Rocketing rents rescue Australian industrial

Australian industrial real estate has been hit by rising interest rates and yields, but strong demand from occupiers continues to support the sector.

Australian industrial real estate has been hit by rising interest rates and yields, but strong demand from occupiers continues to support the sector. Meanwhile, investors still look favourably on industrial and logistics as a long-term investment.

Industrial and logistics properties have become a hot favourite in Australia over the past decade and investor appetite combined with low interest rates compressed average yields by an astonishing 4.47 percentage points between 2013 and 2022, the most significant yield compression in any sector.

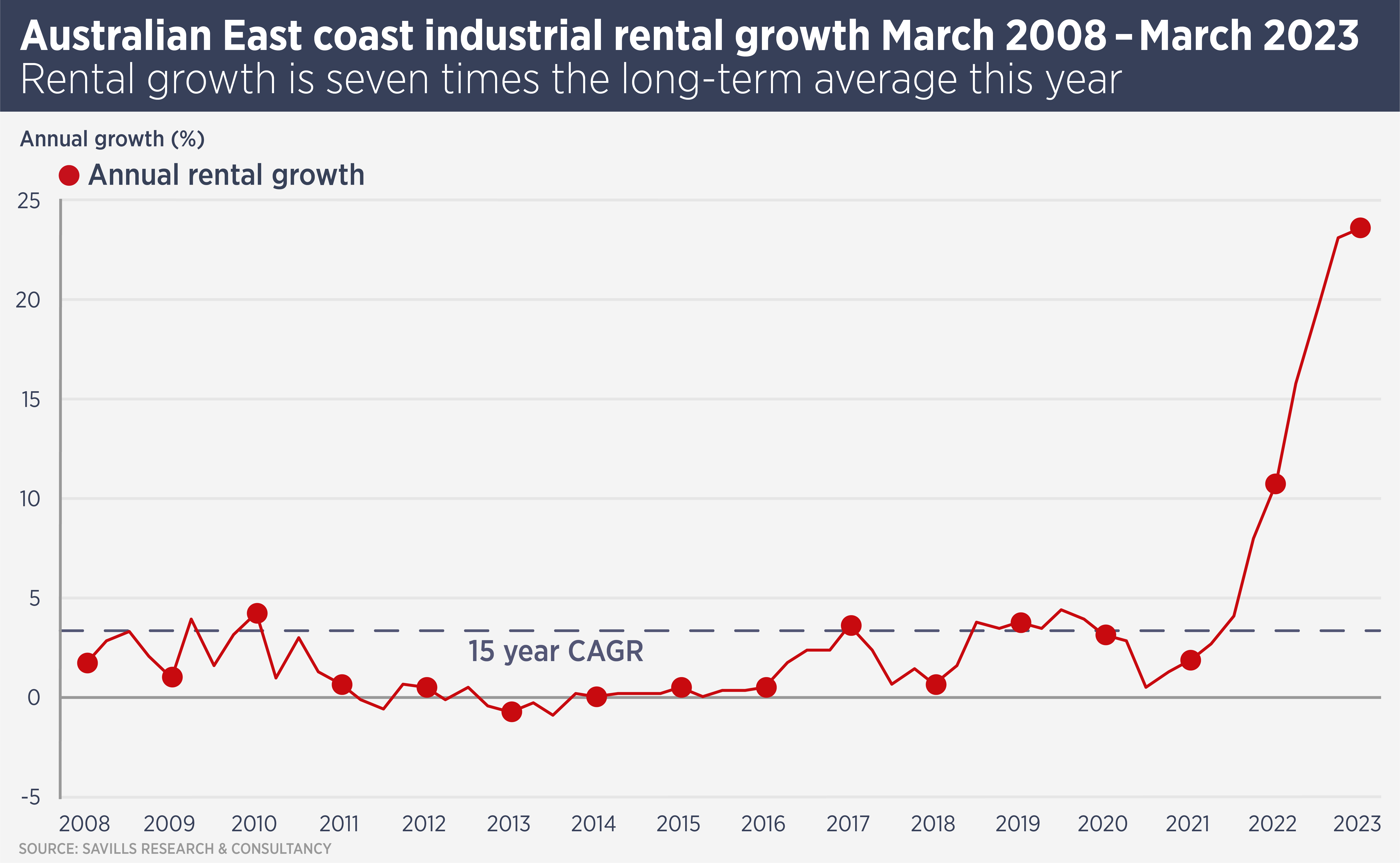

As in other markets, rising Australian inflation has triggered sharp rises in interest rates in recent months and average industrial yields on the east coast have risen to 4.8%, from a top-of-the market 4.0%. However, rental growth has been strong enough to counteract much of the fall in values attributable to rising yields.

Savills data show 2022 was a record year for industrial rental growth, with some sub-markets in Sydney showing growth rates above 35%. Industrial rents in Melbourne rose 28.4 percent, while both Perth and Brisbane saw double-digit growth.

“Such strong rental growth enables owners to capture the upside through market reversion and inflation-linked reviews. This is helping to support valuations despite recent yield expansion,” says Katy Dean, Head of Research & Consultancy at Savills Australia.

Rental growth is supported by vacancy rates which average 1% in major markets, constrained future supply and the continued rise of e-commerce. The increasing trend for nearshoring, moving manufacturing closer to consumers, will also support demand for industrial real estate.

The strongest driver is e-commerce. Online retail accounted for less than 12% of Australian retail sales last year, compared with 6.2% in 2019, and is on target to hit 15% within three years. Compared with other developed markets, Australian e-commerce penetration is relatively low. Online retail accounts for 23% of US retail sales, for example.

“Given the strong correlation between warehouse demand and retail sales, rising e-commerce will amplify the need for more industrial floor space,” says Michael Wall, National Head of Industrial & Logistics at Savills Australia.

Australian developers and real estate investment trusts continue to invest in developing new industrial and logistics stock and more than 80% of pipeline space is already preleased.

Despite rising yields and a rocky short-term outlook for the global economy, real estate investors remain committed to industrial and logistics real estate in Australia. For example, the ANREV Investor Intentions Survey 2023 found industrial & logistics was the second most preferred sector in the APAC region for investors in 2023 after residential, with two of Australia’s capital cities appearing in the top three preferred locations for targeted investment.

Wall says: “Despite some economic headwinds facing the property sector, investors continue to look very favourably on industrial and logistics as an asset class. The landscape may have changed but demand for industrial and logistics real estate remains very strong

and the structural tailwinds are compelling.”

Further reading:

Savills Australia Insight & Opinion