Rallying around retail

Already battered by the rise of e-commerce, the COVID-19 pandemic is set to be a knockout blow for the bruised and bloodied retail real estate sector… or is it?

Simon Smith, head of Asia Pacific research at Savills says: “Running a close second to hospitality as the region’s worse affected sector, retail markets have slumped. In common with elsewhere in the world, any spending which is offline, discretionary or tourism related has suffered particularly badly.”

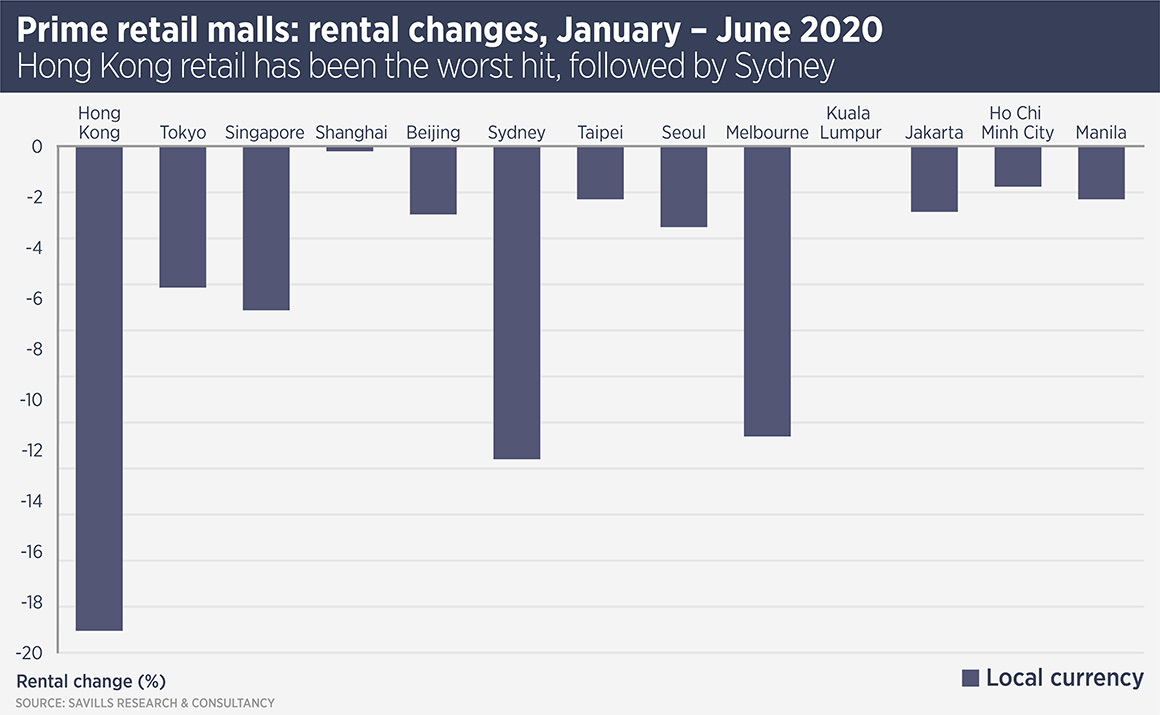

Savills’ Prime Benchmark research contains some grim data for the retail sector, with significant rental falls in a number of markets in the first half of this year, with the worst performance reported in Hong Kong, Sydney and Melbourne. Retail landlords have lost tenants all over the region and the big question is whether the shoppers forced to go online during lockdown will come back to shops and malls.

The investment market is also in the doldrums. Asia Pacific retail real estate transactions fell 54% in the first half of this year, according to Real Capital Analytics, the worst drop among all real estate sectors.

In the short term, what can retail landlords do? The absolute priority is to “keep hold of your tenants,” says Nick Bradstreet, managing director, retail at Savills. “Things are going to be rocky for a while, so if you have lease expiries coming in the next year or so, look to agree sensible terms now to retain your tenants. Landlords need to do whatever it takes to ride out the next year or so and to be flexible with terms.

“If space becomes vacant, look at subdividing it in order to attract smaller users and, again, be flexible about tenancies; look into pop-ups and other innovative ways of using the space.”

The outlook is not universally gloomy for Asia Pacific retail; China has emerged rapidly from lockdown and retail is recovering. Somewhat perversely, it is luxury real estate which has recovered most strongly. In most cities, footfall at luxury malls has recovered to almost pre-COVID levels and luxury brands owner LVMH is reporting year-on-year growth in China. The key to this is twofold; firstly wealthy Chinese shoppers cannot get overseas for their watches and handbags, which has boosted domestic retail and secondly, reductions in luxury goods taxes in recent years mean more shopping at home.

Meanwhile in Japan, rents have fallen in Tokyo and regional cities while tourism, which had been boosting the retail sector, is suspended for the time being. However, in the longer term, retail regeneration projects in the capital and other cities – such as the redevelopment of the area around Tokyo’s Harajuku Station – should keep Japan’s retail mix fresh. “Improved accessibility and modern facilities will add to the vibrancy of high street retail in Japan,” says Savills head of Japan research Tetsuya Kaneko.

The former retail mecca of Hong Kong has taken the worst drubbing of all, with political protests and a reduction in Chinese visitor spending going to work on the retail sector even before COVID put its gloves on. Bradstreet says shop rents have fallen 70% since the peak of 2013, however he still sees positives. “Hong Kong has lost so much because it gained so much,” he says. “The drivers of the extraordinary growth in luxury retail are no longer there and thus the city will return to a more normal retail environment. Hong Kong will remain one of the world’s major retail destinations.”

And despite the slump in retail, Bradstreet does not expect significant distress, which might disappoint some investors. “Landlords here are well-capitalised and there is a lot of capital in play. So far we have only seen distressed sales in secondary locations.”

Bradstreet is also confident that Asia retail will thrive again once the region shakes off the pandemic. “This region has the growth, the wealth and the demographics to make retail work. We have modern stock which works in tandem with e-commerce and provides a destination for more than shopping.”

Further reading:

Savills China retail report

Contact Us:

Simon Smith | Nick Bradstreet | Tetsuya Kaneko