Singapore residential shines

The Singapore residential market is booming, with both rents and sale prices rising, despite a turbulent global economy.

The Singapore residential market is booming, with both rents and sale prices rising, despite a turbulent global economy.

Savills research is predicting residential prices will rise 7% this year, mainly due to a lack of supply of new developments, while rents are set to rise 15-20%, due to an influx of wealthy expat workers.

Alan Cheong, Executive Director, Research & Consultancy at Savills Singapore, says: “Logic suggests that, when economic and geopolitical uncertainties are turning bad, residential prices should perform negatively.

“We believe prices are moving up because there has been a significant decline in new launches this year and new launches are in locations which have seen little new supply in recent years. The gap between launches allows demand time to regenerate.

“Similarly, in the rental market, there is a paucity of suitable accommodation for well-heeled expatriates.”

Despite a variety of measures which make Singapore residential property more expensive for foreign buyers, the proportion of foreigners buying rose sharply in the second quarter of this year, increasing 1.8 percentage points to 4.9% of the total transactions in the quarter.

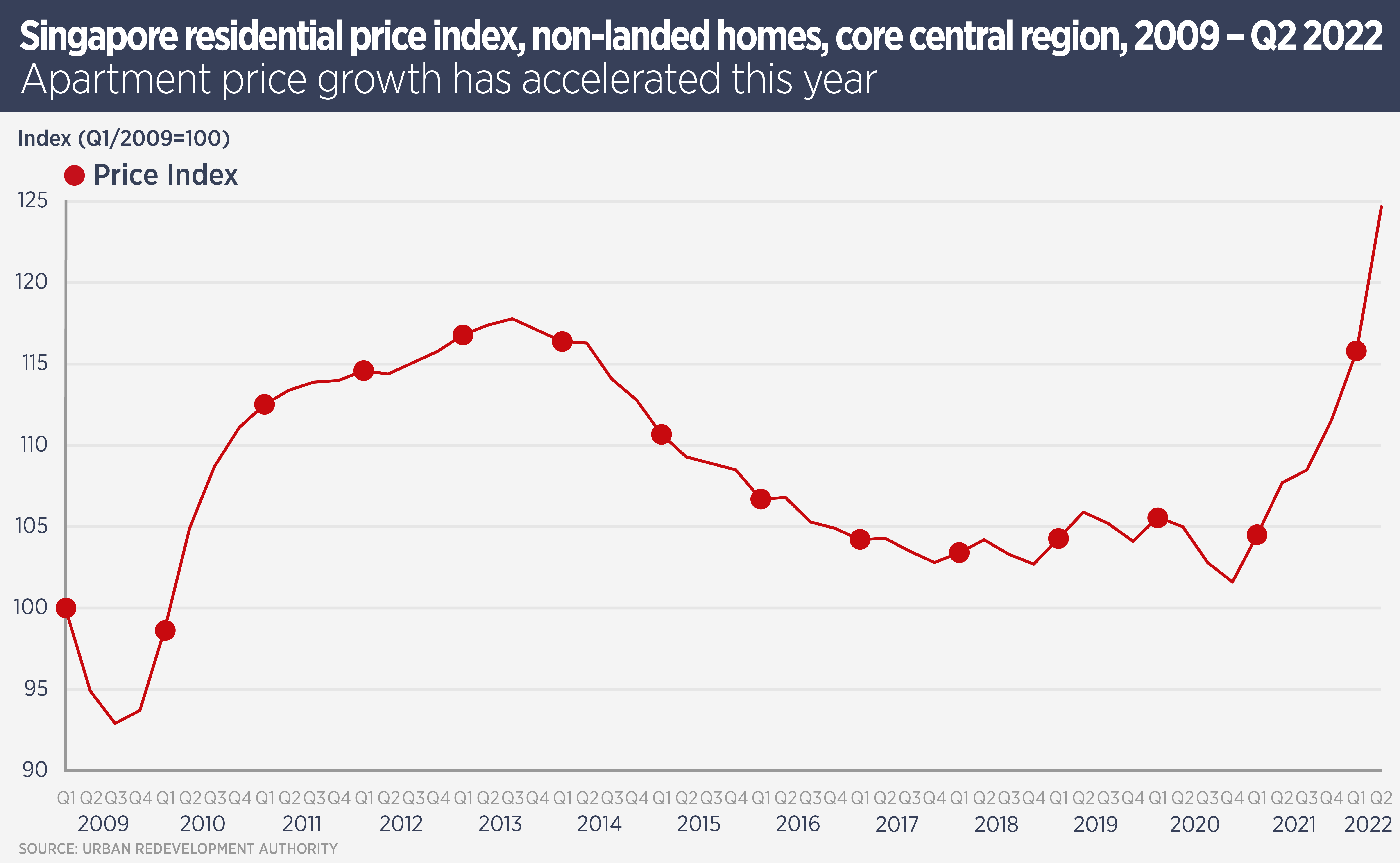

While the overall Singapore residential sales marked jumped in the second quarter, the Savills index of high-end apartments has been rising steadily since mid-2020.

While the overall Singapore residential sales marked jumped in the second quarter, the Savills index of high-end apartments has been rising steadily since mid-2020.

The Urban Redevelopment Authority rental index for all private residential properties surged 6.7% quarter on quarter in Q2 2022, the largest quarterly increase since Q4 2007 when rents increased 6.8%.

The leasing market is hard to judge at the moment, says Cheong, as the overall vacancy rate is below 6%, which means would-be renters are pushed into serviced apartments or co-living spaces because they cannot find suitable accommodation. Anecdotal evidence suggests expat workers are taking serviced apartments while they seek suitable long-term rentals.

Singapore’s residential sales market outlook contrasts with that of regional rival Hong Kong, which has to contend with sharply rising interest rates and continued covid restrictions. Prices in the city’s mass residential market have held up pretty well so far, however Savills is predicting a 5% fall in luxury residential prices this year.

“While interest rates are likely to increase progressively by another 2 to 3 percentage points over the next 12 to 18 months, the timeline for even a partial border reopening remains uncertain,” says Simon Smith, Head of Research & Consulting, Asia Pacific, at Savills.

However, the luxury residential rental market in Hong Kong remains firm. Luxury apartment rents on Hong Kong Island recorded growth of 1% in the second quarter, while rents in Kowloon and the New Territories rose by 2.5% and 0.5% respectively.

“The leasing market is increasingly being driven by Mainlanders and ‘New Hongkongers’, Mainlanders who have been living in Hong Kong for seven consecutive years and have recently become permanent residents,” says Smith.

Further reading:

Savills Singapore research

Contact Us:

Simon Smith | Michael Fenton | Betty Mao | Srinivas N.