Betting on GBA offices

The Greater Bay Area is set to become one of the world’s premier economic zones, offering a range of opportunities for office investors.

The GBA consists of nine Chinese cities – Shenzhen, Guangzhou, Foshan, Dongguan, Zhuhai, Zhongshan, Huizhou, Zhaoqing and Jiangmen – and the special administrative regions of Hong Kong and Macau. The combined population is more than 70m (possibly a lot more when unofficial migration is counted) and GDP is approximately $1.6 trillion.

The Chinese government has invested colossal sums in infrastructure improvements to link the cities and reduce journey times. As well as integrating the region, the Chinese government wants it to evolve from being the factory of the world to a global centre for high-tech manufacturing and innovation, financial services, trade, and tourism.

Simon Smith, head of research and consultancy, Savills Asia Pacific, says: “The continued integration of the GBA, moving up the value chain and its large population mean it will soon overtake the Tokyo Bay and New York Bay regions in terms of GDP. This growth will open up substantial opportunities for real estate investors.”

In particular, the move from lower value manufacturing to higher value tech and financial services business will generate substantial demand for office space. However, not every city has the same growth prospects.

Carlby Xie, head of research, Southern China, at Savills, says Shenzhen will be the hottest office market in the GBA going forward. “Political support and policy incentives from the central and local governments will propel more leasing and purchasing demand from both the public and private sectors.

“On a more micro level, a growing number of enterprises are locating their GBA headquarters offices in Shenzhen, in addition to their existing establishments in Shenzhen or Guangzhou recently. We expect this ‘double office’ phenomenon to become more noticeable in Shenzhen going forward.”

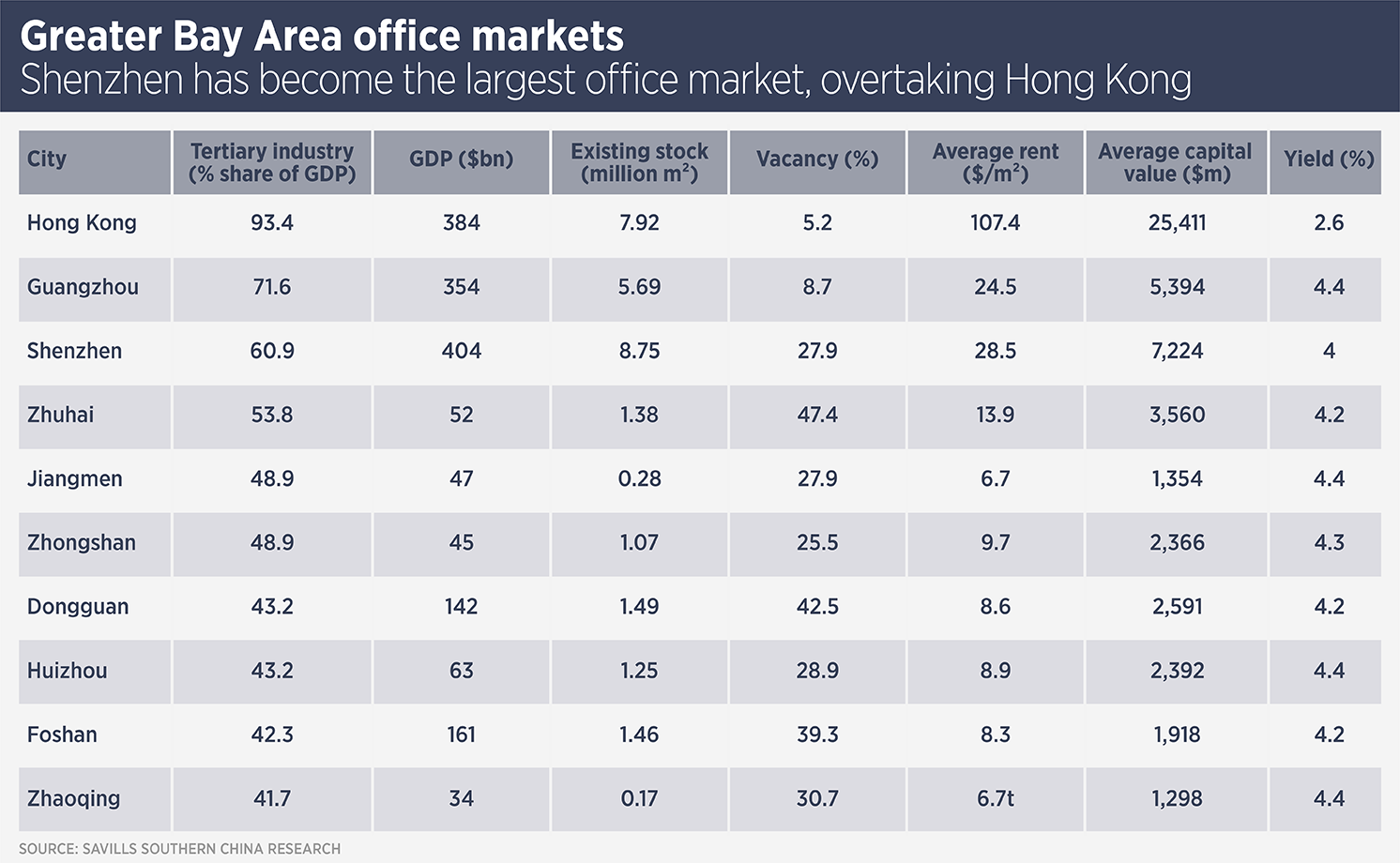

Xie expects Shenzhen and Guangzhou to show the most rental growth over the next 10 years. Both markets offer lower occupancy costs than Hong Kong yet do not have the dramatic vacancy rates of other cities, although Shenzhen’s current vacancy rate is much higher than Guangzhou’s.

Despite the twin traumas of political upheaval and COVID-19, Hong Kong continues to be one of the world’s premier financial centres. PwC predicts a record HK$460m in IPOs in Hong Kong this year and the city continues to be a first port of call for Mainland Chinese financial services companies looking to expand globally. Mainland firms took 4% more space in 2020 than 2019, despite the pandemic.

Smith says: “Companies which raise funds in Hong Kong do not necessarily set up offices here, but IPOs involve investment banks and service providers, such as lawyers, accountants, and securities firms. Meanwhile PRC financial institutions continue to expand in Central.”

Further reading:

Savills China Research

Contact Us:

Simon Smith | Carlby Xie