City lowdown: Chongqing

Not that long ago, Chongqing was “the biggest Chinese city you’ve never heard of” but today, more and more investors are taking an interest in Western China’s powerhouse.

Chongqing is one of the largest cities in the world, with a population of 30.16 million and an area of 82,400 sq km. Furthermore, Chongqing is still attracting migrants; the population rose by 225,000 in 2019. It is a key connection point in the Yangtze River Economic Belt, and a strategic base for The Belt and Road Initiative.

The economy is based on manufacturing, particularly the auto industry and there is a reasonable chance you are reading this on something made in Chongqing: the city produces one-third of the world’s laptops. The city authorities are working to move manufacturing up the value curve.

Chongqing is becoming more familiar to more people due to its booming tourism industry which saw revenues rise by 30% in 2018.

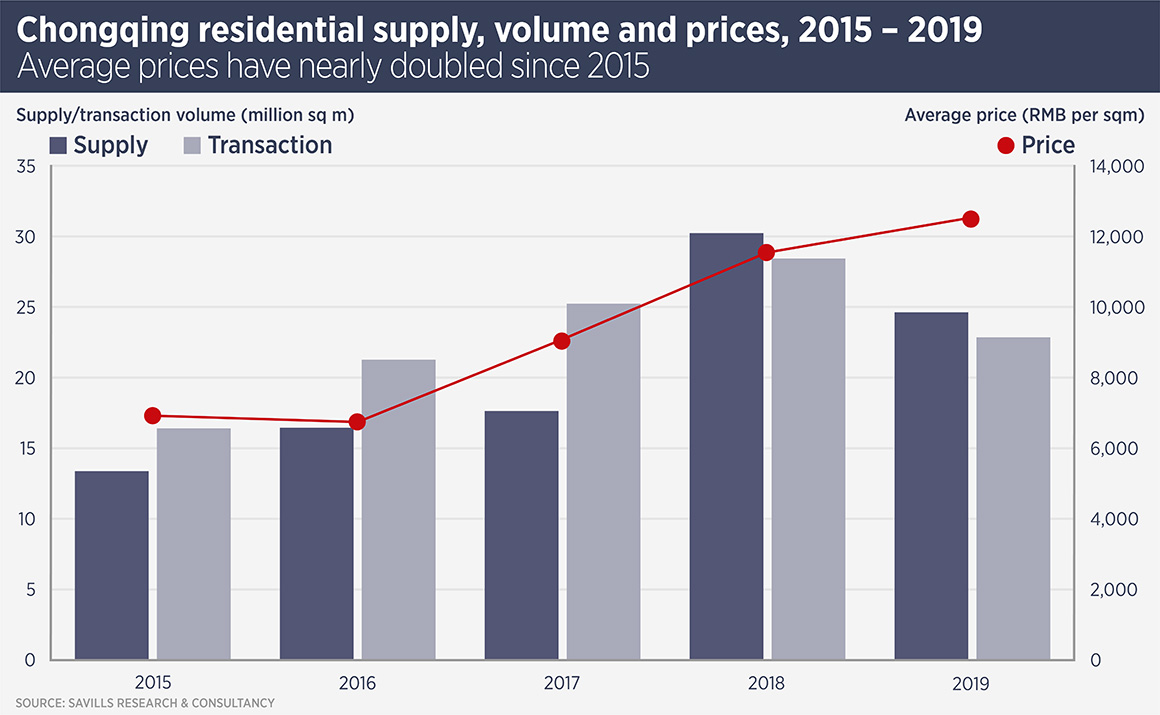

China’s slowing economy and credit squeeze slowed the breakneck pace of housing price increases in 2019, after substantial increases in each of the previous years. Nonetheless, housing prices registered a strong (8.6%) increase over the year. The the supply of new homes in Chongqing’s main urban area decreased by 18.5% year-on-year to 24.6m sq m in 2019, while transaction rose nearly 20%.

Sophy Pan, head of research for Western China at Savills, says: “Chongqing will not escape the immediate market fallout from the coronavirus, but the lifting of government restrictions will have a significant impact on the first-hand commodity housing market in the city.”

Finance, professional services, real estate and information technology companies are the major occupiers in Chongqing’s office market however Pan says: “New economy sectors such as artificial intelligence, big data and cloud computing are growing fast and will be vital drivers for the future development of the office market.”

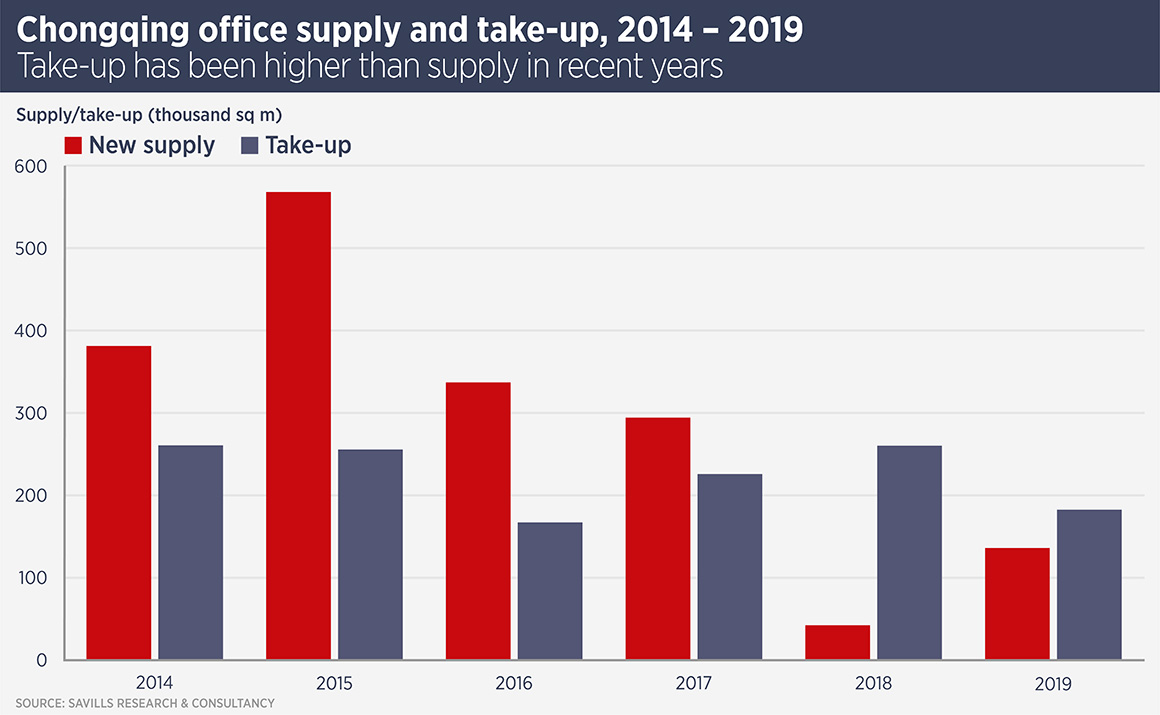

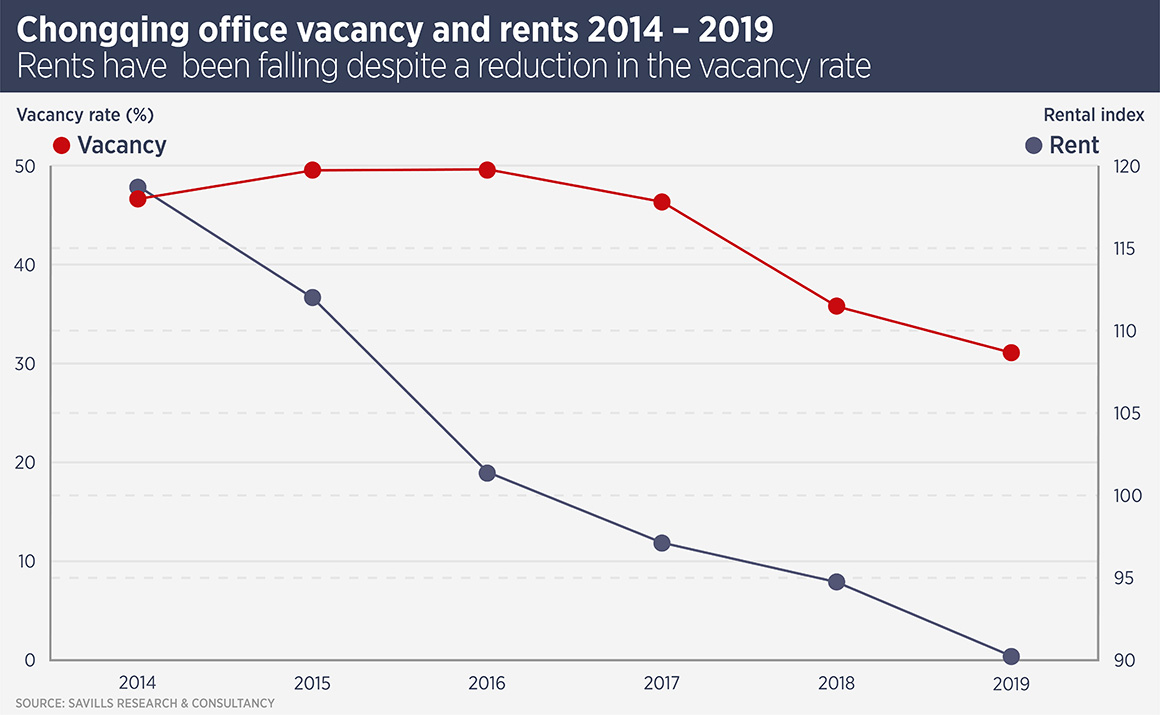

Chongqing has seen considerable office supply in the past five years, causing citywide vacancy of close to 50%. However, supply has slowed since 2016 and take-up is mopping up the empty space. However, the historical backlog of supply has hit rents.

Retail has been strong in Chongqing; retail sales growth of 8.7% in 2019 outpaced the national average of 8%. Supply and demand is in balance: the citywide vacancy rate fell 1.5 percentage points in 2019.

Pan says: “There were many retail brands entering the Chongqing retail market for the first time in 2019, such as Valmont, Superdry, NARS and Lego. Most of these brands settled in the city’s prime shopping malls.”

Further reading:

Savills China

Contact us:

Sophy Pan