Buyers and sellers adjust to changing Asia real estate market trends

Real estate transaction volumes in Asia Pacific plummeted in the first quarter of 2023, but there are signs of recovery as investors adjust to the latest trends. Learn more about the latest developments in the Asia Pacific real estate market.

Real estate has been reeling from the effects of rising inflation and interest rates, geopolitical upheaval and the uncertainty generated by these factors.

As a consequence, Asia Pacific real estate transaction volumes plummeted in the first quarter of this year, down 50% from the same quarter last year to $27.2 billion, according to MSCI Real Assets data.

“Investors hate uncertainty more than almost anything,” says Simon Smith, head of Research and Consultancy at Savills Asia Pacific. “Rapid changes in interest rates, geopolitics and the global economic outlook make doing nothing look very attractive.”

However, there are signs of investors adjusting to the latest real estate trends and this is expected to drive an uptick in activity later this year. One of the main reasons for constipation in the real estate market is a gulf between the expectations of buyers and sellers and – in some markets and sectors – this is beginning to close.

The retail sector suffered valuation downgrades for several years – Hong Kong retail values have fallen 50% since Q1 2019 for example – but this means yields are high enough to absorb interest rate rises and sellers are more likely to be open to offers. Furthermore, the end of covid restrictions around the region has encouraged both shoppers and investors.

For example, Singapore was the most active city in the first quarter of this year, with transaction volumes rising 40%, mainly thanks to activity in the retail sector. This activity was driven by favourable yields.

For example, Hong Kong’s Link REIT bought Jurong Point for S$1.99 billion, reflecting a gross yield of around 4.8% but secured debt finance at around 4.2%. Other significant retail deals closed at cap rates of 4.5-5.5%, demonstrating that yield-accretive transactions are still available in the retail sector.

Meanwhile in Japan, retail yields in some markets actually tightened in late 2022, due to rising confidence in the retail sector. In Australia, meanwhile, retail sellers have been happy to accept higher cap rates: Blackstone Group sold a Melbourne shopping centre for a cap rate of 8.5%.

In Hong Kong, meanwhile, MSCI Real Assets recorded 11 mortgagee sales, suggesting distressed assets are beginning to be resolved. A JV between private equity group PAG Asia and Mapletree Investments bought the Goldin Financial Global Centre for HK$5.6 billion, after former owners Goldin Financial defaulted on their debt.

More generally however, real estate market analysis suggests there will need to be further movement in cap rates before buyers return. In Seoul, for example, Savills research shows office yields rising only 10 basis points in the first quarter. However, Savills Korea Head of Research and Consultancy JoAnn Hong says: “Bid-ask spreads have gradually decreased. As the uncertainty surrounding the level of interest rates starts to fade, investment activity is likely to be more dynamic over the coming quarters.”

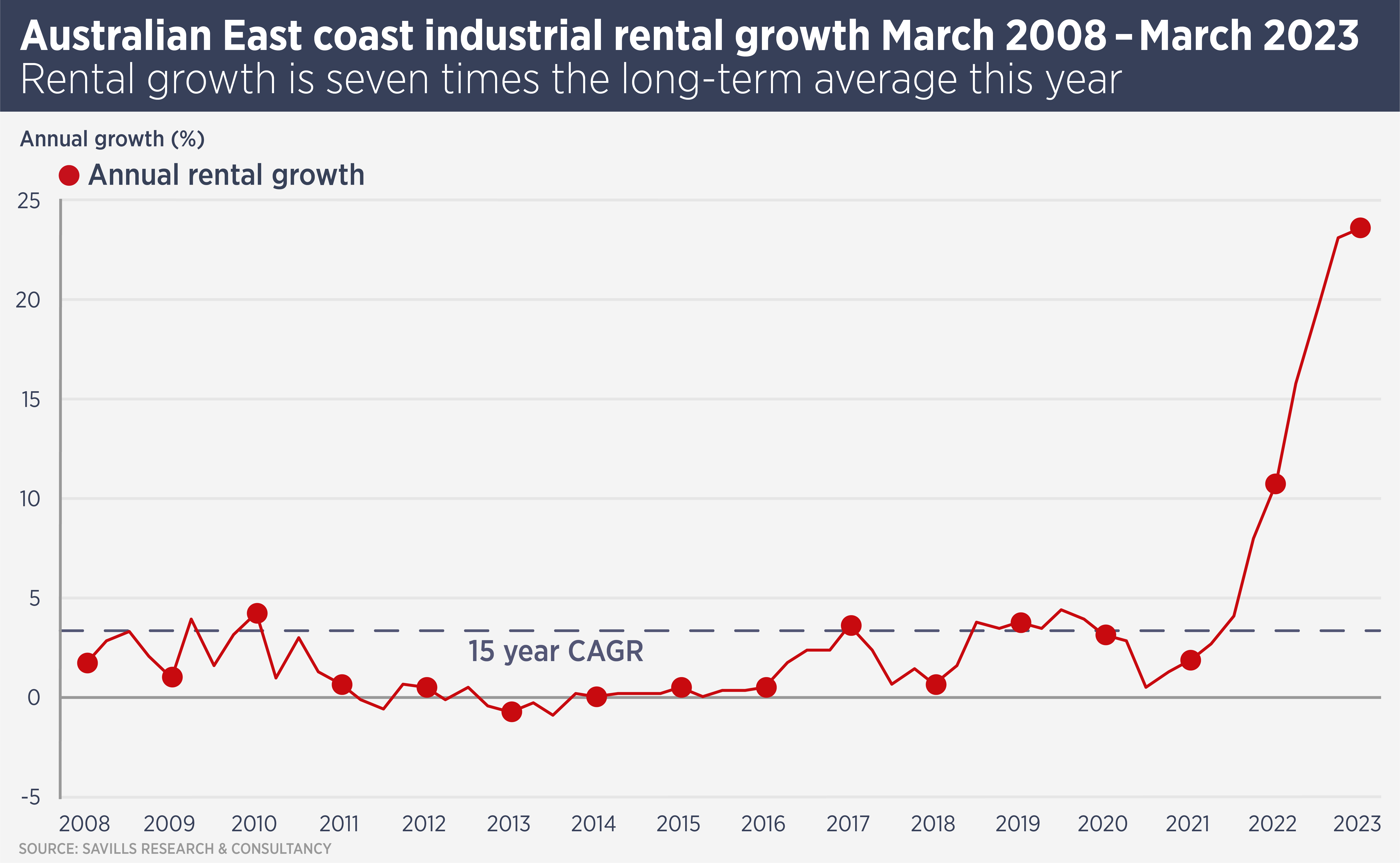

Some of the largest yield movements (30-40 basis points in Australia and Singapore) have come in the logistics sector, where yields compressed throughout the covid period, leaving the sector exposed to rising interest rates. However, rising rents in the sector are preventing a more dramatic pricing reset.

Finally, China remains an outlier low inflation and borrowing costs lower than they were a year ago. Nonetheless, the market is still struggling with a weakened economy, elevated vacancy rates and falling rents.

Simon Smith says: “It is almost impossible to make broad statements about a market as diverse as Asia Pacific, but we can see buyers and sellers gradually adjusting to changed market circumstances. This means we ought to see more transactions as the year progresses.”

Further reading:

Asia Pacific Investment Quarterly

Contact us:

Simon Smith | JoAnn Hong