Residential in Hong Kong starts to wobble

Hong Kong house prices have been heading into the stratosphere since 2009, but have the first signs of a slump emerged?

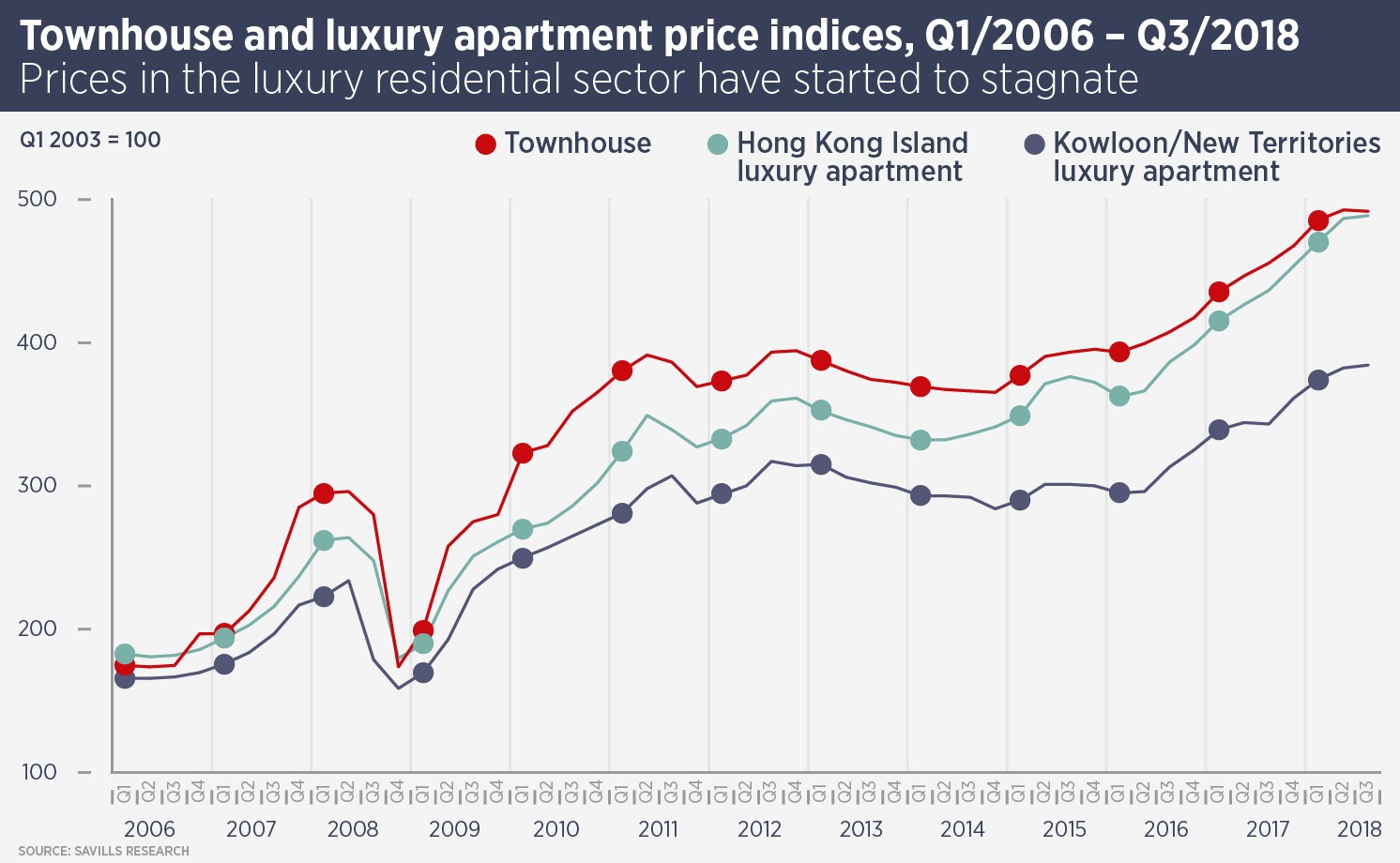

Savills data for the first three quarters of this year show luxury home prices to be flat, while mass-market housing price growth slowed in the third quarter. However, prices began to fall towards the end of the quarter and have continued to fall since then.

These market wobbles follow an extended bull market which saw luxury residential prices more than double and mass market prices increase threefold since 2009. However, the first of several expected rises in Hong Kong interest rates and a weak stock market have taken the edge off the market and most observers are predicting a decline.

Hong Kong’s secretary for transport and housing, Frank Chen said in November the government had no plans to withdraw cooling measures. “We are not yet able to confirm the market is in a downward cycle,” he said. “At this moment it is not appropriate to relax any demand-side management measures, otherwise we would be sending a wrong signal to the market and see it heat up again.”

Keith Chang, managing director, Savills Realty, says the drivers of the luxury and mass markets are very different. “Mass market residential is driven by the employment rate and interest rates,” he says. “The luxury sector is very dependent on wealthy buyers from Mainland China with more than half the buyers coming from outside Hong Kong.”

If capital from China truly dried up, luxury prices might fall as much as 20%, which would be a signal for local capital to start buying, he says. However, Chang does not expect foreign buyers to leave the market. In October, Shi Yufeng and Jin Yuanying, co-founders of online shopping business Alibaba, spent HK$562m on a pair of apartments on Hong Kong’s Southside, suggesting Chinese buyers have not gone away.

However, transaction volumes – which are always fairly small due to the nature of the assets – are likely to fall for a few quarters while buyers takes stock, says Chang.

The mass market looks more vulnerable; while cooling measures mean few buyers have large mortgages, many buyers of new apartments in recent years have taken advantage of finance supplied by the property developers themselves and the most over-extended could be at risk.

However, Chang says: “Unemployment is low and Hong Kong developers have robust balance sheets so there are few drivers for widespread distressed sales. If prices decline by 15% overall, then people will start to look at the buying again.”

Savills predicts a fall of 5-10% in the luxury market and up to 20% in the mass market by the end of 2019.

Further reading:

Savills Hong Kong Research

Contact us:

Keith Chang