New economy to boost India real estate

Discover the emerging sectors of the Indian real estate market and explore the potential investment opportunities in life sciences, digital economy, and data centers.

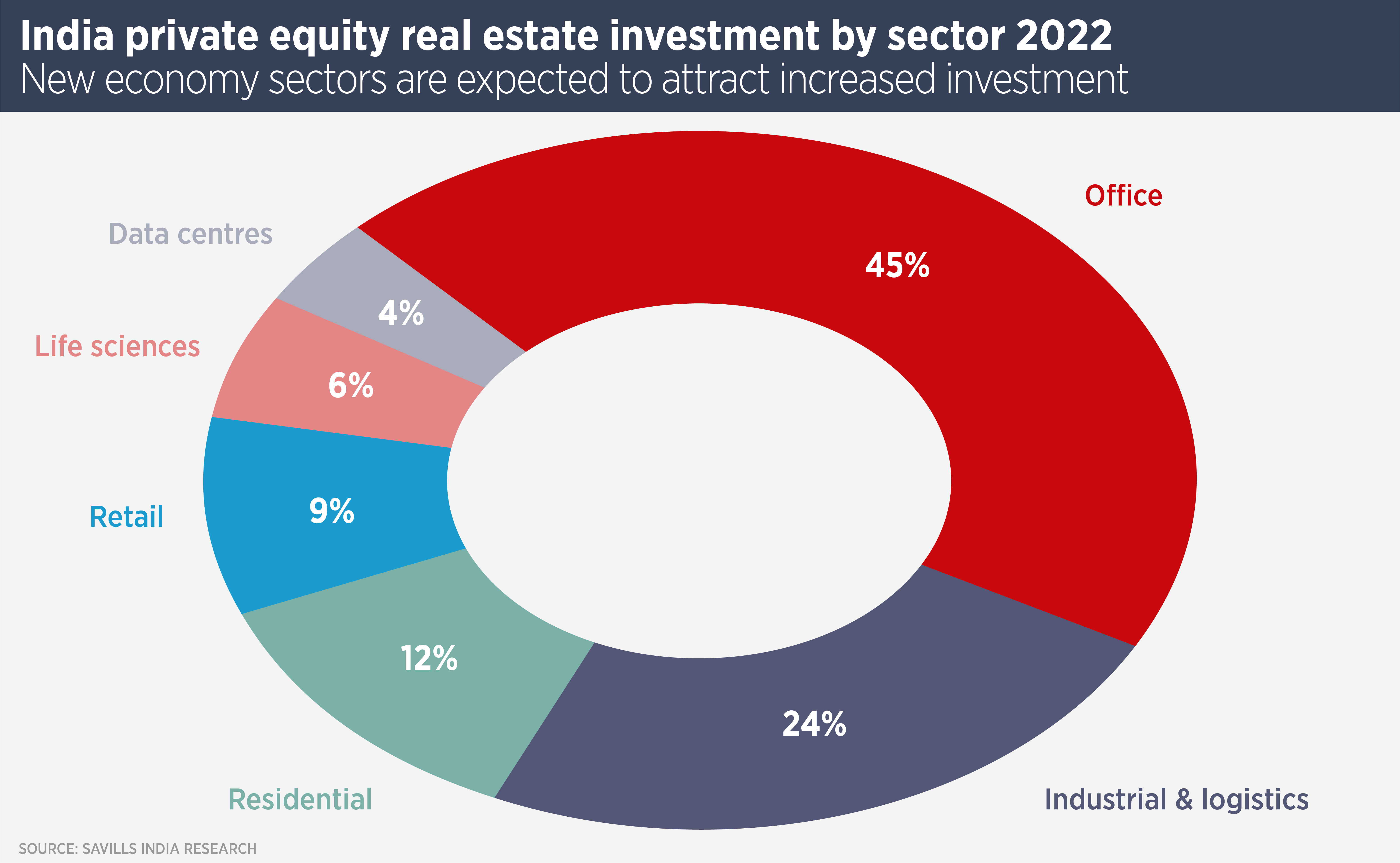

New economy sectors such as life sciences and data centres are set to become important drivers of the Indian real estate market.

The digital economy is also important in driving more traditional real estate sectors, with IT occupiers accounting for 38.9% of office take-up in India’s six largest real estate markets. High tech manufacturing is becoming an important part of the industrial real estate landscape; in November last year, US consumer electronics giant Apple announced plans to set up an iPhone manufacturing plant in Bengaluru , which will employ 60,000 people.

The life sciences sector is set to be of particular interest to global real estate investors, as it has attracted significant capital elsewhere. Blackstone Group spent $3.45 billion buying a US life sciences real estate portfolio from Brookfield in 2020, while Dutch pensions group APG invested $400 million in a Chinese life sciences real estate fund in 2021.

India is already the world’s largest manufacturer of generic drugs, so is seen as a prime location for life sciences expansion in Asia. Arvind Nandan, Managing Director, Research & Consulting at Savills India says: “We believe the life sciences industry is at an inflection point, with growth drivers such as an established pharma manufacturing base, owing to India being the largest manufacturer and exporter of generic medicines, a large skilled workforce for supporting R&D research outsourcing, and cost efficiencies already in place.

“According to our estimates, India has the potential to create demand for around 10 million sq ft every year for R&D laboratories until 2030. This could provide institutional investors with ample opportunity to increase allocations to the sector, especially in the development space.”

The booming Indian digital economy means demand for data centres is set to increase. There are several facets to the Indian digital revolution, including the world’s highest number of financial transactions, at over 70 billion in 2022, as well as e-commerce and burgeoning sectors such as AI and gaming. Savills estimates India data centre space requirements will increase by around 15 to 18 million sq ft across major cities over the next four to five years.

Savills expects the Indian data centre market to surpass one-gigawatt capacity this year with around 150MW of capacity to be added in new colocation centres. A number of Indian cities have introduced policies to encourage the development of data centres.

Last year, Blackstone Group set up a Indian data centre arm, owned by its real estate and tactical opportunities funds. It plans to develop two hyperscale data centres, in Mumbai and Chennai, with 600MW total capacity.

The sector got a boost last year when centres with more than 5MW capacity were awarded infrastructure status by the Indian government. This means easier and cheaper finance as well as more straightforward investment for overseas capital.

Savills predicts $3.5-4 billion of private equity real estate investments in India this year, up from $3.4 billion in 2022, with increased commitments from long-time India stalwarts such as GIC and Blackstone, increasing interest from Japanese developers as well as international investment managers targeting India for the first time.

Nandan says: “We anticipate manufacturing sector growth and digitisation of the economy to drive investments in the industrial and warehousing, data centres and life sciences segments.”

Further reading:

Savills India Research

Contact Us:

Arvind Nandan