Asia Pacific real estate investors keep faith with alternative sectors

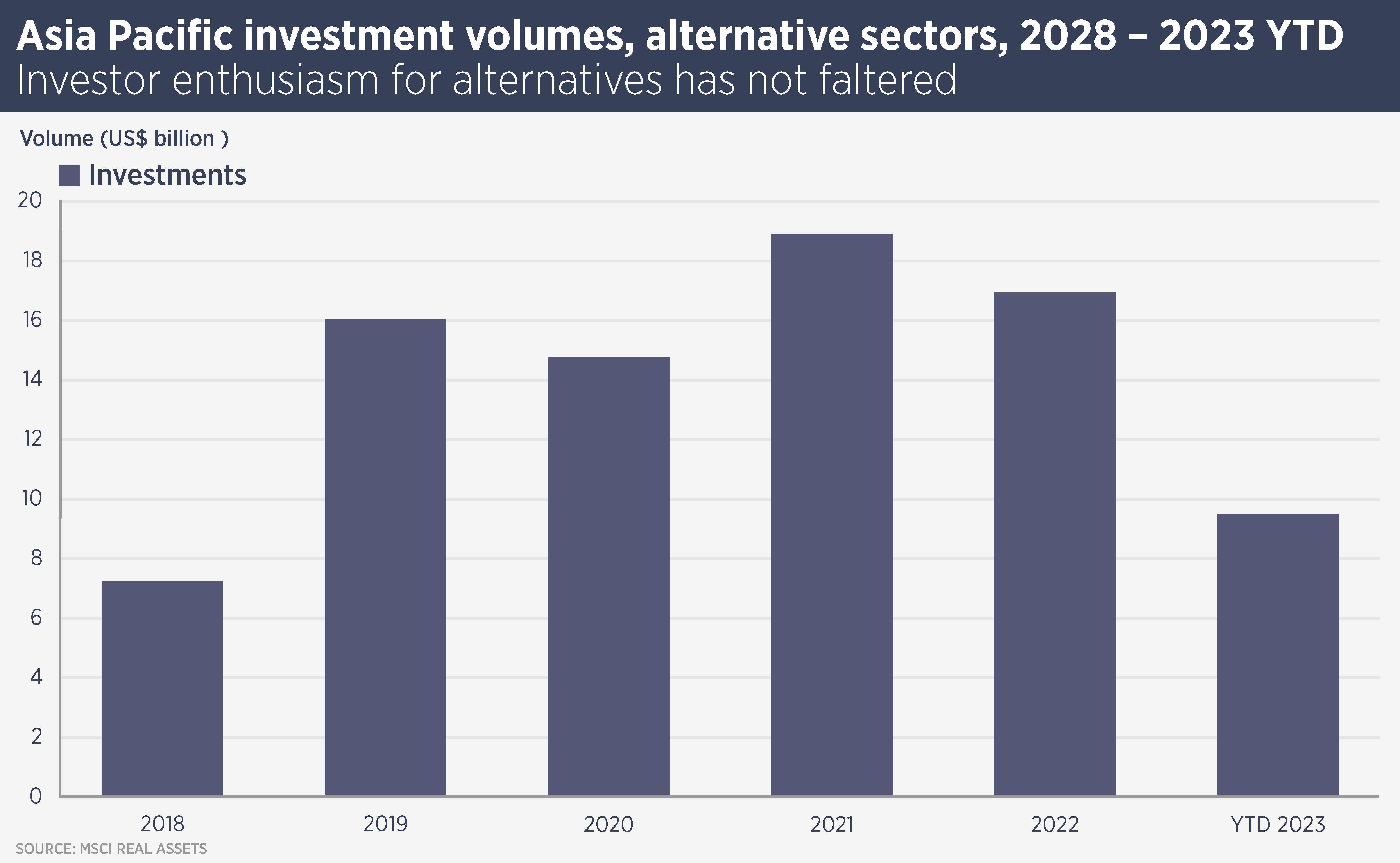

Discover why alternative real estate sectors like self-storage, data centers, and life sciences are thriving in Asia Pacific. Despite a 40% dip in overall real estate transactions, these niches attract over $8 billion in capital, poised to surpass 2022 totals.

Niche and emerging real estate sectors are attracting strong interest from investors, even as demand for more traditional sectors falters.

Data for the second quarter of 2023 from MSCI Real Assets reports overall Asia Pacific real estate transaction volumes down 40% on the same period last year to $32.7 billion, however alternative sectors such as self-storage, data centres and R&D/life sciences assets attracted more than $8 billion of capital, putting them on track to match or even beat the total for 2022.

Simon Smith, Head of Asia Pacific Research & Consultancy at Savills, says: “Investors are maintaining purchases of Asia Pacific alternative real estate sectors for a number of reasons.

“Sectors such as data centres and life sciences tap into global megatrends and so should grow despite the general downcycle in real estate. Alternative sectors tend to have a stronger operational element, which brings the opportunity for income alongside traditional rents. They are also in an early stage of development in many Asia Pacific nations, which means investors may be able to establish a dominant platform.”

MSCI data show data centre acquisitions in the first half of this year nearly matched the total from 2022, while this year is set to be another strong year for construction of new centres, following two record years.

Smith says: “Content creation, cloud computing and AI are generating huge quantities of data, which needs to be stored securely. Demand for data centres from “hyperscale” users such as Amazon and Microsoft, as well as homegrown players, will be substantial for the next few years. Meanwhile the investment market for stabilised data centres will grow as more are created.”

Multifamily residential might be a standard institutional investment sector in the US, but here in Asia Pacific, is only developed in Japan. However, the market is growing in Australia, China and elsewhere. Japanese multifamily has continued to attract investors from around the world but if you consider multifamily (ex-Japan) as a separate niche, it has posted a remarkable performance. So far this year, investors have spent nearly $2.5 billion, close to the total for the whole of 2022.

Smith says: “Multifamily real estate worldwide has been proven to be resilient to downturns and its attractiveness in Asia Pacific is compounded by its scarcity. Many of our crowded cities are crying out for high-quality affordable rental accommodation and investors who meet that need should do well.”

Meanwhile, while office transactions fell 56% in the second quarter of this year and retail 49%, industrial volumes fell only 14% and Japanese industrial and logistics remains popular with investors. Furthermore, investors are still spending more on industrial real estate than they did before the covid pandemic.

“No real estate sector should be written off,” says Smith. “There are still a lot of positives for the office sector in this region, where we are back in the office. Bricks and mortar retail has learned how to interact with online and is making a comeback with shoppers keen for experience. Meanwhile, the region still needs more modern industrial and logistics space.”

Further reading:

Asia Pacific Investment Quarterly Q2/2023

Contact Us:

Simon Smith