Recovery opportunity in Japan hotels

The Japanese hospitality market is on the cusp of recovery, offering investors a window of opportunity to acquire hotel properties before the sector bounces back.

The Japanese hospitality market is on the cusp of recovery, offering investors a window of opportunity to acquire hotel properties before the sector bounces back.

Japan opened its borders to tourists in June, although only those travelling on organised tours, meaning the number of visitors so far is tiny. However, the nation is expected to open up further as the pandemic recedes and foreign visitors would like to take advantage of a weak yen. Furthermore, domestic tourism has already begun to recover and is close to pre-pandemic levels in many regions.

Tetsuya Kaneko, Head of Research & Consultancy at Savills Japan, says: “Prospects look brighter for the hotel industry in 2022, with both domestic and inbound travel set for a resurgence in the second half of the year.”

However, the overall number of hotel stays is still only 65-85% of 2019 numbers. That year was a record for Japan, with well over 30 million visitors and a successful Rugby World Cup.

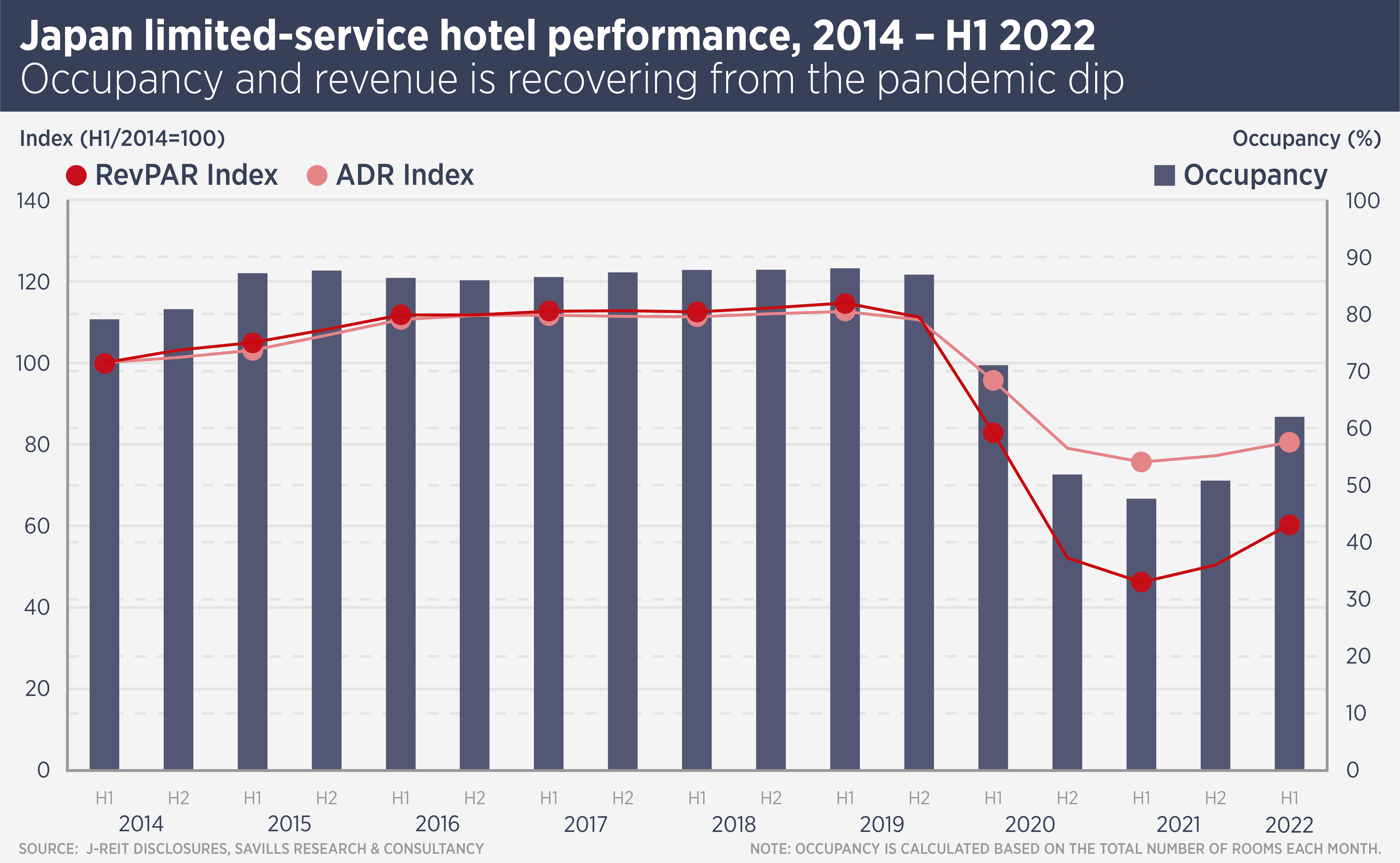

Savills analysis of the performance of hotels owned by Japanese real estate investment trusts (J-REITs) shows occupancy, which dipped below 50% in 2020, climbing to more than 60%, with a sharp rise in the first half of 2022. Meanwhile, average daily rates and revenue per available room have also begun to rise (see chart below).

Kaneko says: “While the hospitality industry is expected to gradually recover, there is likely to be notable divergence in recovery.” While inflation in Japan is low compared with other developed nations – it was 2.4% in June, compared with 9.1% in the US – it is rising and this will affect households and thus budget hotels.

Meanwhile luxury hotels catering to wealthy Japanese and overseas visitors are able to raise rates: Savills prime benchmark shows an increment of 11% for luxury room rates in July 2022 compared to the previous half-year.

Inflation is also expected to boost investment in hotels. After years of ultra-low interest rates, Savills expects the Bank of Japan to revise its monetary policy by next spring, when a new governor is appointed, and interest rates are likely to increase. The rise, in response to inflation and a weaker yen, is predicted to be small – 20-30 basis points – but will put pressure on sectors such as logistics and residential, which have seen considerable cap rate compression.

As the Japan hospitality market recovers, hotels have strong growth prospects and should attract more interest from investors. Although investment volumes are down since the pandemic, there have been a number of large deals involving overseas and domestic players.

For example, Sekisui House bought a 49% stake in the Ritz-Carlton Kyoto (pictured above) for ¥23 billion ($170 million), while KKR is reported to have been in talks with Odakyu Electric Railway over the purchase of the Hyatt Regency Tokyo hotel.

Earlier this year, Singapore’s SC Capital announced the final close of a $1 billion Japanese hospitality real estate fund, consisting of commitments from large global investors, focusing on distressed opportunities. Founder and chairman Suchad Chiaranussati, said there was a “compelling investment opportunity in Japanese hospitality.”

Kaneko says: “The next few months may present an opportune window for investors to acquire hotels. Banks are still generally cautious about providing loans for hotel acquisitions, and only investors with sufficient capital and grit would be able to capitalise on this opportunity.”

“Indeed, as inbound tourism recovers and banks become more confident in providing funding, prices of hotels will only increase.”

Further reading:

Japan hospitality report

Contact Us:

Tetsuya Kaneko