Investors vie for Australia offices and warehousing

Data from Real Capital Analytics show foreign investors accounted for nearly 30% of Australian commercial real estate transactions in 2021, spending the bulk (75%) of their investment in Sydney and Melbourne.

Overseas investors have been piling into Australian real estate and there is little sign of demand slowing.

Data from Real Capital Analytics show foreign investors accounted for nearly 30% of Australian commercial real estate transactions in 2021, spending the bulk (75%) of their investment in Sydney and Melbourne.

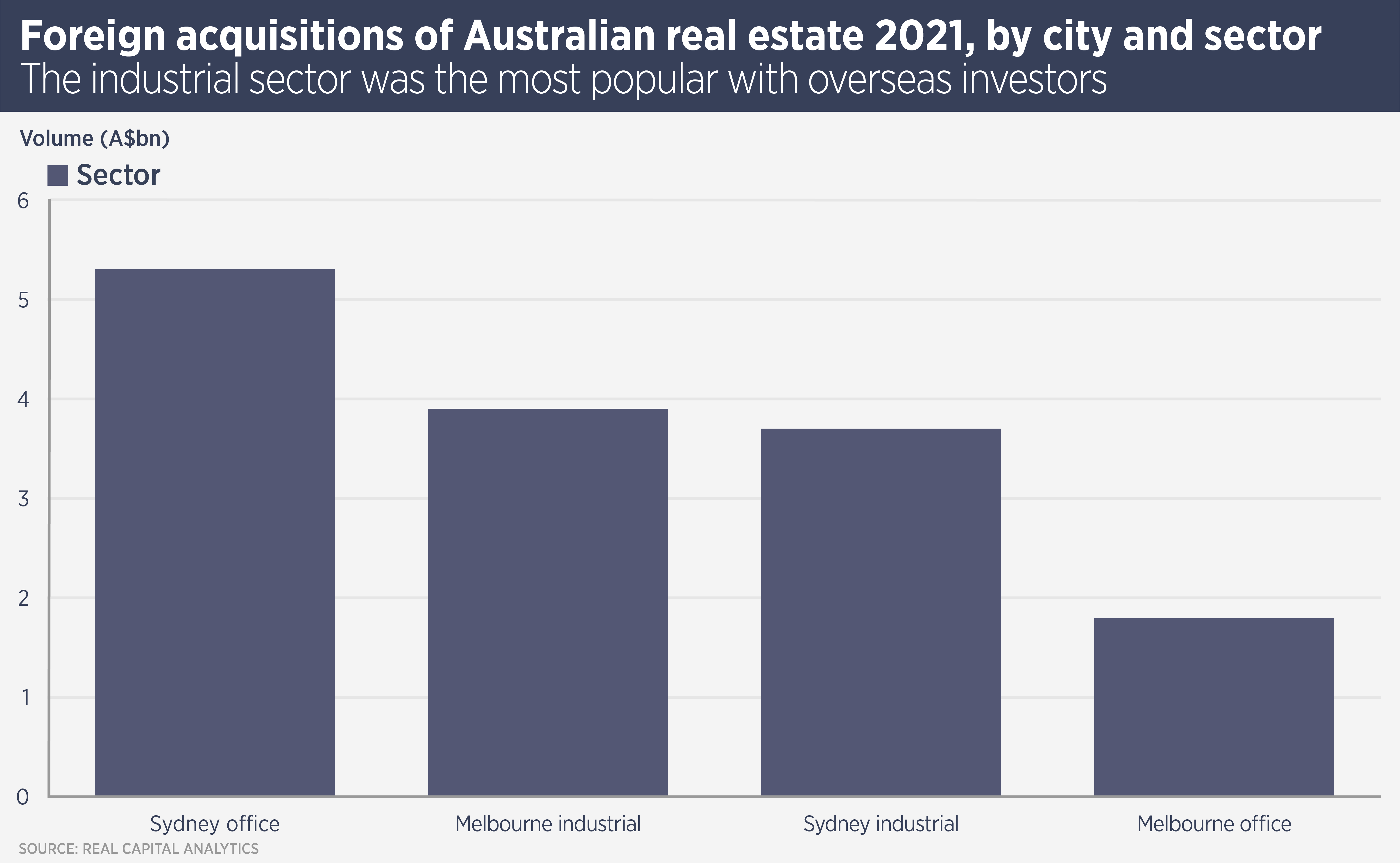

The industrial sector was the most popular, as it has been in many markets around the world, as investors vied to gain access to a sector which thrived during the pandemic and continues to benefit from rising online spending.

Ben Azar, national head of cross border transactions at Savills Australia, says: “There has been a lot of investment in logistics and there is still a huge amount of capital keen to get into that sector. It’s backed up by rental growth, so we don’t see any slowing of demand.”

Perhaps more surprisingly, Sydney and Melbourne offices were nearly as popular. Azar suggests that major investors took a long-term view on the sector and took advantage of circumstances to acquire assets which might not otherwise have hit the market.

“There’s been a lot of competition for the best office stock, modern assets with long WALEs and good ESG performance, which has sent cap rates into the low 4s and even below 4% for the very best buildings,” he says.

“Office leasing was strong in the fourth quarter of 2021, due to pent-up demand. Face rents have held up, but we have seen more incentives. We have seen a flight to quality in leasing and investment has followed.”

There was less buying of retail and hospitality assets, however suburban, supermarket-anchored retail properties continue to attract investor interest, even though foreign investors were net sellers of retail overall last year.

RCA’s list of top buyers in Australia puts Blackstone, ESR, GIC, NPS and Manulife Financial at the top, with the top three having been heavily involved in industrial transactions. Azar says: “Most of the foreign capital has come from large investors which either have operations in Australia or a strong relationship with a manager here, so they have been able to transact even when the borders were closed. However, now the borders are open, we see investors inbound and looking for assets.”

With travel restrictions over in Australia and loosening elsewhere, the market expects to see more investment from Hong Kong and Singaporean investors. RCA data shows the latter to have been the most active overseas in 2021, spending more than $40 billion in 2021. More than $16 billion of this was spent in Asia Pacific.

Further reading:

Savills Australia cross border investments

Contact Us:

Ben Azar