Is Asia Pacific retail on the way back?

Asia Pacific's retail sector shows signs of recovery, with rising rents and positive growth driven by strong economic outlooks, increasing retail sales, and a rebound in tourism.

Retailers and retail owners have had a tough time across the region in recent years, however there are signs that the retail sector has turned a corner, after a number of difficult years.

“As always, the diverse nature of the Asia Pacific region means different markets are under different pressures, both positive and negative, however we have seen retail rents bottom out and begin to recover,” says Simon Smith, Head of Research & Consultancy, Savills Asia Pacific.

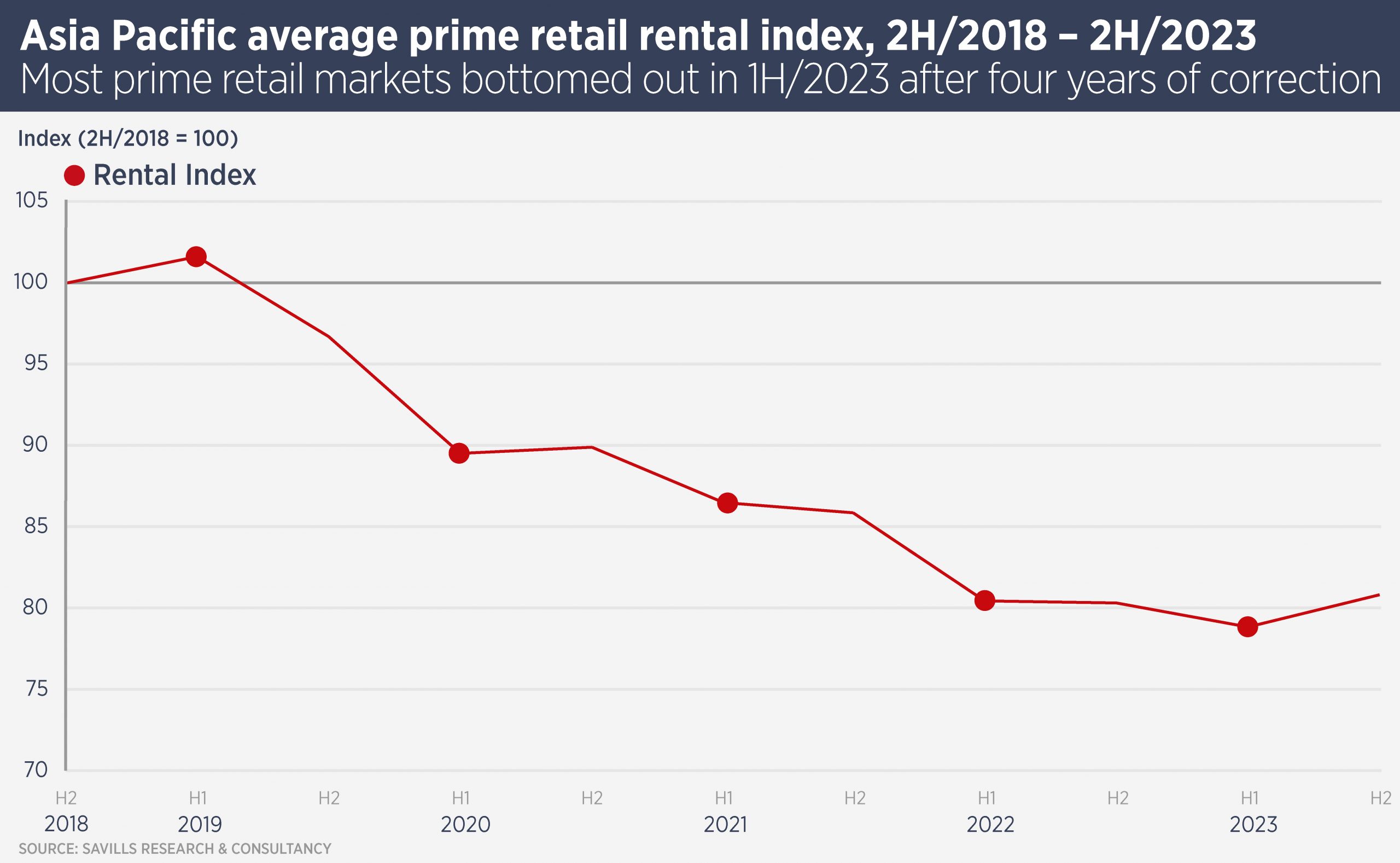

Savills Asia Pacific Average Prime Retail Rental Index showed rents bottoming out in the first half of 2023, before beginning to rise again in the second half of the year, after four years of correction.

The second half rental increase was small in most markets, with only Osaka and Hanoi showing more than 5% growth, however only Seoul continued to show a fall in retail rents.

There are a number of positive drivers for Asia Pacific retail, beginning with the region’s relatively strong economic outlook. Asia Pacific GDP growth is forecast to be nearly 4% this year, more than double that forecast for the US and way ahead of the Eurozone’s sluggish performance. Some Asian nations – India, Vietnam, Malaysia and the Philippines – are on course for more than 6% growth this year. Retail sales are set to rise by around 5% this year, with India and Hong Kong in line for double-digit growth.

Tourism, an important driver of retail, especially the luxury sector, has been slower to recover in Asia Pacific, as most nations retained pandemic restrictions for longer than other regions. A full recovery is expected this year and next, driven by a gradual return of Chinese tourists. Nonetheless, markets such as Japan are seeing a strong recovery even with lower numbers of Chinese tourists.

“While Chinese tourists are not travelling overseas as much, internal travel has recovered to pre-COVID levels, which will boost domestic retail,” says Smith. “Bain & Co is predicting 4-6% growth in the Mainland China luxury goods market. Wealthy consumers will spend more than RMB450 billion this year.”

Savills data show F&B, athleisure and cosmetics retailers leading leasing across the region in the second half of 2023. Retailers in the outdoor sector also expanded, while leisure and activity brands took more space in shopping centres.

In the luxury sector, jewellery and watch brands have been cautious and only expanding in key markets. However, they and other luxury brands have been investing in concept stores and other more experiential retail. Flagship luxury shops, like watchmaker Richard Mille’s new Singapore store, offer a complete luxury experience, complete with bars, cafes and artwork.

“After several years of pandemic restrictions, it is no surprise that Asian shoppers are looking to get out and about,” says Smith. “Meanwhile, high-end brands understand that shoppers want a complete luxury experience in-store.”

The 2024-2025 outlook for retail rents across the region is mixed, with some markets – such as Singapore and Ho Chi Minh City – in the late stages of an upswing, while markets such as Hong Kong and Tokyo are in the early stages of an upswing. Substantial supply this year and next will mute rental growth in Mainland China, while Savills predicts that Kuala Lumpur could be in line for double-digit growth this year and next. Most other markets are set for single digit growth in both 2024 and 2025.

“Retail real estate will be supported by economic growth and recovering travel for the next two years, meaning a broadly positive outlook, however investors should be selective about markets and assets,” Smith says.

Further reading:

Asia Pacific Retail Spotlight

Contact Us:

Simon Smith