Japan logistics keeps on trucking

Japanese warehouses are getting bigger and the logistics sector continues to thrive, while it is boom time for data centres.

Vacancy rates in Greater Tokyo and Osaka have risen in the first half of this year, due to increased supply, however rents have continued to rise, up 1.6% in the year to June 30 in Tokyo.

Supply is being driven by huge modern logistics facilities developed by domestic players such as Mitsui Fudosan, which launched a 270,000 sqm, eight-storey facility this year, and overseas sector specialists like Prologis, which is set to complete two facilities totalling 370,000 sqm in Osaka this year.

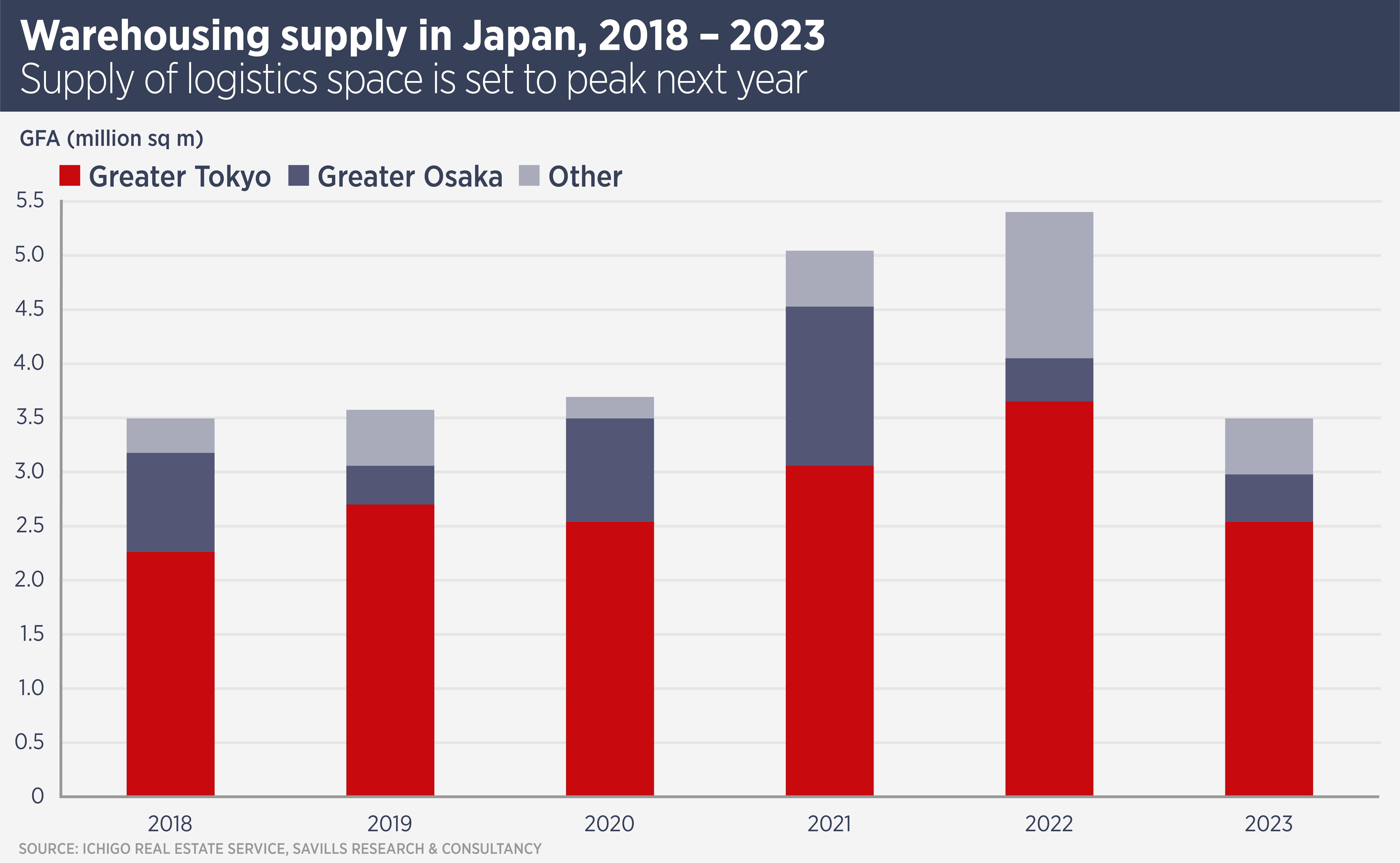

“There are multiple large-scale projects in the pipeline for Greater Tokyo, says Tetsuya Kaneko, head of research & consultancy at Savills Japan. “2022 and 2023 are projected to see more than 20 developments with gross floor areas greater than 100,000 sqm each.”

However, oversupply is not a concern at present. The giant Tokyo developments slated for 2022 and 2023 “appear to be well spread out over different areas and are taking place in convenient locations such as along major expressways, making it easier for the market to absorb these high levels of supply,” says Kaneko.

Japan is expected to see record logistics supply of just over 5m sqm this year and even more in 2022, with more development outside Tokyo and Osaka. More domestic companies are getting involved in the sector; for example, JR West Real Estate & Development started its first logistics development in Hyogo prefecture this year.

“Fundamentally speaking, the logistics sector remains as strong as it was last year. Demand has effortlessly kept up with the ample supply entering the market,” says Kaneko.

The boom in modern logistics property in Japan has slowed as the market has matured and it seems that data centres has become the emerging sector of choice among both domestic and international investors seeking opportunistic returns.

The data centre market in Japan is set to grow by 33% between 2020 and 2024, according to IDC Japan. The Japanese government is supportive of the sector, which is contributing to the boom.

Goldman Sachs plans to increase its real estate investments in Japan to ¥250bn ($2.3bn) per year, with data centres a prime target, while Mitsui & Co has announced plans for ¥300bn of investment in the sector. Overseas sector specialists AirTrunk and Princeton Digital Group are developing hyperscale centres in Japan.

Further reading:

Savills Japan Research

Contact Us:

Tetsuya Kaneko