Tokyo’s Olympian heights

Asia’s largest office market remains a top target for investors, and new supply ahead of the 2020 Olympics is likely to have a positive effect.

Tokyo’s office market was the most widely traded city/sector combination in the region in the first quarter of this year, Real Capital Analytics data show. Sales volumes of US$14.59bn were nearly 50% ahead of Shanghai, the next busiest office market.

Tetsuya Kaneko, head of research and consultancy, Japan at Savills, says: “There is increasing demand for core real estate assets and Tokyo is the largest office market in Asia Pacific. While prices are high, it is still relatively affordable compared with other major cities such as Hong Kong, Singapore and Sydney.”

The all important yield spread between prime office cap rates and 10 year bond yields remains 2.9%, according to research from DWS, significantly ahead of other major cities.

Domestic buyers were the major players in the first quarter, with Japanese real estate investment trusts returning to the market in force. DWS estimates J-REIT activity in the six months to March was 80% greater than in the six months to September 2017.

The biggest deal of the year so far and the second biggest after the financial crisis, saw a new real estate joint venture between utility companies Kansai Electric Power Co. and Tokyo Gas acquire the Shiba Park Building in central Tokyo for around ¥150bn (US$1.4bn).

The 14 storey, 97,294 sq m building, known as the “Battleship”, was sold by a consortium of foreign investors – PAG Asia, CV Starr, Abu Dhabi Investment Council and Asia Pacific Land – which acquired it for ¥120bn in 2013 following the collapse of daVinci Holdings. An attempt was made to sell in 2015, however the consortium could not get its desired price and refinanced instead.

J-P Toppino, group president at PAG Asia, says: “Demand for this type of asset comes from large Japanese corporations and global core buyers; a number of sovereign wealth funds are also looking at Japan. “

For PAG Asia and its partners, the deal was an opportunistic purchase with a classic value-add strategy which involved minor refurbishment and improving net operating income, Toppino says.

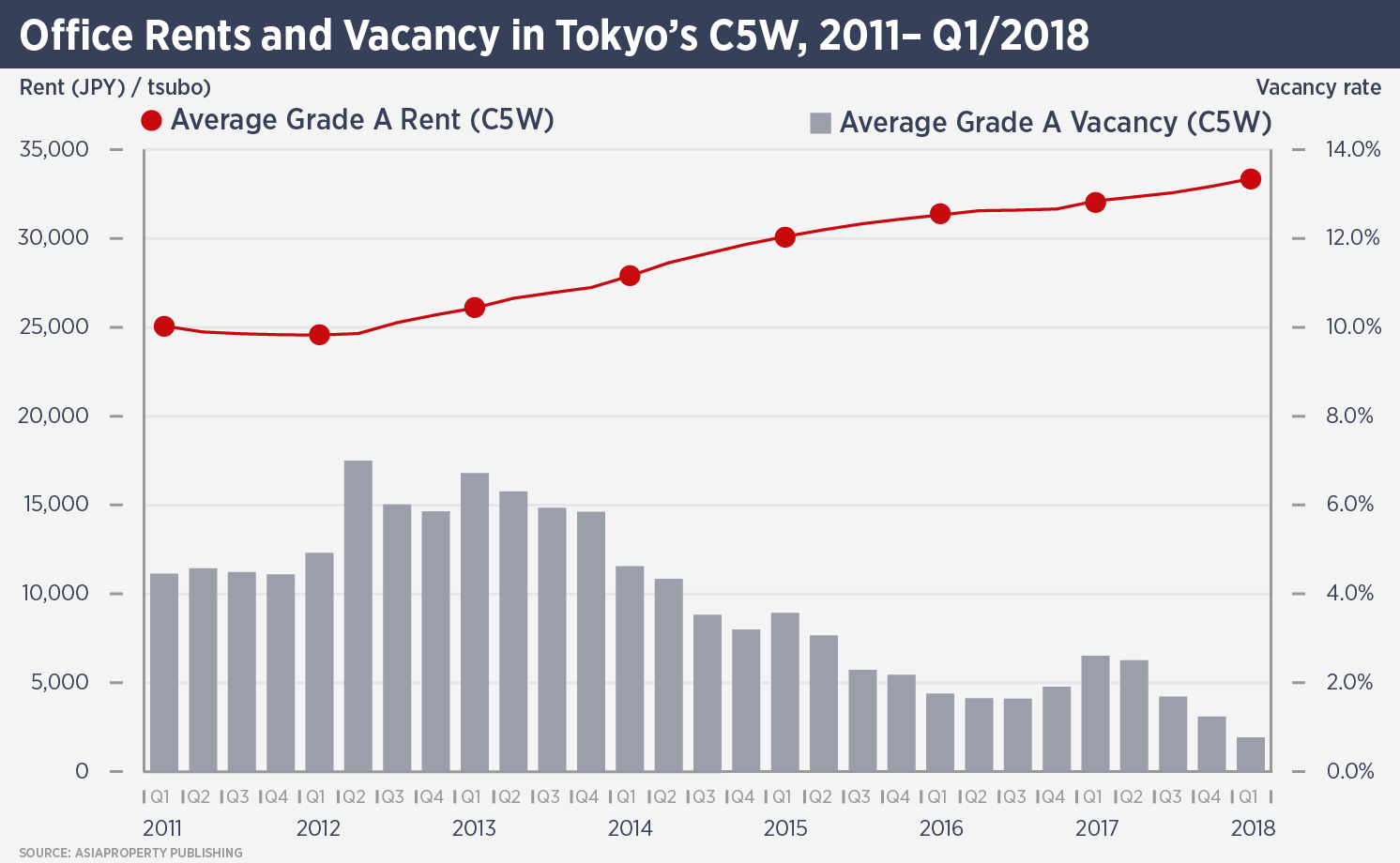

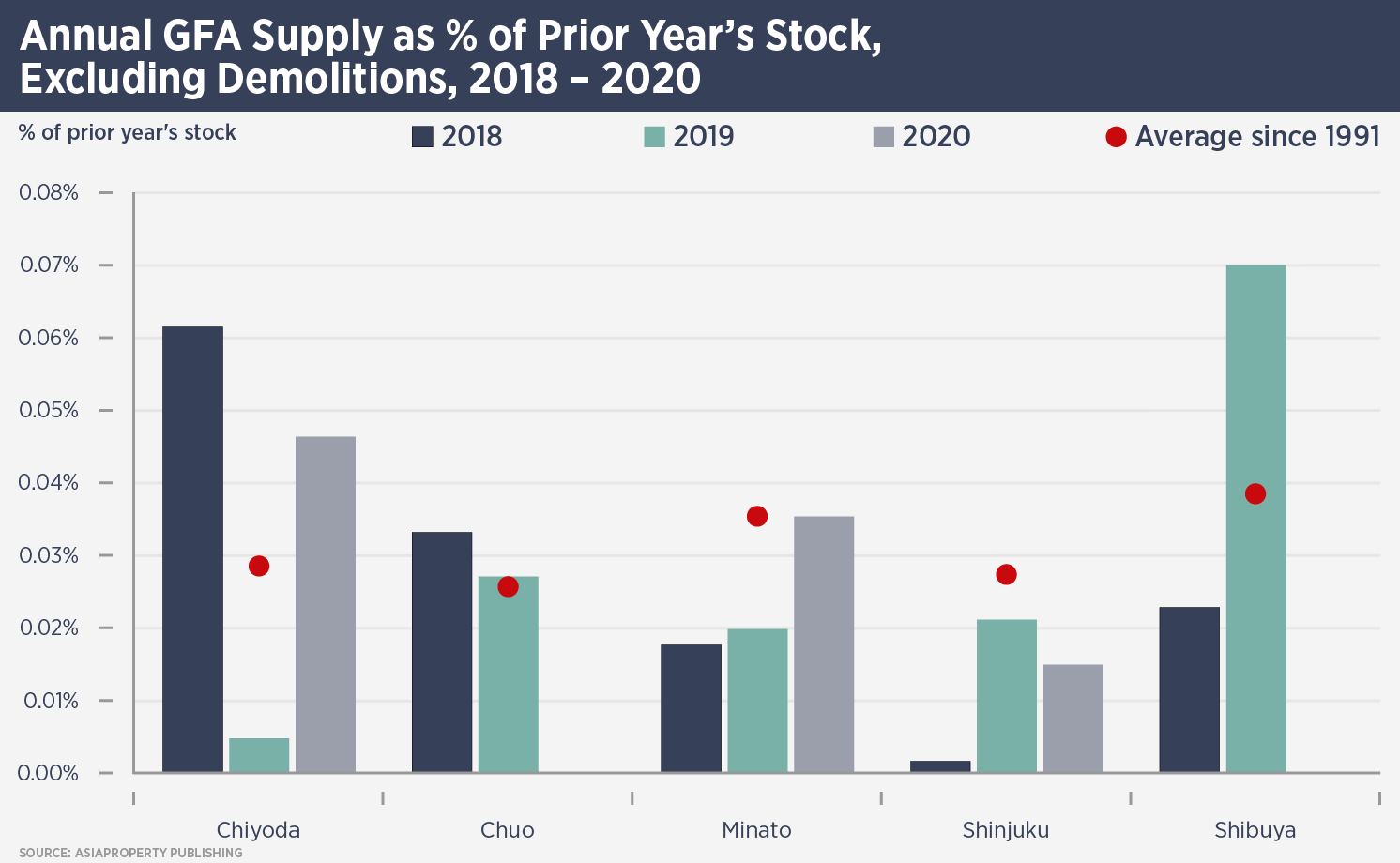

Tokyo’s Grade A office market will see substantial supply between now and 2020. A total of 630,000 tsubo (2.08m sq m) will add 9% to Tokyo’s prime office stock.

Kaneko says: “While landlords remain somewhat cautious due to the new supply, completions so far in 2018 are enjoying robust occupancy levels and an encouraging share of upcoming completions has already been pre-leased.”

The new supply should not just be considered as a simple addition to the city’s office market, but also how it will affect Tokyo’s various business districts. Much of the office supply comes as part of major mixed-use developments which could revitalise the areas surrounding them, just as the Roppongi Hills project did for the eponymous district.

Furthermore, Tokyo’s infrastructure will benefit from an Olympics effect: the first new metro station in 30 years and a planned new railway station in Shinagawa, one of the districts set for more office supply.

Japan’s economy is supportive of the new supply: real GDP growth was 1.8% in 2017, an encouraging number for a mature market with a falling population – although Tokyo’s population continues to grow due to internal migration. Unemployment has fallen to 2.5%, a level not seen for more than two decades and business outlook surveys remain positive.

“The strength of the economy and landlords’ management of secondary and tertiary vacancy is expected to determine support levels for overall market rents over the next few years,” says Kaneko.

Further reading:

Savills Tokyo office research

Contact us:

Tetsuya Kaneko