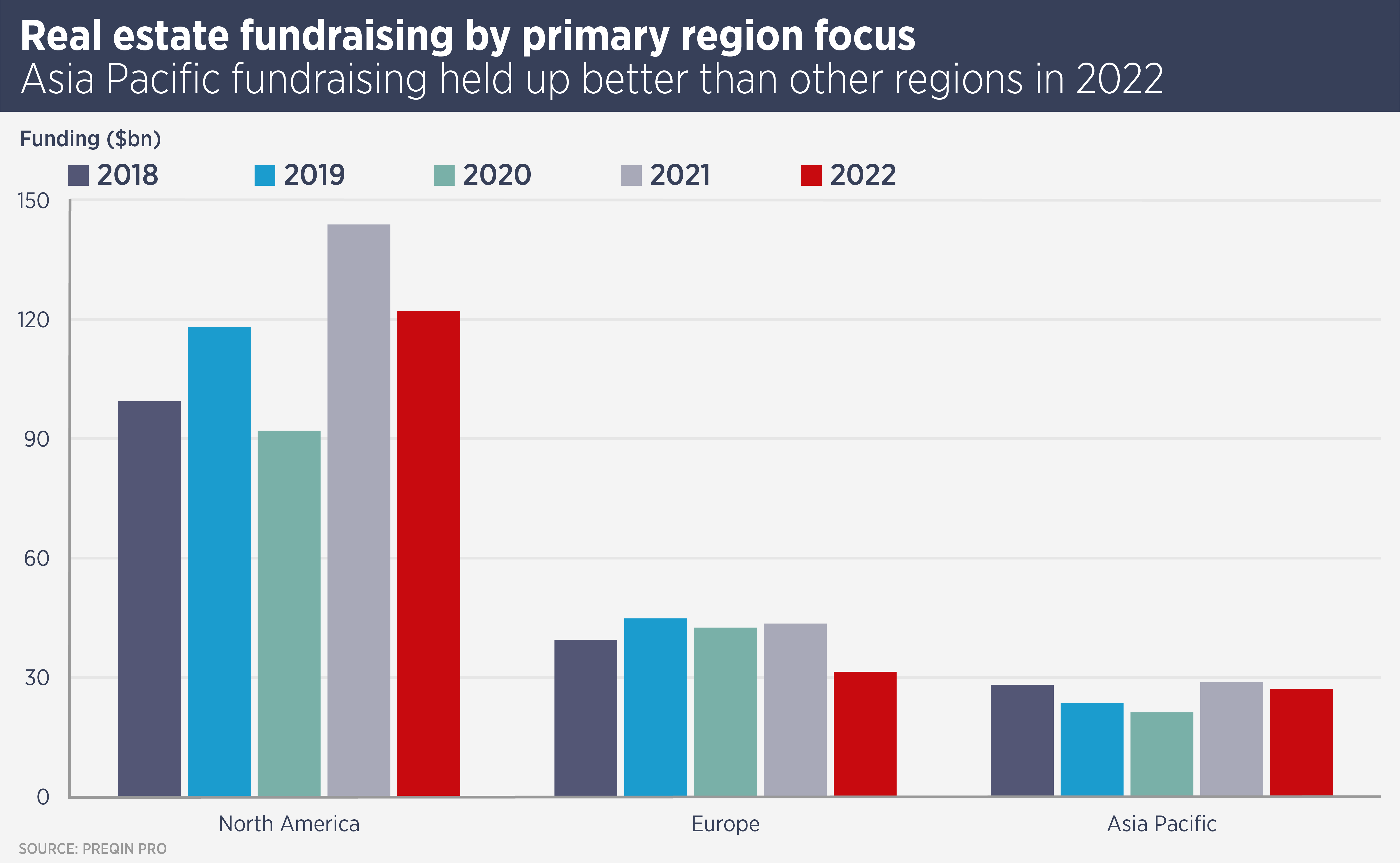

Asia Pacific fundraising holds up in difficult environment

The amount of capital raised by real estate funds targeting Asia Pacific has fallen, however the region has proven more resilient than Europe or North America in the face of inflation and political uncertainty.

The amount of capital raised by real estate funds targeting Asia Pacific has fallen, however the region has proven more resilient than Europe or North America in the face of inflation and political uncertainty.

Data from private equity researcher Preqin show that Asia Pacific-focused real estate fund-raising fell 6% in 2022, compared with a drop of 15% for North America and 28% for Europe. Asia Pacific funds also account for a higher-than-average percentage of the global total of capital raised. Preqin suggests this trend is likely to persist.

Capital-raising has slumped as real estate values have come under pressure from rising inflation and interest rates. European markets have seen inflation reach double digits, while the US has been steadily hiking interest rates.

Real estate capital raising has also been hit by the denominator effect, where real estate weightings rise due to falls in the value of other asset sectors. Pension funds which find that falling equity prices mean they are overweight in real estate are less likely to commit to new real estate investments.

The Asia Pacific total of $27.1bn was only $4.3bn behind Europe, the closest the gap has been in recent years and funds from the region netted more capital ($3.5bn) in the final quarter of the year than Europe ($2.6bn).

Simon Smith, Head of Research & Consultancy at Savills Asia Pacific, says: “European real estate in particular has been hit by rising inflation and interest rates. Asia Pacific has not been immune, but markets such as Japan have been less impacted.

“The capital-raising environment will continue to be tough while there is so much global geopolitical uncertainty, however Asia’s relative growth prospects continue to make it attractive.”

Compared with other regions, Asia Pacific office and retail markets have come under less pressure due to changing work and shopping patterns. Office workers may require more flexibility and wellness features, but they have returned to their desks. Markets such as Bangkok are still adding major retail-led projects.

Globally, Preqin noted a surge in fund-raising for opportunistic funds in the last quarter of 2022, suggesting investors are hoping to capitalise on distressed or mispricing opportunities this year.

Smith says: “While there is likely to be somewhat less distress in Asia Pacific, there are localized instances of oversupply and there may be opportunities in the public sector, where real estate investment trust prices have fallen further than their underlying assets.”

Preqin also reported that first-time funds were more successful in 2022, after several years in which the dominance of large and established players became entrenched. First time Asia funds raised more in the first three quarters of 2022 than in the whole of 2021. This suggests new managers in Asia Pacific could thrive as investors look to new ideas and strategies.

Further reading:

Savils Asia Pacific Investment Quarterly Q4 2022

Contact Us:

Simon Smith