Fair winds to swell the ASEAN luxury retail sector

Luxury retail markets in Southeast Asia are set fair for growth thanks to a combination of demographics, increasing wealth and their rapid emergence from the COVID-19 pandemic.

Luxury retail markets in Southeast Asia are set fair for growth thanks to a combination of demographics, increasing wealth and their rapid emergence from the COVID-19 pandemic.

Asia is now established as the leading region for luxury retail, surpassing Europe and the Americas. Bain & Company reported that personal luxury goods sales in Asia rose to €112 billion last year, accounting for 39% of all global sales.

Established luxury retail markets, such as Mainland China, Tokyo and Seoul, have been supported by domestic shoppers during the pandemic, while many destinations in Southeast Asia have been hit hard by the absence of high-spending tourists.

Between 2019 and 2021, rents corrected across the region, with the contraction ranging from 2.6% for Kuala Lumpur to nearly 43.7% in Jakarta. Only Hanoi saw rents rise, by 11.1%.

However, ASEAN cities are likely to see a rapid recovery with the return of international tourists to hotspots such as Bangkok, Singapore, Kuala Lumpur, Phuket, Pattaya and Bali.

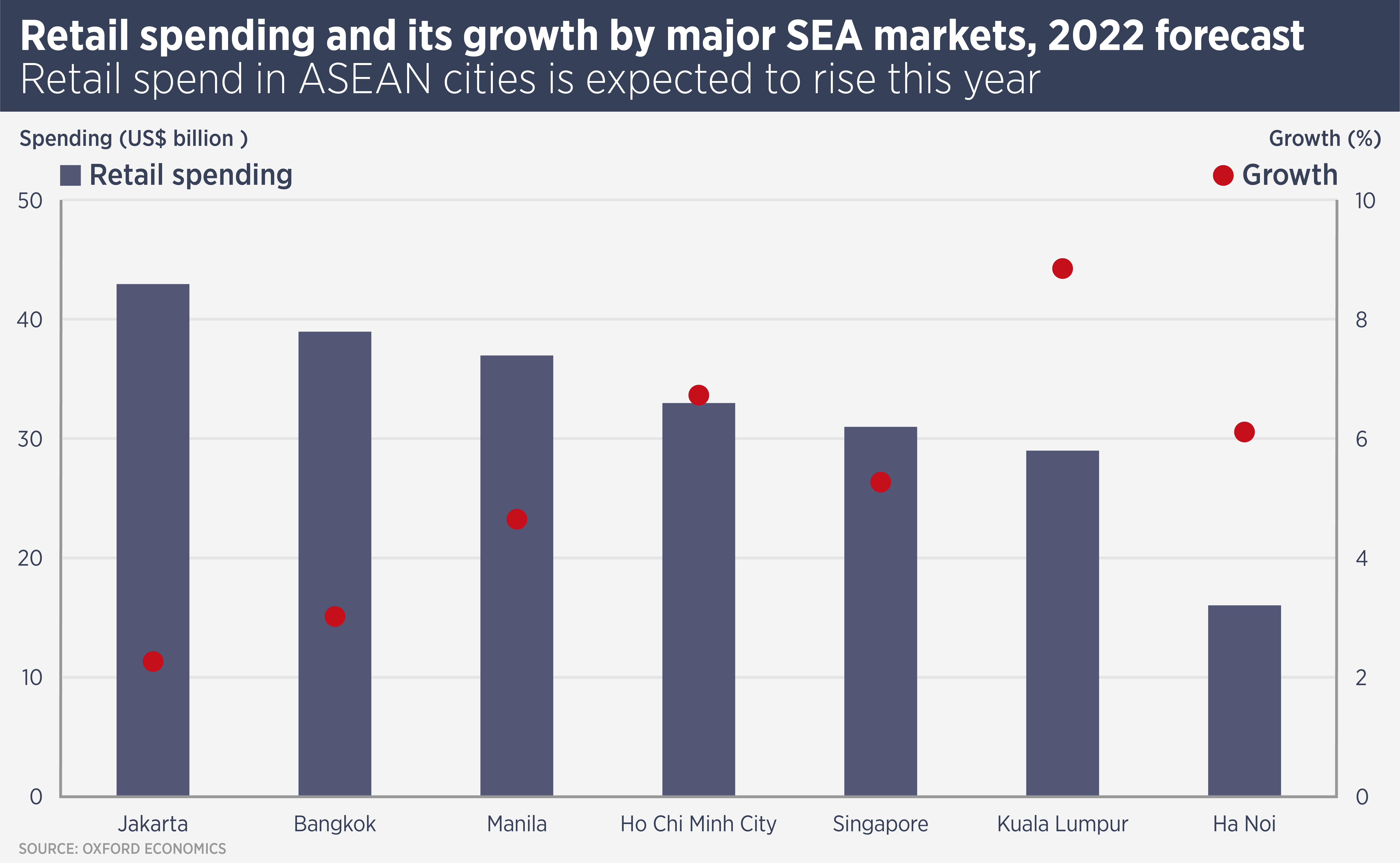

These six locations alone attracted $80 billion of tourist spending in 2019 and are now, alongside the Philippines, open to travellers again. Oxford Economics predicts retail spending growth of between 3.8% (Jakarta) to 9.1% (Kuala Lumpur) in 2022.

“We expect these Southeast Asian markets may enjoy first-mover advantages in the short term,” says Nick Bradstreet, Head of Asia Pacific Retail at Savills.

Meanwhile, more established markets in Greater China and Japan are still reliant on domestic shoppers due to ongoing pandemic restrictions.

In the longer term, luxury retailing in developing ASEAN markets, such as Viet Nam, Thailand, Malaysia, Indonesia and the Philippines, will be supported by rising populations, fast-growing wealth and rapid urbanisation. The region has a population of more than 620 million, with a youthful population in larger markets such as Indonesia.

The aggregated consumption expenditure of all ASEAN countries is expected to record a compound annual growth rate (CAGR) of 5.2% per annum over the ten years to 2031, surpassing an overall Asia Pacific CAGR of 4.7%. This growth should drive new retail development and rising rents and values.

“Growth in demand has quickly out-paced supply in many developing retail markets, especially for quality projects in prime areas,” says Bradstreet. “We have seen a consistent trend for luxury retailers to follow trusted developers, expanding their footprint in new projects designed to house these high-end players.”

There are still downside risks for ASEAN nations this year, with the potential for a re-emergence of the pandemic and further travel restrictions. Furthermore, the absence of wealthy Chinese tourists continues to be a drag on luxury retail markets across the world.

However, open borders and growing wealth mean ASEAN nations are on course for a burgeoning luxury retail sector.

Further reading:

Savills Viet Nam retail

Contact Us:

Nick Bradstreet