Asia’s two-tier hotel market

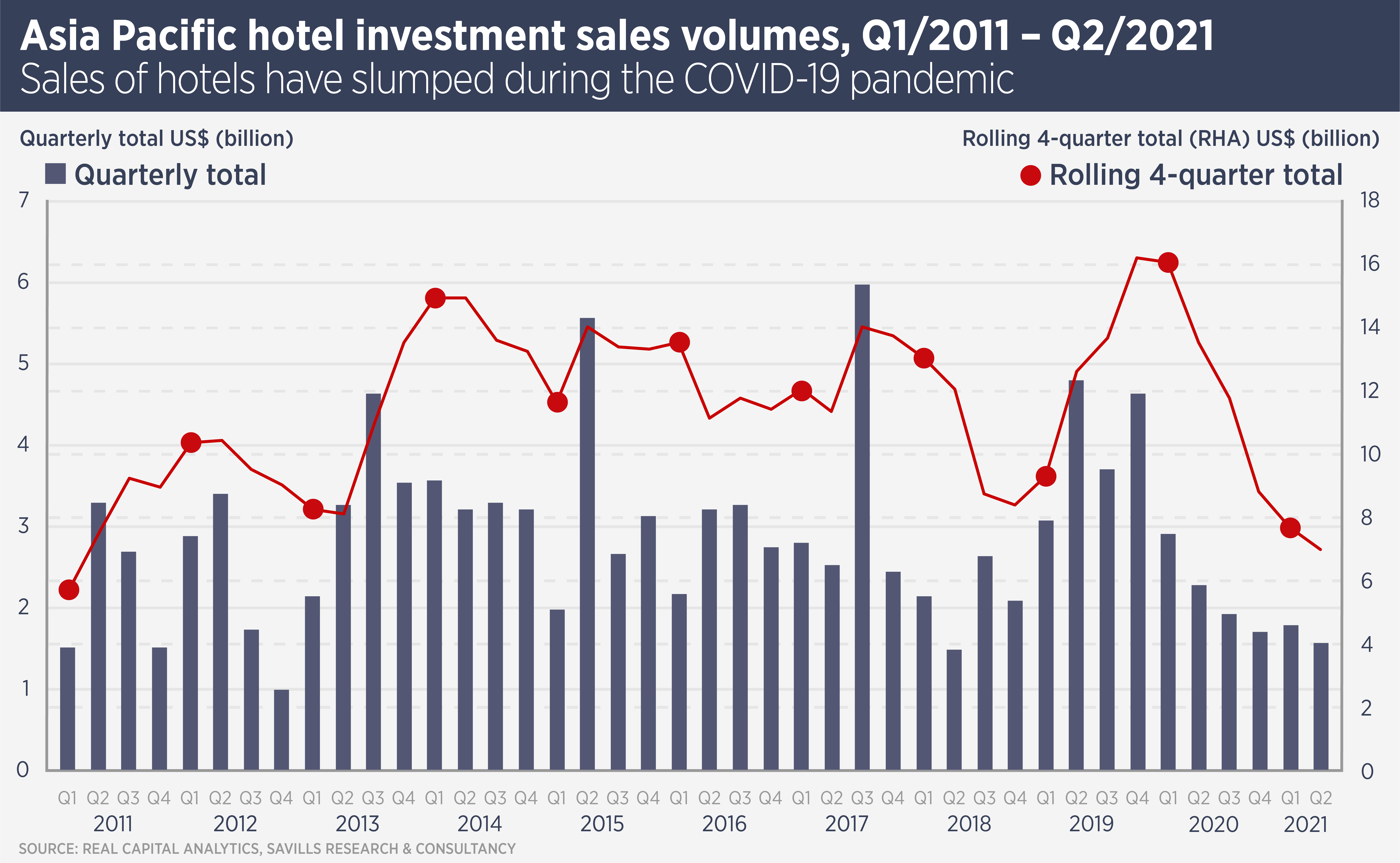

Every hospitality market in Asia Pacific is struggling with the COVID-19 pandemic, however the outcome for the hotel investment market is widely divergent.

Investors are buying Australian and Japanese hotels, while sellers in markets such as Indonesia and Vietnam are finding it all but impossible to shift assets. Total regional hotel transaction volumes stood at $1.5bn across 31 transactions in the second quarter of this year, a similar level to Q1 2021, but representing a 32% decline year-on-year. North Asia accounted for 76% of the regional total transacted during this quarter.

“So far this year, almost all institutional scale hotel deals in the Asia Pacific region have happened in Greater China, Japan, South Korea and Australia,” says Michael Roberts, director, hotels, Asia Pacific at Savills. “There is little activity in emerging Southeast Asia because international capital, which faces ownership restrictions in many markets, is staying away and domestic capital is finding it hard to raise debt. Meanwhile in Singapore, government support for the sector means we haven’t seen motivated sellers.”

A number of global real estate investors have been busy in hospitality, including Singaporean sovereign fund GIC Private and Swiss private equity firm Partners Group, which teamed up with Australian hospitality group Salters to buy a portfolio of 11 Travelodge hotels for A$620m ($457m). Meanwhile, Blackstone Group bought a portfolio of eight Japanese hotels for $540m.

In both cases, the investors have bought in the expectation of a strong recovery in hospitality once the pandemic is over. Japan in particular has accelerated its vaccination rate and expects to have 60% of the population fully vaccinated by the end of September. In Australia, ongoing lockdowns and the lack of business travel continue to hurt hotels in the nation’s central business districts, meaning GIC and Partners will have to wait to benefit from the recovery.

Some Australian hotels are booming, however. Hotels and motels outside the big cities have been filled with domestic travellers prevented from heading overseas. “In Australia, regional hotels which cater to domestic tourists have had a record year, with a captured, high-spending customer base,” says Roberts.

There has been buying activity in Hong Kong and Mainland China, however buyers are looking to exploit the hospitality downturn and are acquiring hotels in order to change the use, mainly to residential. In Hong Kong, for example, US real estate developer and fund manager Hines, acquired the 158-key Butterfly on Prat in Tsim Sha Tsui area for HK$980 million. The asset is expected to be converted to residential use. Meanwhile Weave Living bought a hotel in Kai Tak for HK$390m, which it will convert to a co-living facility.

“We’d expect to see more of this kind of deal in markets where demand for residential space is high but where hospitality continues to suffer,” says Roberts.

Further reading:

Savills Hotel Asia Pacific

Contact Us:

Michael Roberts