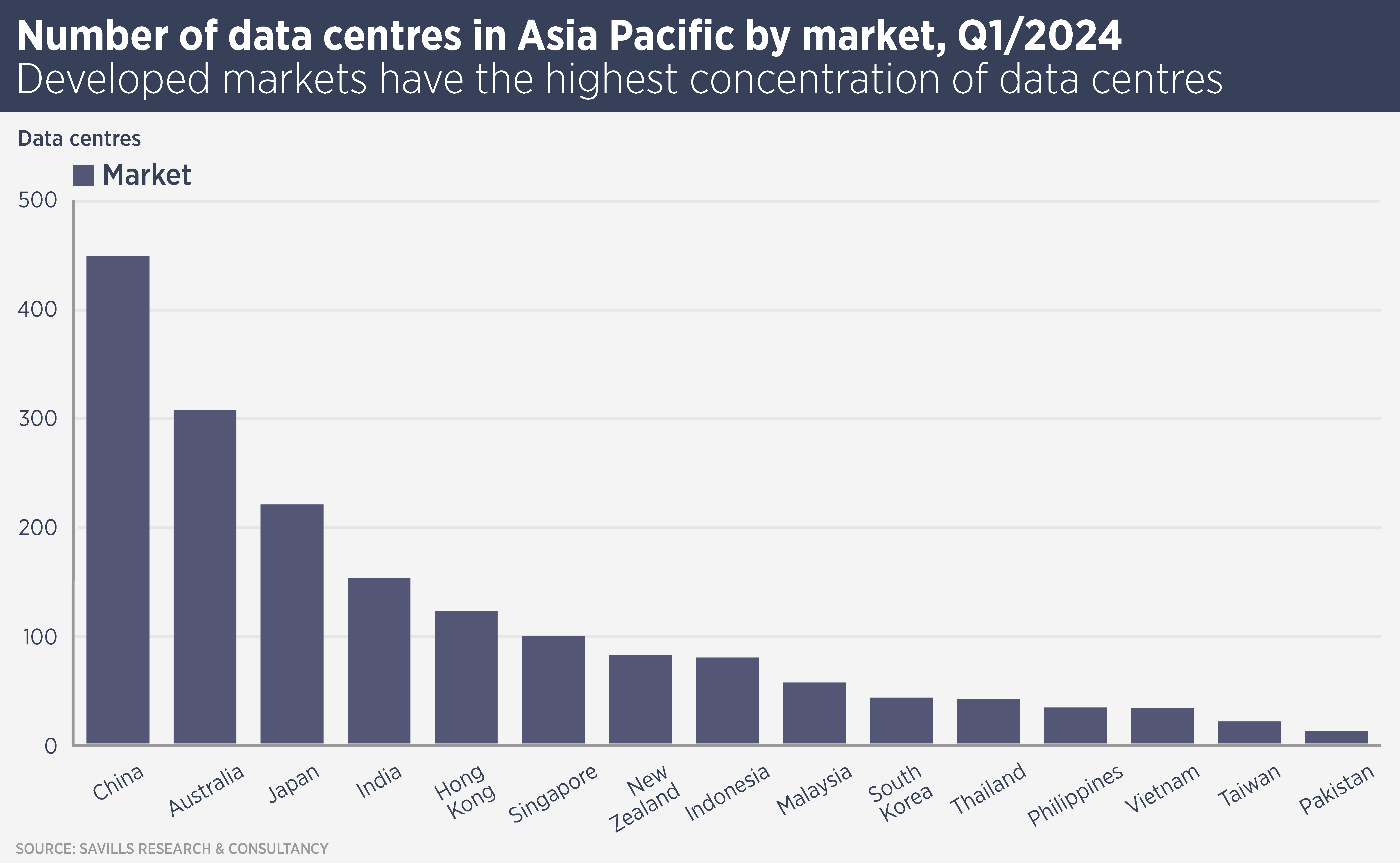

At present, Mainland China has the largest number of data centres (see chart) but smaller developed markets such as Australia, Hong Kong and Singapore have the greatest concentration of sites.

“Data centres are essential infrastructure for our increasingly digitised business and personal lives,” says Simon Smith, Regional Head of Research & Consultancy, Asia Pacific at Savills. “Real estate investors have recognised this and are investing significant capital in the sector.”

MSCI data shows $1.7 billion of Asia Pacific data centre transactions in the first quarter of this year, up 81% on the last quarter of 2023 and more than three times the transaction volume in the same quarter last year.

However, investing in data centres is not straightforward, says Smith. “They require secure access to substantial amounts of electricity, ideally produced by renewables. Securing power is the key task for every developer of a new data centre.” Facilities also need good internet connections and to be near to the markets they serve.

These factors have pushed up construction costs. Tokyo is now the most expensive market in the world to build a data centre, while Singapore and Jakarta are both in the top 10 list of expensive locations, both ahead of London.

Data centre developers are thinking laterally and, indeed, aquatically. A number of companies around the world are working on floating data centres. Water-borne facilities are free of land restraint and also offer the benefit of low power use, as water acts as a heat sink. A centre’s cooling bill is usually the biggest part of running costs. Lower energy use also boosts sustainability, an important factor for occupiers.

In Singapore, Keppel Data Centres has received approval to build a floating data centre park (pictured above). It will utilise a modular design, so the modules can be developed and deployed rapidly. Such projects are in their infancy, but could be essential for boosting capacity in developed markets.

As well as new technology, data centre developers are seeking out new locations in Southeast Asia. Structure Research estimates this region will grow faster than Asia Pacific as a whole, with CAGR of 16.5%.

Malaysia is proving popular due to its connectivity with the rest of Southeast Asia and a supportive government, which offers a range of tax incentives. Kuala Lumpur is the biggest market but Johor, close to Singapore, is tipped to be a regional hub for large ‘hyperscale’ centres.

Indonesia’s government is also keen to boost its digital economy and is offering incentives to developers. Jakarta is the main market, but developer interest is expanding to other cities, including Batam, an island close to Singapore.

The Vietnam data centre market is small and dominated by local players, however a proposed change in the law will allow 100% foreign ownership of data centre facilities. Smith says: “Savills has seen a surge in enquiries from overseas operators looking to set up operations. We expect a substantial influx of capital to be directed to the Vietnam market once there is more clarity on related policies and regulations.”

Further reading:

Asia Pacific Data Centres Spotlight

Contact Us:

Simon Smith