Going the extra mile

The continued growth of e-commerce and ever more demanding customers are taking logistics real estate closer and closer to city centres.

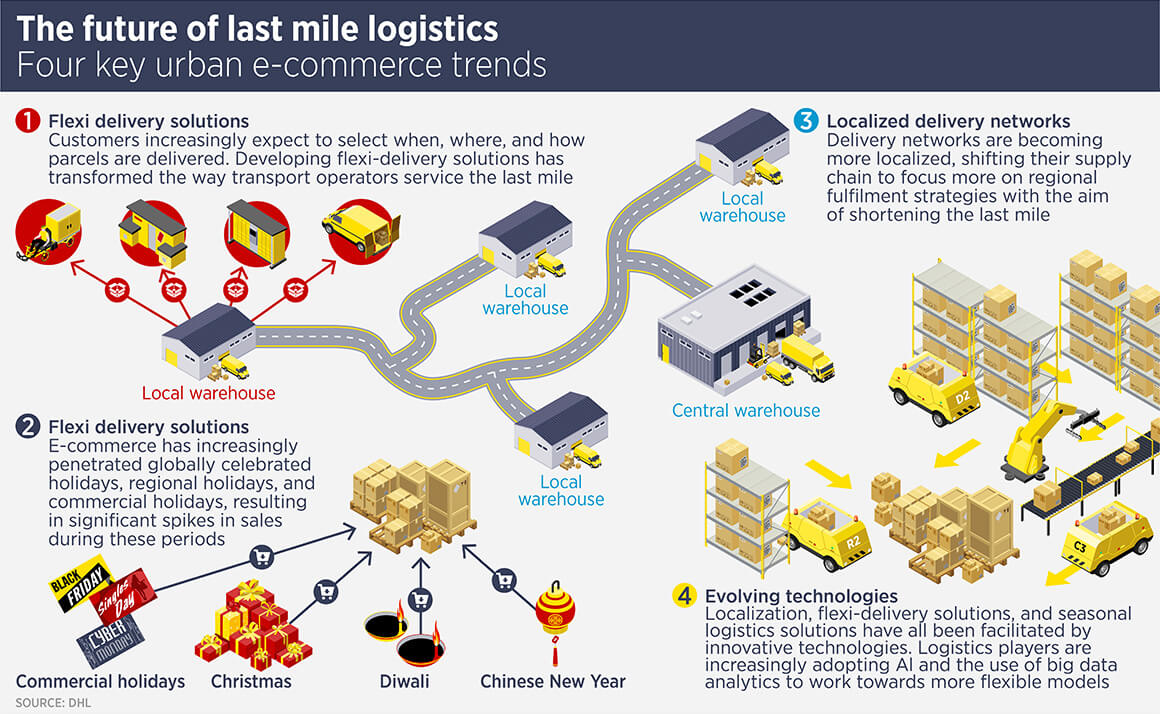

The stereotypical modern warehouse is a sprawling complex located out of the city, close to major road networks in order to bring goods in and out. However, huge out of town facilities will not help an online retailer which has pledged same-day delivery to its customers. Last mile logistics focuses on the movement of goods from a transportation hub to the final delivery destination, usually the customer’s home or office (but not literally the ‘last mile’).

Much of the recent demand for logistics space has come from online retailers. A US research project carried out by logistics specialist Prologis estimated traditional retailers with $1bn of sales required 325,000 square feet of logistics space and 250,000 square feet of retail space. An online-only retailer needs 1m square feet of logistics space.

For a retailer to able to offer same day delivery it needs logistics facilities stocked with an abundant variety of products situated in close proximity to large customer bases and which have ample access to major roads so delivery times and costs can be minimised.

Enabling last-mile delivery is tricky for logistics real estate companies. Urban land is expensive and logistics warehouses take up space. There are also seasonal fluctuations in demand, for example: can your China logistics network survive singles day?

Simon Smith, head of Asia Pacific research at Savills, says: “In order to fulfil the needs of last mile delivery, real estate investors need to think creatively about using space. For example, vacant space in shopping centres could be utilised as last mile logistics space, as could older, lower grade industrial buildings, as long as they are accessible. Vacant floors in fringe office locations could also be adapted to logistics.”

Last mile logistics centres are a potential alternative use for car parks, should they become obsolete due to increased car sharing.

Simply because a building is vacant and in the right location does not mean it is ripe for conversion. “A last-mile logistics facility should have good access, appropriate ceiling heights, loading areas and the capability to sustain heavy floor loads,” says Smith.

Logistics companies also need to adapt to the requirements of last mile service, with different vehicles and more automation. In particular, they need to adapt to reverse logistics – the return of goods.

Real estate investors are seeing the value of last mile logistics facilities. In August 2019, Nuveen’s Asia Pacific Cities Fund acquired a last mile logistics centre near Seoul, which is occupied by online shopping platform Coupang and the Emart24 convenient store chain. Both occupiers are in the process of rolling out a one-day delivery service. In July, Credit Suisse Asset Management Global Real Estate bought two similar assets in Seoul.

Further reading:

Savills Industeial & logistics

Contact Us:

Simon Smith