Do the golden years offer golden returns?

Ageing populations in the developed world mean an increasing focus on the provision of elder care and Asia Pacific is no exception.

However, the market across the region is undeveloped making senior housing a potentially risky play for real estate investors looking for higher yields outside core property sectors. Prospects takes a look at three markets at different stages of development.

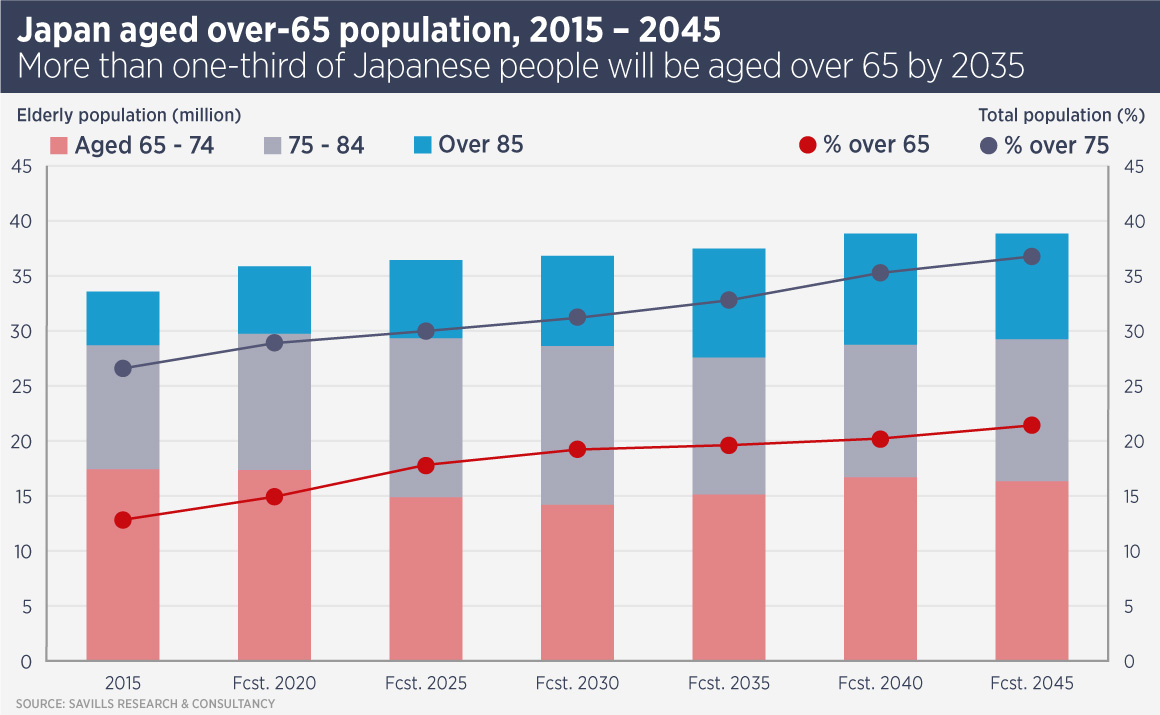

Japan: the world’s oldest nation gears up for a grey future

Japan is at the sharp end of global ageing; by 2025, it is projected to have 22m over-75s, while shrinking household sizes mean more senior citizens are alone and vulnerable.

Tetsuya Kaneko, head of research at Savills Japan, says: “State long-term care facilities still lead market supply, but the number of private nursing homes and senior housing units has expanded greatly over the past decade. Given the government’s financial restrictions, private solutions for elderly care are essential.”

There are a number of private senior housing types in Japan, with varying levels of nursing care and support services. The most popular amongst investors is ‘kaigo-tsuki’ – nursing homes with full-time care staff.

Japan now has three healthcare real estate investment trusts, each of which holds mainly senior housing assets, while Singapore healthcare REIT Parkway Life also owns a number of nursing homes. Private equity groups such as Fortress have also invested in senior housing, as have residential J-REITs.

Aberdeen Standard Investments and Sumitomo Mitsui Trust Bank recently launched a joint venture which will invest in a range of residential assets – including senior housing – in Japan and subsequently other mature Asia Pacific markets.

Savills analysis of nursing home acquisitions suggests cap rates have compressed substantially since the first healthcare REITs launched in 2013. Cap rates for Tokyo properties are a little above 4%, while those for properties in regional cities have dropped below 6%.

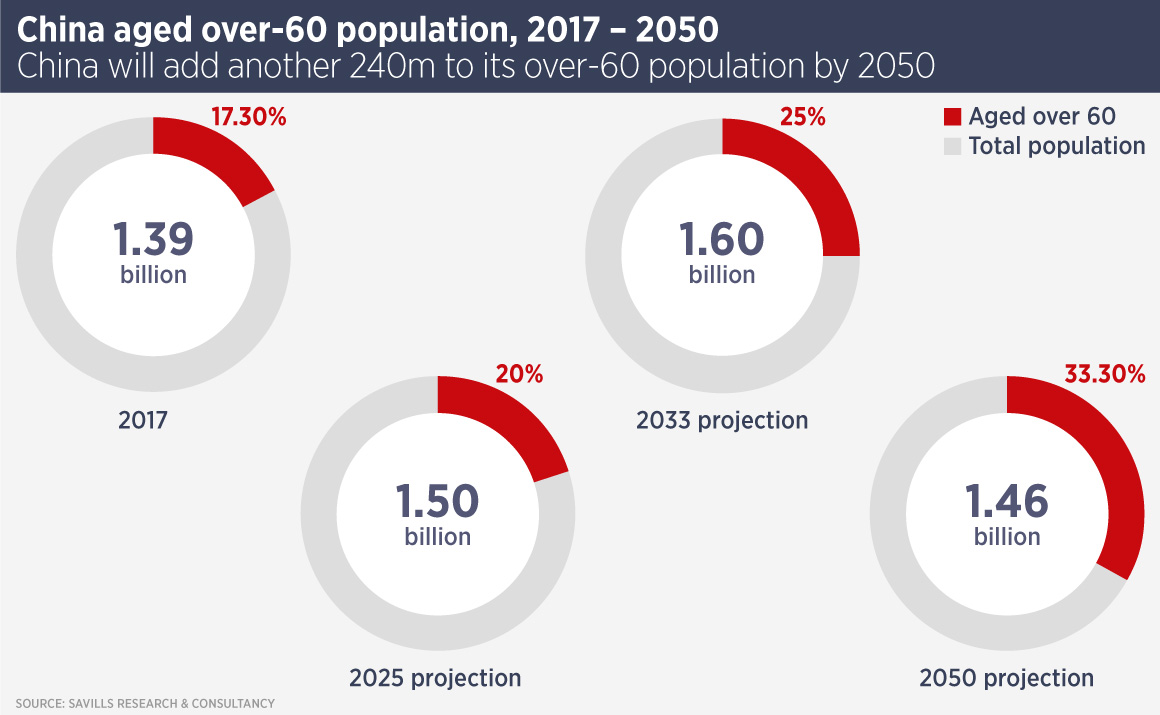

China: still searching for a model

The statistics for China’s ageing population are even more dramatic than Japan’s. In 2015, 9.5% of the population was aged over 65; by 2050 this will grow to 27.5%. This means the elderly population will total 400m, larger than the entire US population.

The ageing population and the effect of China’s one-child policy means the tradition of children caring for their parents is no longer viable, as few families are large enough to support elderly parents. Furthermore, urbanisation means more Chinese work in cities far from their parents.

Until recently, China had little senior housing and most of that was provided by the government. However, the private sector is taking a larger role. A number of China’s larger developers have launched senior housing projects, including Vanke, Poly Real Estate and Greenland Group.

China’s insurers are also investing in senior housing; for example Ping An Group developed a 1.5m sq m retirement community in Tongxiang, Zhejiang and has also established a senior housing fund.

Last year, Australian developer Lendlease, which manages 70 senior living communities in Australia, announced it would develop a 900-unit retirement home in Shanghai. It is one of a number of Australian groups, including Sapphire Holdings and Aveo, which aim to transfer skills learned in their home market to China.

Typically, the projects brought to market by property developers are retirement communities with minimal nursing facilities. Fees are generally in excess of RMB10,000 a month – more than double the average Chinese pension of RMB4,000 per month.

However, market observers point to a lack of operators and a shortage of trained carers and nurses. Comments from developers involved in senior housing suggest many are struggling for profitability.

James Macdonald, Savills China head of research, says: “As elderly care facilities require heavy capital input, and only selling services will generate negative yields, the biggest challenge in the elderly care market is that investors are struggling to find the right profit model.”

Australia: wealthy seniors are ‘younger longer’ and looking for a lifestyle change

The most developed senior housing market in the region, Australia still offers opportunities for real estate investors.

Companies such as Stockland and Lendlease operate retirement communities across the nation, although tending to favour coastal locations for resort-style developments.

However, Shrabastee Mallik, head of research at Savills Australia and New Zealand, says: “There is a niche for retirees who are looking to downsize but who do not want or need nursing care. We see more housing developments catering to these buyers on a variety of scales.

“Australia has well-funded retirees in good health who are looking for a different lifestyle. They no longer need or wish to maintain a large home and its gardens.”

Australian senior housing has already attracted the interest of international investors. In 2017, APG Asset Management spent A$450m to buy a 25% stake in Lendlease’s senior living arm.

Further reading:

Japan healthcare report

Contact Us:

Tetsuya Kaneko | James Macdonald | Simon Smith