City lowdown: Xi’an

A winning combination of history, policy and location has made Xi’an a target for international investors.

Xi’an is capital of Shaanxi Province and the largest city in north west China. It was China’s capital on numerous occasions between 1046 BC and 904 AD and is now most famous as the home of the Terracotta Army of the first Chinese emperor, one of the nation’s biggest tourist attractions. It is also the starting point of the Silk Road, both historically and today as a key point in China’s belt and road plan to enhance regional connectivity.

The population of just over 12m is growing rapidly, with around 600,000 people added to the population last year alone. One of its attracting factors is education; it is ranked as the fourth best university city in China.

Dave Law, general manager at Savills Xi’an, says: “Xi’an was the most visited city in China during the recent lunar new year holiday and it is equally popular with international tourists. The city is attracting more talented people and this will drive business and real estate growth.”

China’s ambitious high-speed rail infrastructure is boosting Xi’an; new rail links put it only four hours from Beijing. It is a centre for military and aeronautical manufacturing and has been designated as the first area in China to develop an “aerotropolis”, with aviation manufacturing and research.

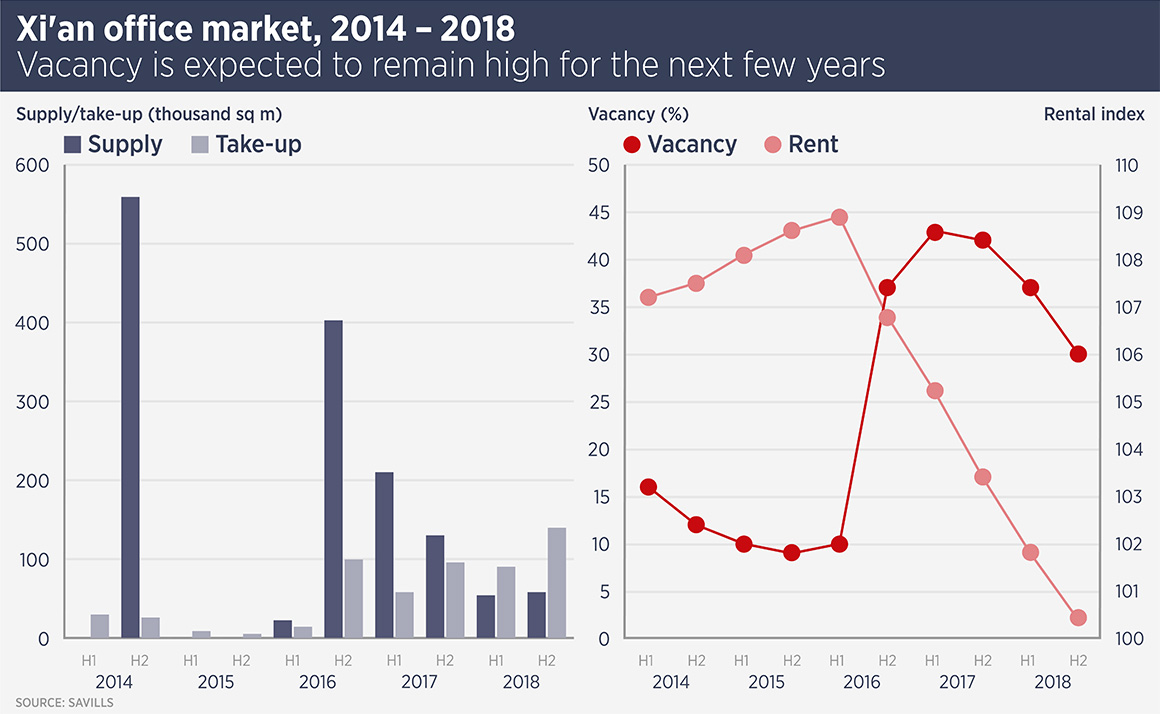

Xi’an’s office market is focused in the CBD and several submarkets, the largest of which is the high tech zone in the south west of the city, which accounts for 60% of total stock.

In recent years, development has outstripped demand and vacancy has increased to more than 30%. Law says: “We expect office market supply to remain high over the next couple of years and vacancy therefore also will remain high, although net absorption is also growing and hit record levels last year.” He suggests the Xi’an office market will not be a short-term play but will bear fruit in the long term.

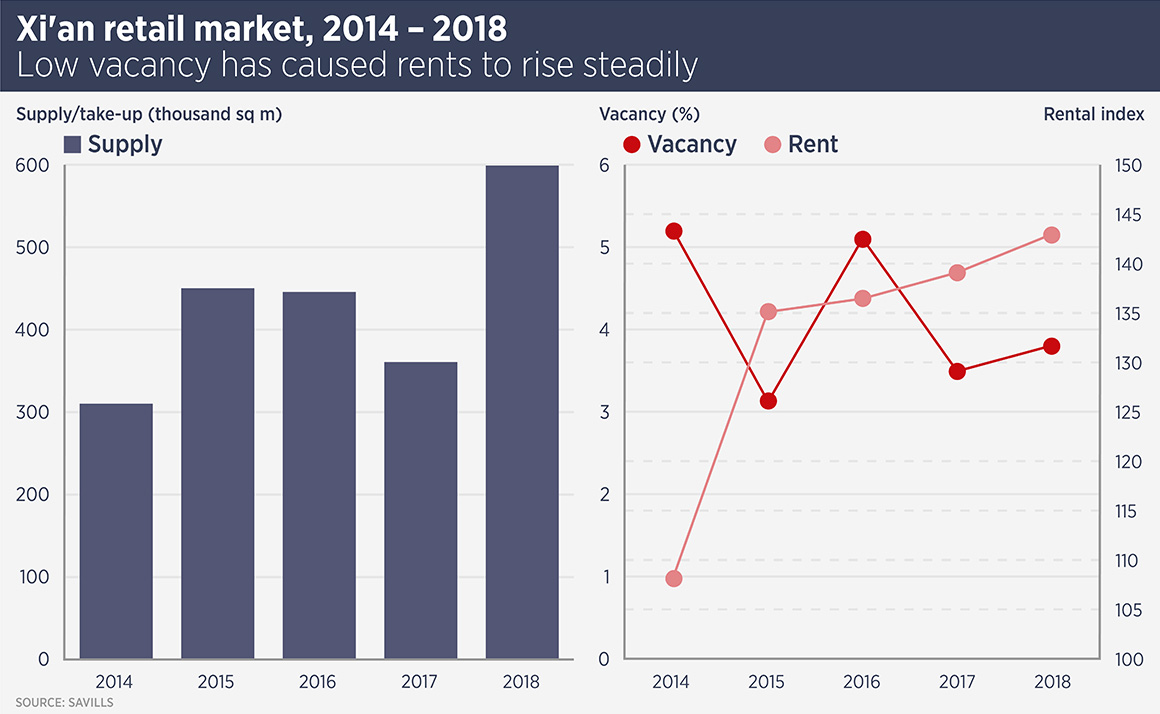

Xi’an’s shopping malls are a focus for the entire Shaanxi Province as well as for the city’s many tourists. New supply has been growing rapidly since 2015 but has barely kept ahead of demand; today vacancy is only 3%.

The positive supply and demand balance has attracted a number of foreign investors and developers already. Blackstone invested in Xi’an retail via its acquisition of a stake in Taubman Asia’s portfolio. CapitaLand has invested in Xi’an malls, as has Macquarie Infrastructure and real assets. “Xi’an is somewhat underdeveloped in terms of modern retail,” says Law. “There was still more department store space than mall space until 2017 and investors recognised the opportunity.”

Further reading:

Savills China Research Spotlight

Contact us:

Simon Smith