Healthy interest in China life sciences space

Explore China's thriving life sciences real estate sector driven by an aging population, growing wealth, and booming pharmaceutical market. Discover investment opportunities backed by strong demographics and government support. Read more

China’s ageing population and growing wealth are attracting investors to the burgeoning life sciences real estate sector.

More investors are looking to buy or develop laboratory or manufacturing space for pharmaceutical and other healthcare companies. These firms require high specification assets for specialised fit outs.

China is the world’s second-largest pharmaceutical market after the US, according to health-data company IQVIA. Chinese spending on medicines reached $166 billion last year – compared with $429 billion in the US – and is expected to grow by almost $30 billion in the next five years.

As in other major life sciences markets, demographics is an important growth driver. Older people account for the bulk of medical spending and China is ageing rapidly. By 2019, there were 254 million older people aged 60 and over, according to the World Health Organisation. By 2040, an estimated 402 million people will be over the age of 60.

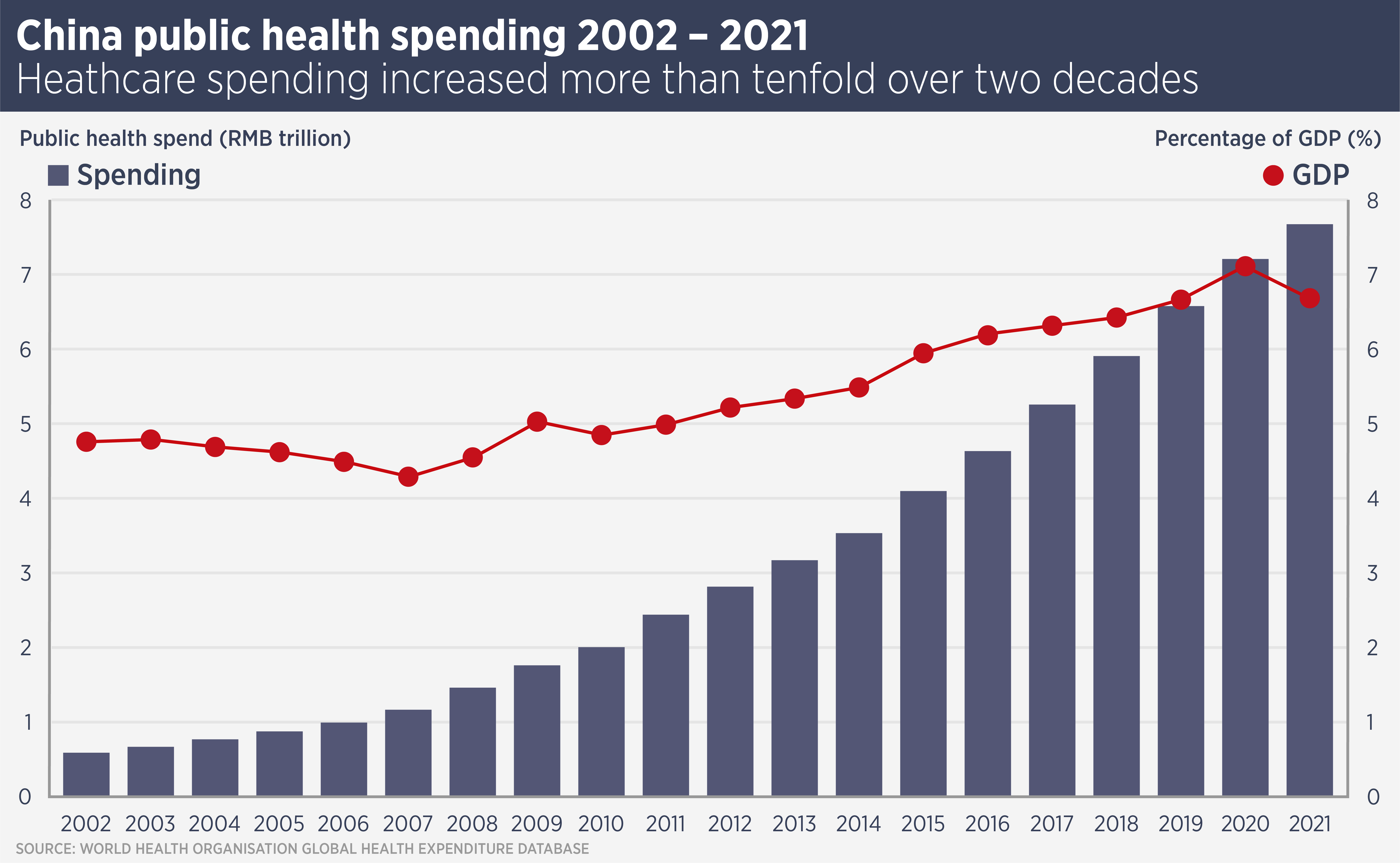

Wealth is another important factor in healthcare spending and China’s GDP nearly doubled in the past decade, even though the pandemic damaged growth in the past few years. Healthcare spending as a percentage of GDP rose to more than 7% in 2020.

A number of Chinese cities have the elements needed for a life sciences ecosystem: good universities, a qualified workforce, a good hospital system, government support and an active venture capital funding environment. Life sciences clusters have developed in cities such as Shanghai, Beijing and Suzhou.

“China has the fundamentals for a booming life sciences industry,” says James Macdonald, Head of Research at Savills China. “Global pharmaceutical companies are putting political tensions aside and investing in China, while the Chinese government is committed to improving healthcare under the Healthy China 2030 programme.”

Life sciences real estate appeals to investors for a number of reasons. Firstly, it gives exposure to a booming industry, which is backed by concrete demographic trends. Tenants tend to be ‘sticky’ because they often invest substantially in the fit out of their space and because rent is a small part of their expenses. And in China, there is strong government support for the sector at local and national level. Cities are keen to attract high value companies and their staff.

Last year, Chinese investment manager DNE Group closed a China life sciences real estate fund and it is reported to be seeking $750 million equity for a follow-on fund. Asian healthcare investment firm CBC launched a life sciences real estate arm in 2021 and is raising a $1.5 billion fund, supported by Dutch pensions group APG. Meanwhile, industrial specialist ESR bought a life sciences business park in Shanghai for $40 million in August 2022.

However, Macdonald says the sector is not easy for investors to access, not least because land must be zoned for industrial or R&D use and buildings must have an environmental impact assessment (EIA) permit in order for research or manufacturing to be carried out.

Local governments are focused on attracting the life sciences firms, so prefer the associated real estate to be developed by private equity groups which invest in the healthcare sector and thus have strong links to tenants.

However, he says: “The big challenge for life sciences is finding good investment opportunities. It is a relatively small market and a lot of investors are taking an interest in the sector.”

Further reading:

Global luxury retail outlook 2023

Contact Us:

James Macdonald