Singapore industrial looks to the future

Real estate crowdfunding has the potential to revolutionize the market, but like any venture which engages the general public, has a certain amount of risk.

Industrial and logistics space has moved on from the ‘sheds’ age but the sector in Singapore will develop even more dramatically as the city-state.

A wider range of industrial and logistics space occupiers is emerging, driven by Singapore’s need to stay competitive and to meet the particular challenges of a small island nation. The coronavirus pandemic has “borne out the challenges of a small island state dependent on its neighbours for essential supplies,” says Chris Marriott, South East Asia chief executive at Savills.

Singapore is looking to boost food security by producing more of its own and by holding more food supplies, as a buffer in case of events which interrupt supply chains. Holding more food creates more demand for cold storage centres, recently emerging as a distinct niche of logistics real estate.

And the desire to grow more food has led to Singapore championing agrotechnology and vertical farming. In the future, a greater proportion of Singapore’s industrial space could be devoted to huge indoor hydroponics farms; the city plans to produce 30% of its own food by 2030, up from 10% today. In August, Singapore sovereign fund Temasek formed a joint venture with German group Bayer to develop breakthroughs in vertical farming.

The technology to make such urban farms work is evolving constantly and in most markets, the price of energy makes them something of a gimmick. However, Singapore’s commitment to its “30 by 30” plan and the high price of land will underpin growth in this emerging sector.

Towards the end of 2019, some commentators declared the Singapore data centre market saturated, however the shift to online accelerated by the pandemic has increased demand, which will be maintained by the advent of 5G, demand from the financial services sector and e-commerce, and which is expected to grow 9.1% per year over the next five years.

In order to drive innovation, Singapore will need more space for tech incubators and for industries such as biopharmaceuticals, information technology and clean energy generation, which are growth targets in the city’s industrial roadmap.

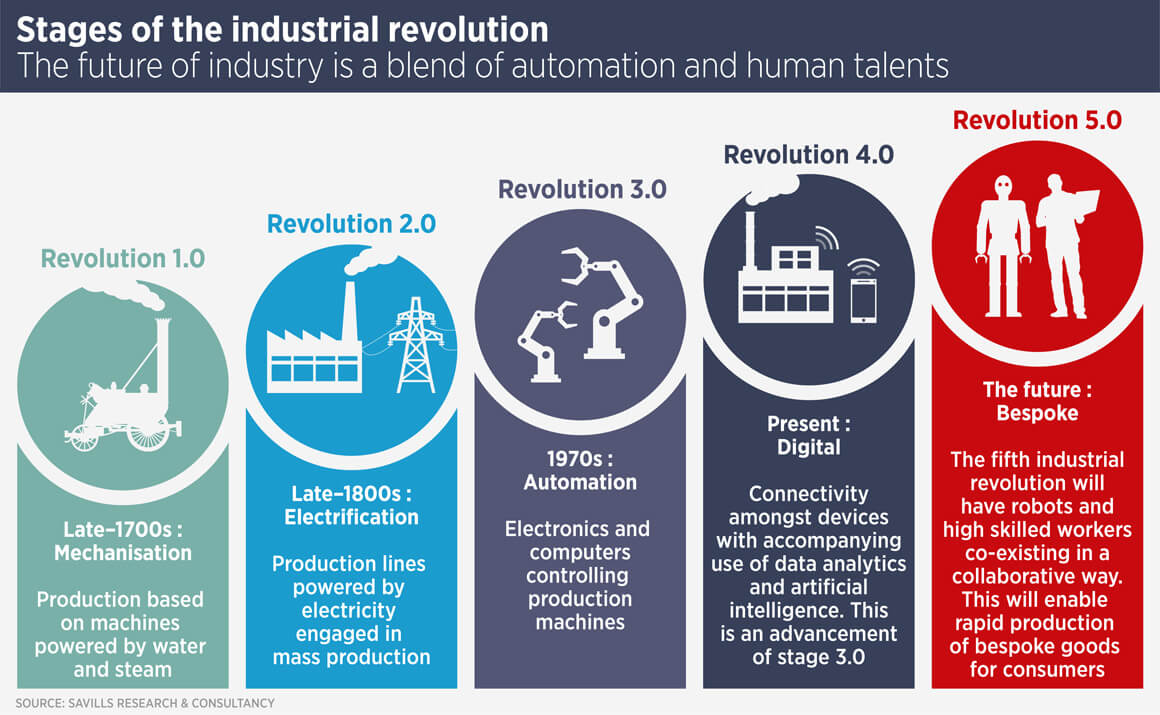

Overarching this is the prospect of industry 5.0, which involves the collaboration of robots and AI with skilled human workers to allow the “mass customisation” of products, says Savills’ head of Singapore research Alan Cheong. “New factory and warehousing facilities will have to be built to accommodate this new version of manufacturing. Although still in its infancy here, we expect greater focus on this new production process with new factories built.”

Even ‘conventional’ logistics stock will need an upgrade to help Singapore meet the targets for its industry transformation map for the logistics sector. The island-state will invest in next-generation facilities with high-specification units which encourage the co-location of companies and drive the use of advanced technologies. These facilities are expected to improve supply chains, boost productivity and provide more professional and technical jobs for Singapore workers.

“Singapore is on a technology enhancement drive for all industries and looking to make its workforce more efficient,” says Marriott. “Real estate investors need to look at providing industrial and logistics space which enables this.”

Further reading:

Savills Singapore industrial report

Contact Us:

Chris Marriott | Alan Cheong