Booming cities will drive Asia Pacific growth

Discover the future of urban growth in Asia Pacific: Megacities set to drive economic expansion and present unprecedented opportunities for real estate investment.

Urbanisation and rising populations will create new megacities across Asia Pacific, which will be outsize contributors to the regional economy

Existing and burgeoning megacities will fuel economic growth and opportunities for real estate investors. Simon Smith, Head of Research and Consultancy, Asia Pacific, at Savills, says: “Cities globally are the prime drivers of innovation and growth. As Asia continues to urbanise, we will see more megacities emerge, with large populations and large contributions to GDP.

“Naturally, the growth of these cities will require new real estate to accommodate people and businesses. Fast-growing cities represent a long-term opportunity for real estate investors in Asia Pacific.”

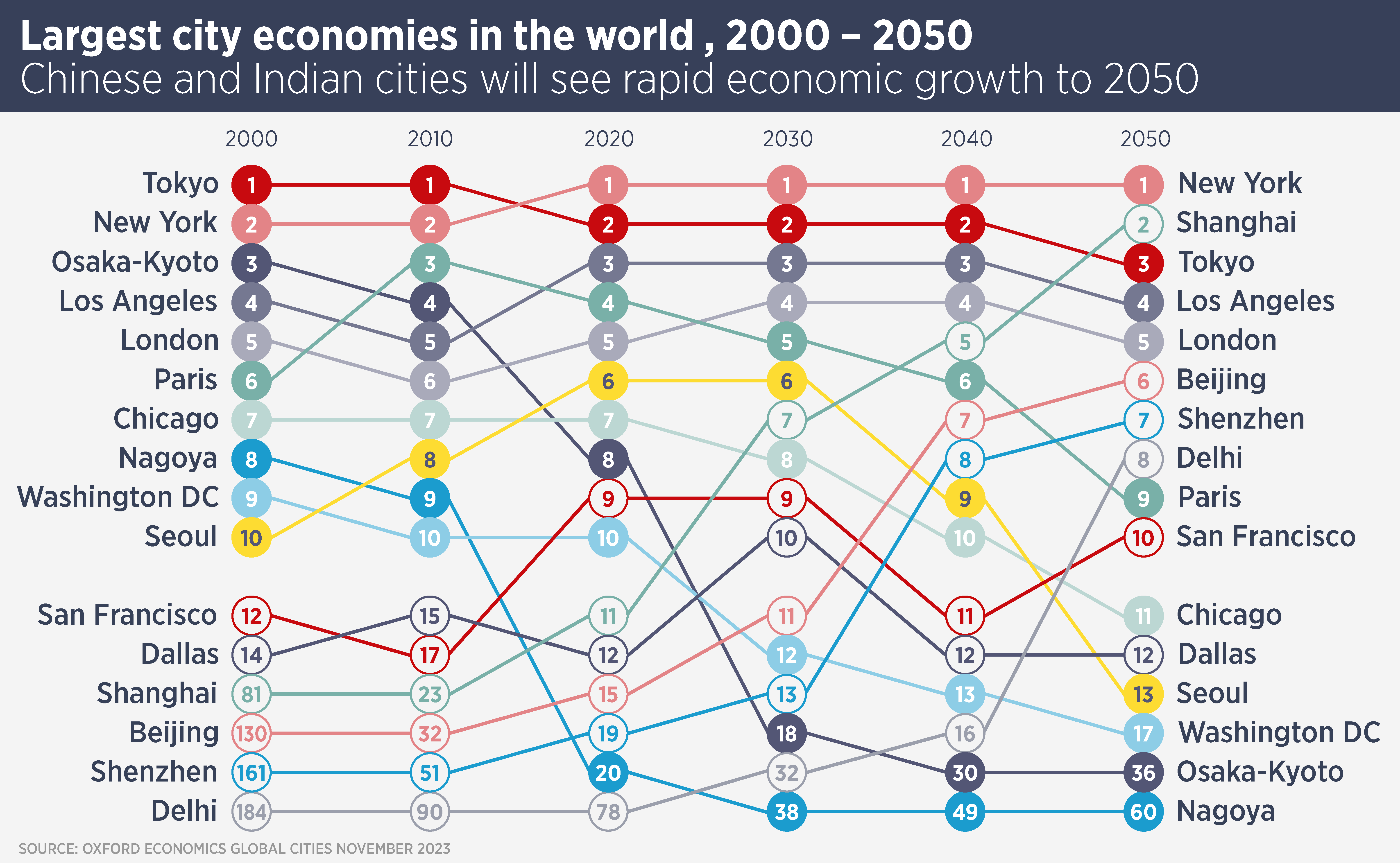

Research from Oxford Economics shows 19 cities across the world with a GDP of more than $500 billion, which it describes as “urban economic powerhouses”. The largest is New York, with a GDP of $2.3 trillion, higher than that of Italy. In Asia Pacific, the largest city economy is Tokyo’s, ranked second in the world, while Osaka, Nagoya and Seoul are also in the top 10

Between now and 2050, Asia’s growth will reorganise the top table, with Shanghai, Beijing, Shenzhen and Delhi entering the top 10 in 2050. By that time, Delhi is expected to have a population of 47 million and be the largest city in the world. Tokyo will retain a top five spot and Seoul will be in the top 20, but Osaka and Nagoya will slip down the rankings, while remaining large and important cities.

While China’s Tier One cities will move into the global top ranking, the most dramatic movement will come in India and Southeast Asia. Delhi was the 78th largest city economy in 2020, but Oxford Economics predicts it will be the 8th by 2050.

This growth will be supported by a growing consumer base and will benefit from new market opportunities in low-value manufacturing, which Chinese cities are now diversifying away from, Oxford Economics says. Cities such as Manila, Dhaka and Ho Chi Minh city will also show rapid growth.

The growth in Asian urban powerhouses will be part of a shift of economic strength eastwards, although the US will have new and growing economic giants on its east and west coasts, with New York retaining top spot and Los Angeles and San Francisco being in the top 10.

Smith says: “These forecasts for Southeast Asia demonstrate that there is potential for real estate investors across the region. Even mature cities in Japan and Korea will continue to offer opportunities due to economic growth and internal migration while Australia’s major cities will also pass the $500 billion GDP mark by 2050.”

Further reading:

Asia Pacific Investment Quarterly Q4/2023

Contact us:

Simon Smith