The London Advantage: Why Asian Real Estate Buyers Prefer the UK Capital

London remains a top target for Asian real estate investors, showcasing its appeal as a global city with a thriving real estate market. While global economic uncertainty and rising interest rates have impacted investment volumes, London's resilience draws capital seeking exposure.

Asian real estate investors have put London at the top of their shopping list and the UK capital is still attracting new players.

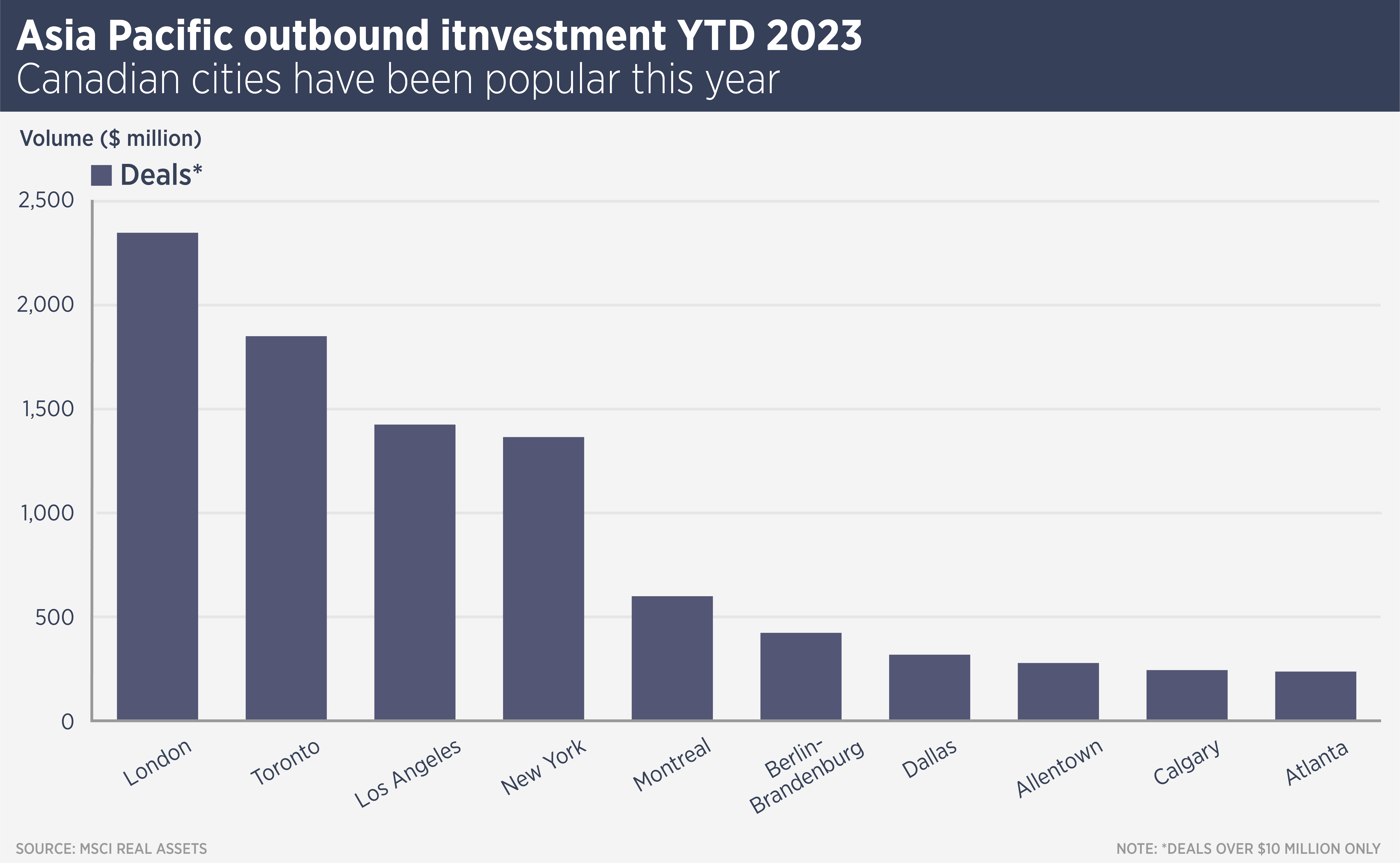

Rising interest rates and an uncertain global economy mean commercial real estate investment volumes have fallen this year. Asian outbound investment fell to $18.4 billion in the first half of 2023, compared to $20.4 billion in the same period last year, according to MSCI Real Assets.

As a global city with a liquid real estate market there is always capital seeking exposure to London, says Emma Steele, Director, Global Cross Border Investment, at Savills. “Wherever we go around the world and speak to investors, they always want to hear about London. There continues to be an abundance of capital wanting to access the market but some groups are simply on the side-lines right now, waiting to see further price stablisation.”

Deals are still happening, however. For example, Lion Plaza, a City of London office building was marketed in late 2022 with offers sought above £262.7 million ($336 million). It sold recently for a reported £209 million ($267 million). It was the first London commercial real estate purchase for a Vietnamese investor. The building also attracted interest from other global investors.

Long term Asian investors have also been active, such as Singapore’s City Developments, which bought the St Katharine Docks mixed use complex near Tower Bridge (pictured above) for £395 million ($507 million) in March.

As in many markets around the world, there is a bifurcation between the best assets and the rest, says Oliver Watt, Director, Global Cross Border Investment, at Savills. “Everything has come down in value from the peak, but prime assets are maintaining their value a lot better, at least in part because the owners of those assets tend to be well-capitalised, therefore distress is less common.”

Nonetheless, the difficulty of finding opportunities where debt would be accretive – due to the cost of borrowing being above property yields – in the UK and elsewhere, is putting off some Asian investors, says Watt. “There is something of a wait and see approach for some investors as they are hoping for prices to fall further, or borrowing costs to change trajectory, before they move.”

As well as the UK, the largest markets in North America are also attracting interest. In June Mori Trust bought a 49.9% stake in 245 Park Avenue, a 1.8 million sq ft office building, in a deal reflecting a $2 billion valuation for the asset.

However, opinion amongst investors is divided over the future of the US office market, which is still reeling from the home working trend which has pushed vacancy rates in major CBDs above 20%.

Interest from APAC investors in continental European cities is always more nuanced, says James Burke, Director, Global Cross Border Investment and European Capital Markets, at Savills. “The strong purchasing power of domestic capital in many mainland European jurisdictions means that, even during volatile points in the market cycle, it can prove more difficult for new overseas entrants from Asia Pacific to break into those markets.

“Coupled with typically sharper yields than the UK, underpinned principally by the ECB’s lower interest rates, Europe presents a greater number of potential hurdles for capital from APAC but, in spite of this, there remains a tenacious and committed group of investors who continue to monitor the region for future investments.”

Beyond the continued interest of Asia Pacific investors in offices, the Savills Global Cross Border Investment team reports widespread interest in the living sector, including multifamily and student housing, and also in the hotels sector, which has bounced back worldwide since the end of the pandemic.

And despite subdued activity overall, new Asian investors continue to enter the global real estate markets. Capital continues to flow from core markets such as Singapore, South Korea, Hong Kong and Malaysia, while new players from markets such as Vietnam are emerging.

“For new investors in particular, given the pricing moves we are witnessing, today does feel like an interesting time for them to build their knowledge of outbound markets and to deploy in a less competitive environment,” says Steele.

Further reading:

Asia Pacific Investment Quarterly Q2/2023

Contact us:

Emma Steele | Oliver Watt | James Burke