India set to cruise ahead

For the past five years, India has been led by a government with a huge majority, thus the policy paralysis of the previous decade has turned into a policy overdrive, with a raft of new and revived initiatives.

Fundamental changes in policy have been initiated; such as scrapping the Planning Commission, implementing the Goods & Services Tax (GST), introducing an Insolvency & Bankruptcy Act, a Smart Cities Initiative and the Real Estate Regulatory Act (RERA) as well as the removal of several restrictions on foreign direct investment in real estate.

These policy initiatives will provide a solid bedrock for growth in the property sector, while increasing transparency and accountability. Defaults in the banking and non-bank finance sector this year have put some brakes on real estate growth, but these should only be temporary.

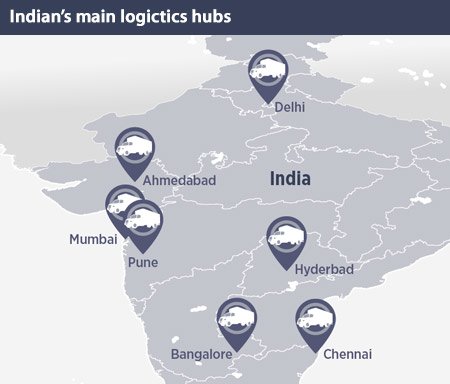

Newer sectors are emerging, such as industrial and logistics, which have been enabled by the GST and fuelled by e-commerce, and will benefit from logistics being defined as an infrastructure sector. In the last few years, more than $2bn has been allocated by offshore institutions towards industrial and logistics development.

For the Indian office sector, 2018 was one of the best years, with several key cities recording record high rents and low vacancy. India’s first office REIT is also set for launch. The quality of office space is improving significantly and some of India’s Grade A office buildings now rank with the best in the world. There is an ever-increasing focus on safety, environmental quality and the occupier experience. On the tenant side, co-working space has been the biggest trend and could become a market changer in the future.

Institutional investor interest in yielding assets in India is at an all time high; over the past five years, most of the major office developments have moved from private domestic ownership to part or full offshore institutional ownership. This will bring about further enhancements in the quality and operation of office stock in India.

The residential sector has been in the doldrums since 2013, due to oversupply, delayed deliveries in many markets, developer insolvencies and the introduction of a GST on sales. However, new legislation such as RERA has improved buyer protection and will go a long way in bringing back confidence and should also lead to consolidation in the sector. Meanwhile technological advances are improving the quality of residential stock.

Next year promises to be a decisive year for India in political terms due to the general election, however the overwhelming consensus is that the result will have little or no impact on the reform process or the economic outlook. Looking forward, demand remains robust for Grade A office space, while the residential sector, having left the worst behind, is expected to find equilibrium. The Indian elephant is in cruise mode!

Contact Us:

Anurag Mathur