India: the next location for life sciences

India is on the cusp of a boom in the life sciences and this booming industry is set to drive demand for new specialist real estate.

The life sciences industry – pharmaceuticals, biotechnology and medical devices – is booming worldwide due to ageing populations and more recently the COVID-19 pandemic. The sector is longest established in the US and the UK, where clusters of specialist real estate – office, laboratory space and high-tech manufacturing – have attracted investor interest and created a new niche.

Asia Pacific is not being left behind; life sciences clusters can be found in Singapore, China and also in India, which is already the world’s biggest manufacturer and exporter of generic medicines and the largest vaccine producer. The industry generates an $11bn trade surplus and is growing at 10-12%, government statistics show.

Savills India estimates the growth of the life sciences in India could generate demand for around 96m sq ft of new real estate by 2030 and possibly as much as 151m sq ft.

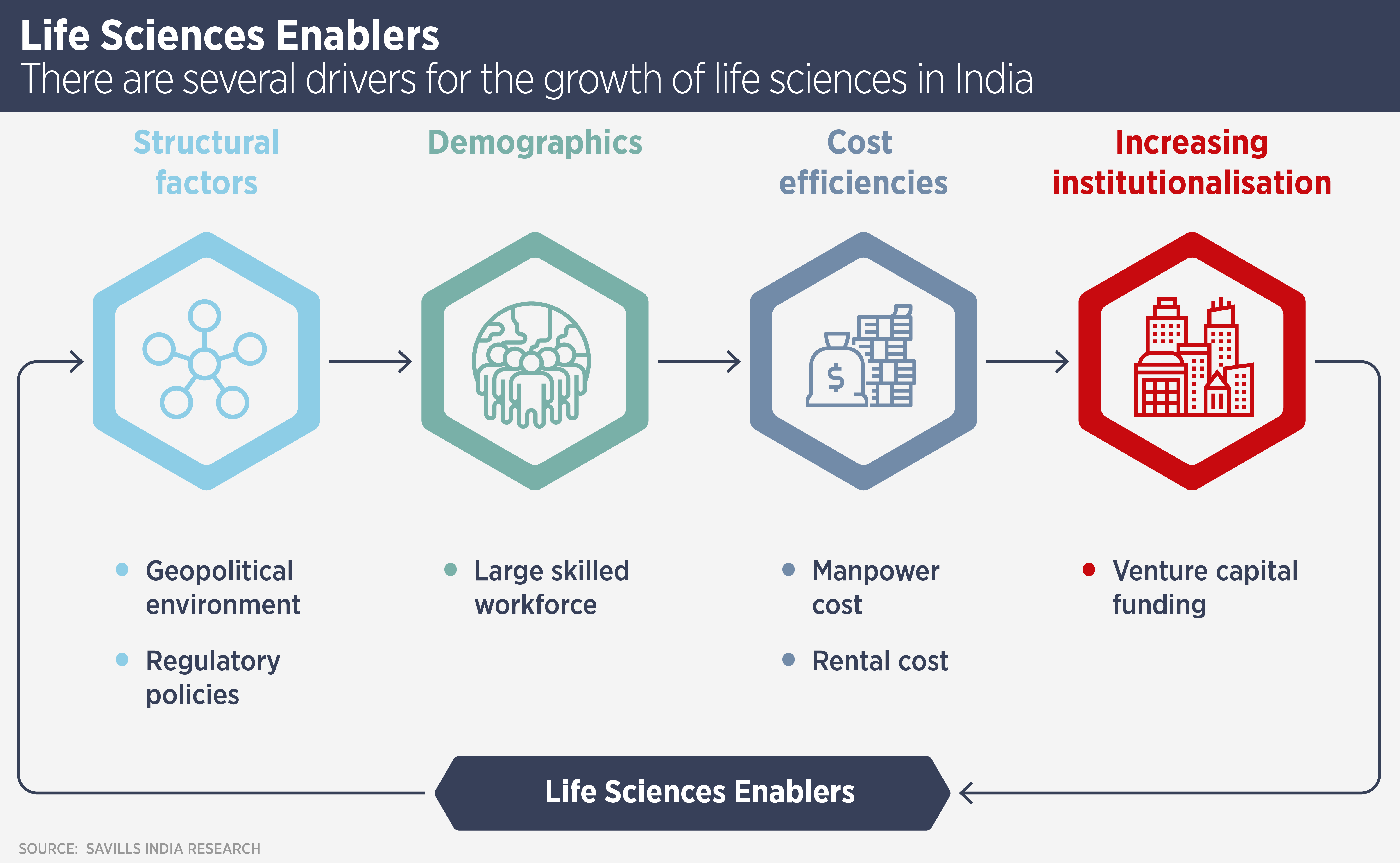

“The life sciences sector in India is set to grow owing to several favourable factors,” says Arvind Nandan, managing director, research & consulting, at Savills India. “These consist of structural changes, including the current geopolitical environment and regulatory regime, India’s large skilled workforce, cost efficiencies in terms of lower manpower and rental costs, and the growing attractiveness for venture capital funding companies. This, in turn, is expected to positively impact the growth of related real estate in India.”

The size and youth of India’s population mean it generates 20 times as many pharmacy graduates as the US, yet the average salary for a scientist is only $12,000, compared to $94,170 in the US, $46,680 in the UK and $36,550 in China.

Existing life sciences clusters in India include: Ahmedabad/Gujurat, Mumbai/Pune, Bengaluru, Hyderabad/Andhra Pradesh, Kolkata, Chennai and Delhi NCR.

At present, the stock of life sciences real estate is small and there are few participants with a track record, says Nandan. “Nonetheless, we believe that investing in the sector at present will provide a significant early mover advantage in terms of scalability and tenant relationships as the sector matures over time.”

Canadian real estate investor Ivanhoé Cambridge has been a pioneering investor in Indian life sciences real estate. Last year, it committed to invest $100 million, alongside Singaporean asset manager Lighthouse Canton, to develop about 1m sq ft of laboratory space in Genome Valley, Hyderabad. Genome Valley is a life sciences cluster which is home to more than 200 companies.

A particular attraction for investors in life sciences real estate is that the sector has been resilient to economic downturns. Nandan says: “Historical evidence from prior recessions suggests that global life sciences sector had witnessed stronger demand than the broader economy. In our view, life sciences employment is well positioned from both a near-term and long-term perspective.”

Further reading:

Savills India Life Sciences report

Contact Us:

Arvind Nandan