Multifamily valued

Japan’s multifamily residential sector remains the favourite sector for overseas investors.

The multifamily sector globally is prized by institutional investors in uncertain times, having proved resilient in the Global Financial Crisis, and Japan offers the only developed multifamily sector in Asia Pacific.

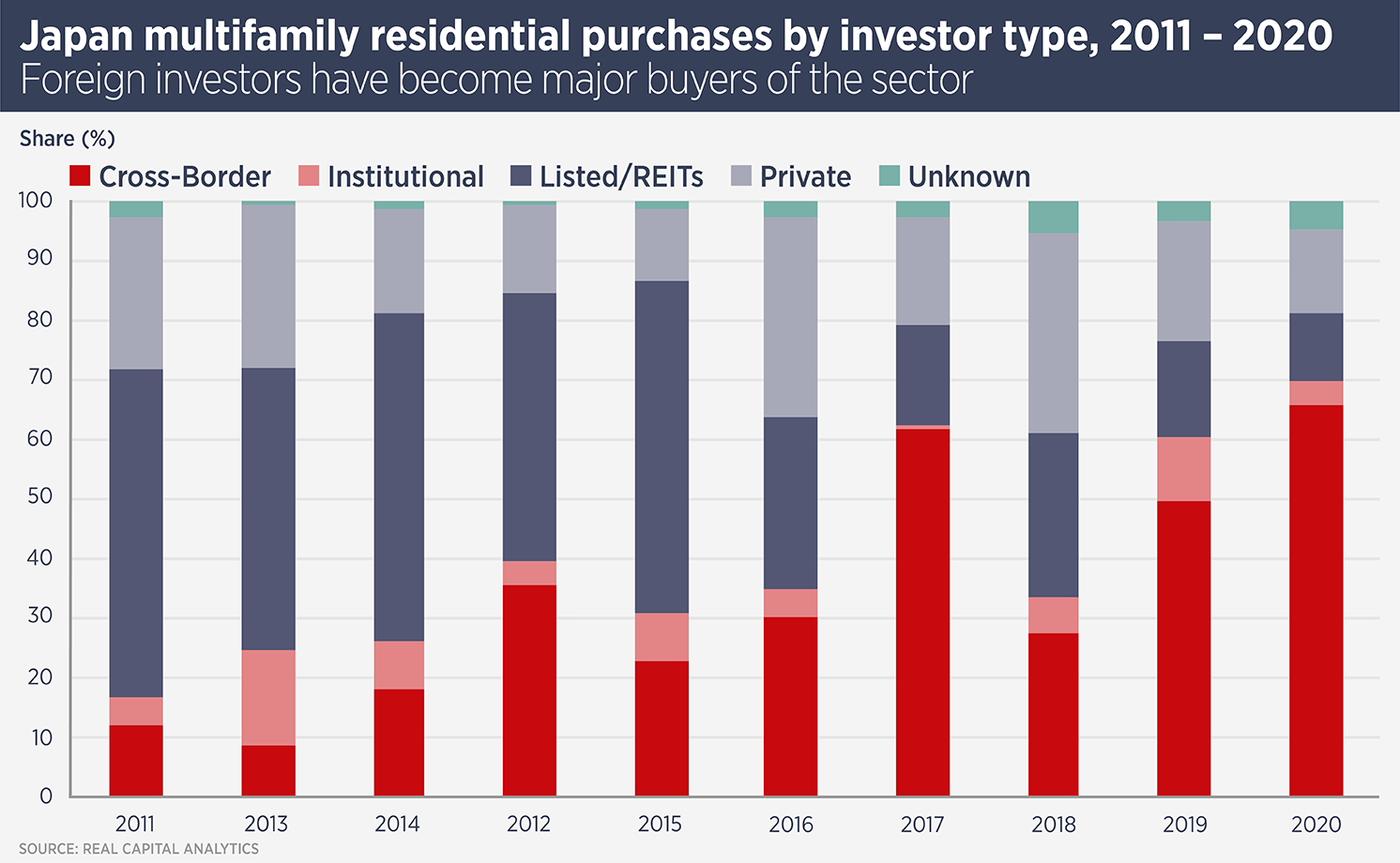

Last year, according to Real Capital Analytics, the Japanese multifamily sector saw 37 deals involving overseas investors, the largest of which was Blackstone Group’s ¥300bn purchase of a 220-asset portfolio from Chinese insurer Anbang. Total deal volume was ¥930 billion. Japan was not alone, RCA data show six of the 10 largest global apartment markets in 2020 recorded an increase in activity compared with the year before.

Tetsuya Kaneko, head of research and consultancy at Savills Japan, says: “The attractiveness of the market is based on favourable funding conditions, as well as its stable political and economic fundamentals. These factors have stood out especially in recent years as social disruption, including COVID-19, has been experienced globally. As the world economy remains clouded by uncertainty, and abundant liquidity seeks investment opportunities, the Japanese residential market will likely continue to gain traction.”

Overseas investors’ share of the market has been growing since 2014, when Blackstone bought a large portfolio from GE Real Estate (a portfolio which formed the basis of the one it sold to Anbang in 2017 and re-purchased last year). There is more to the market than Blackstone’s trading, investors including Allianz Real Estate, AXA IM – Real Assets, Nuveen Real Estate, PGIM Real Estate and Savills Investment Management have all been active in recent years.

Foreign investors have – to some extent – filled a gap left by Japanese real estate investment trusts, which were active from 2009 to 2014, but have been less active as yields in the sector have compressed – yields contracted 40 basis points in Tokyo in 2020 alone, according to transaction data from RCA. Savills research pegs Tokyo mid-market residential cap rates at 3.4%, with no change in 2020.

The market is dominated by Tokyo, which accounted for 42% of transactions in 2020, Savills data show, while Osaka, Nagoya and Fukuoka account for a further 31%. Tokyo’s dominant position is partially due to it being the largest and most liquid investment market, but also due to its growing population, something shared by the other three cities. Overall, migration to larger cities, for employment and education, is a countervailing force to Japan’s falling population.

Overall migration figures are not the only story, Kaneko points out. “Population growth rates vary widely even in the same city, and therefore, investors need careful assessments of submarket-level population movements. For example, although the population of Osaka City overall is forecast to shrink by 4.1% between 2020 and 2030, central wards such as Naniwa, Kita, Tennoji and Chuo are expected to see double-digit growth during the same period.”

Population growth has driven residential rents upwards, however one effect of the COVID-19 pandemic seems to have been a pause in Tokyo’s population growth and a dip in rents in the city’s Central Five Wards for now.

While the pandemic may yet bring some changes in the way Japanese people live and work, urbanisation is set to continue and should underpin the sector.

Further reading:

Savills Japan Research

Contact Us:

Tetsuya Kaneko