The dividends of data

Data centres are real estate’s way to plug into a huge migration of business online; how can real estate investors gain access to the sector?

The data centre market in Asia Pacific has multiple winds behind it: the rollout of 5G, the Internet of Things, increased demand from businesses and the effects of the COVID-19 pandemic. The global colocation market is expected to grow 15% this year and the compound average growth rate of enterprise spending on cloud infrastructure is expected to grow 22% over the next five years, while global mobile data traffic is expected to rise 31% annually until 2025.

Simon Smith, head of Asia Pacific research and strategy at Savills, says: “The sharp increase in homeworking and online shopping due to the pandemic has buoyed the data centre sector this year, but future growth will be just as strong. 5G mobile customers will be far more data hungry, as will self-driving cars and IoT devices in homes and businesses.

“Data centres fulfil the demand from investors for niche real estate sectors with a strong operating component, which will outperform in an environment where yields are expected to be low for the very long term.”

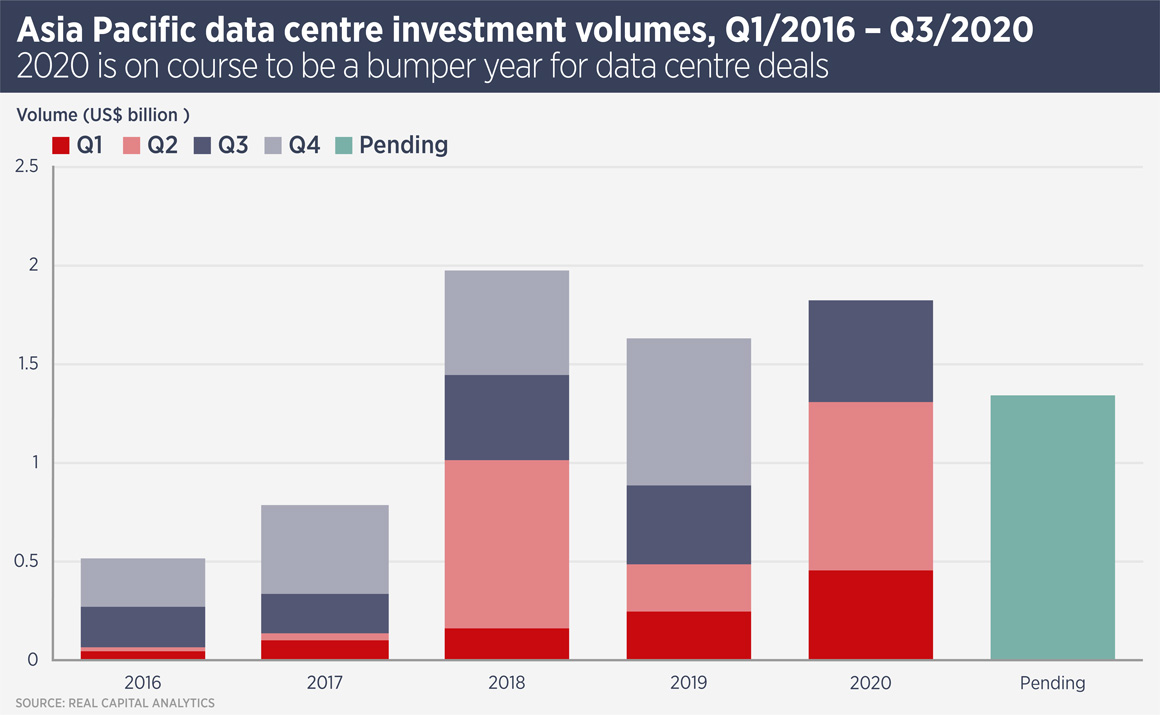

Investors have noticed, with Gaw Capital Partners closing a $1.3bn China data centre fund in September. And in October, Bain Capital-backed data centre operator Chindata raised $540m in an IPO which valued the firm at $4.9bn. Real Capital Analytics data (see below) shows Asia Pacific data centre investment sales are on track to quadruple this year, compared with 2016.

Jonathan Berney, chief operating officer at Chayora, a Hong Kong-based developer of China data centres, says, while many of the world’s data centres are controlled by large players such as Equinix or Digital Realty, Asia Pacific is unusual in offering a more fragmented market. “It is still possible to acquire data centres on an asset by asset basis in this region,” he says.

However, he recommends that a real estate investor partner with a specialist. “Data centres are fundamentally an operating asset and the demand side is much more discerning these days. The land, shell and core aspects of the building are a relatively smaller part of its value compared with the MEP (mechanical, electrical and plumbing) components. Data centres also need trained staff and this is an area where Asia has difficulty in keeping up with the growth of the market.”

Investors assessing a data centre or data centre site need to consider the reliability and cost of power, says Berney. “Some data centre locations have developed purely due to their access to power.” For many users, sustainability and use of renewables is important. Naturally, data centres also need excellent connectivity and availability of fibre. Data centres require huge amounts of cooling, so a cooler location is advantageous.

Location is important for a data centre, but only in the context of its eventual use. “A disaster recovery centre needs to be located away from the primary centre it acts as back up for,” he says. “On the other hand, a data centre to support high-frequency trading needs to be as close to the trading floor as possible.”

Data centres also differ from other real estate niches in one important aspect. The expensive and specialised build means the opportunities for an alternative use is limited, although Berney adds: “the demand is huge, so that should not be a problem”.

Further reading:

Chayora

Contact Us:

Simon Smith