Security and value in the post-COVID investment world

The COVID-19 pandemic has definitively brought to an end the long global real estate upcycle which began in 2009, as the world emerged from the global financial crisis.

Asia Pacific real estate transactions fell 28% in the first half of 2020 and economies continue to suffer as a result of domestic lockdowns and the disruption of international supply chains. Simon Smith, head of Asia Pacific research at Savills, says: “The economic damage is proving to be extensive with only China and Vietnam expected to post modest positive growth this year of 1.5% and 2.7% respectively.”

This region seems to be leading the rest of the world out of the pandemic and the resulting economic slump, but what should investors do in the post-COVID environment? Most have been happy to sit on their hands for a while, with new deals tough to do when dealmakers cannot travel. However, with $35.6bn of dry powder for Asia real estate, according to Preqin, there is capital pressure to do deals, but which ones?

A characteristic of the recent market peak was a blurring of the lines between real estate strategies, says Callum Young, executive director, regional real estate advisory, at Savills. “You would sometimes see core, value add and opportunistic buyers bidding for the same asset, at comparable prices and with structuring and finance tolerance the only real differentiators.’

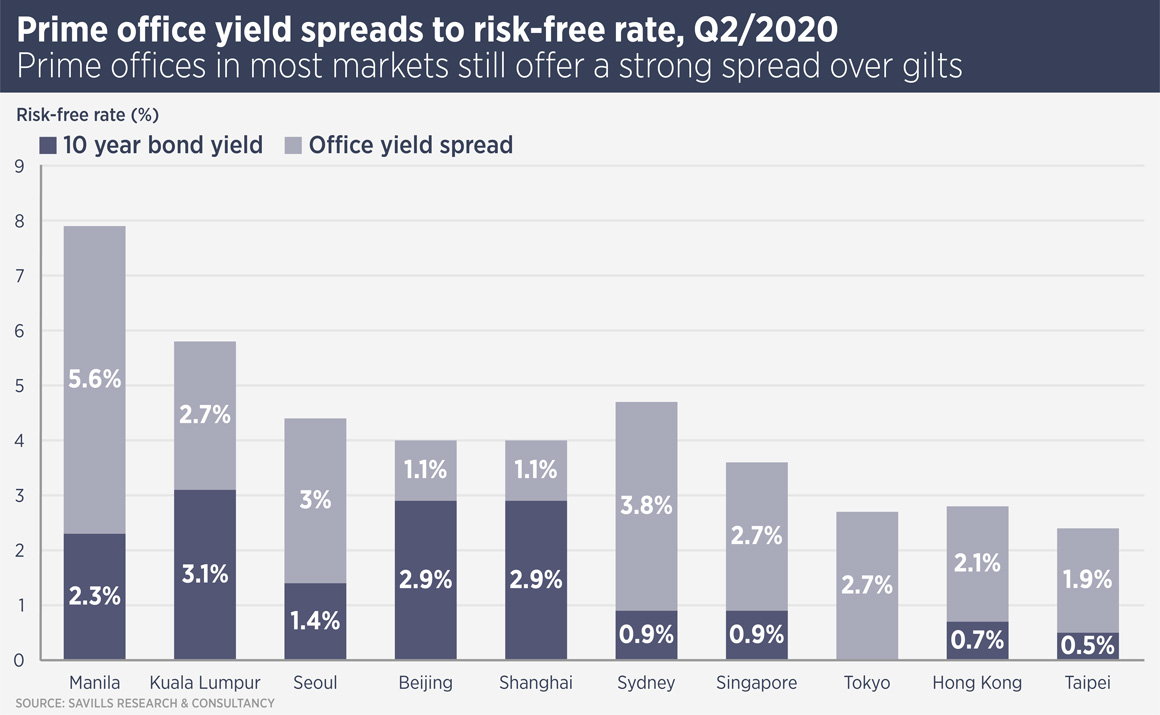

At the other side of the peak, the market is still having something of an identity crisis. “In the post-COVID environment, how will core capital price office assets across markets?” he muses. Thus far however, there remains a strong yield gap between prime offices and 10 year bonds across Asia Pacific.

From a risk/return standpoint, Young sees a gap emerging between core investors who are looking to double down on sustainable income streams and opportunistic players, who are looking for distress or at least mispricing opportunities. In the middle, the investment landscape has shifted for a number of value add players in a rental growth constrained environment.

What core investors want depends on their existing portfolio, of course. “Asset management has been the focus but we expect further re-weighting,” says Young, “and investors will be carefully considering their sector and geography allocations.

“However, the key to core returns is security of income, which means investors are doubling down on prime markets, assets and tenants. We see investors becoming a lot more stringent on location and covenant criteria. Long income streams will also demand a premium, however there are limited sectors or markets which provide these in Asia Pacific.”

Another favourite for core investors is Japanese multifamily, which has seen buying from Allianz, M&G, AXA and others in recent months. “Multifamily has proven resilience to economic cycles, but there is very little of it in Asia Pacific outside Japan,” says Young. As a consequence, pricing will continue to be strong. The same applies to logistics, “the sector everyone wants,” says Young, which has seen areas of yield compression, despite the rocky economic circumstances.

With such hot competition for Asia’s relatively small stock of core assets, Young expects core investors to look for theme-driven investments, which might be hard to conventionally define as core. “Prime logistics is now undoubtedly core, but can be frustratingly hard to acquire at scale, so do you then turn to a build to core strategy? Global megatrends support growth and stability in the data centre market, but how much stabilised core product is there now for a real estate investor?”

There is a lot of opportunistic capital on the side lines at the moment, but Young wonders where and when such investors will find value. “We do not see much distress yet, nor do we see banks looking to make life difficult for borrowers,” he says. “As things stand, there is abundant capital patiently waiting in the expectation that better value will appear.”

With interest rates set to be even lower for even longer, it appears the beginning of the new cycle might be like the end of the old one, with investment styles mainly differentiated by the levels of debt brought to bear. “As the pandemic unwinds, I would expect opportunities to become clearer,” says Young. “Today might not be quite like the post-GFC environment, where often the first to buy into the recovery almost always did well.”

Investors who want absolute core assets are going to have to continue to pay heavily for them, he suggests, which might not be a bad strategy in a low interest rate environment. Meanwhile, opportunistic investors should look to Asia’s growth markets, including China, which will return to growth first and fastest.

Further reading:

Savills India rental housing report

Contact us:

Simon Smith