Education-hungry Asia boosts prospects for student housing

Student accommodation is gaining traction among real estate investors in Asia Pacific, driven by rising demand and limited supply. Discover key trends, investment hotspots, and market insights for 2025.

Student accommodation is becoming more popular with real estate investors in the Asia Pacific region, buoyed by growing demand and restricted supply.

The Urban Land Institute/PwC Emerging Trends in Real Estate Asia Pacific 2025 report found it was the fourth most popular niche sector, behind data centres, health and wellness, and senior housing. However, investment volumes into student accommodation are small compared with multifamily housing, the most popular part of the “living sector”.

The biggest investment market for purpose built student accommodation (PBSA) is Australia. Japan has steady demand from international students, while Hong Kong has seen an upsurge of interest. In the longer term, the Indian market is considered to have considerable potential due to its size: last year there were 43.3 million students enrolled in higher education.

Simon Smith, Head of Research & Consultancy at Savills Asia Pacific, says: “The region’s growing middle class and its strong focus on education means the number of university students will keep on rising. This means continued demand for student accommodation, both for overseas students and domestic students who are educated away from their home town.

“Developed Asia Pacific markets with strong universities should see an increase in international students from within the region in the future. And, as Asia becomes a larger part of the world economy, it will attract students from Europe and North America.”

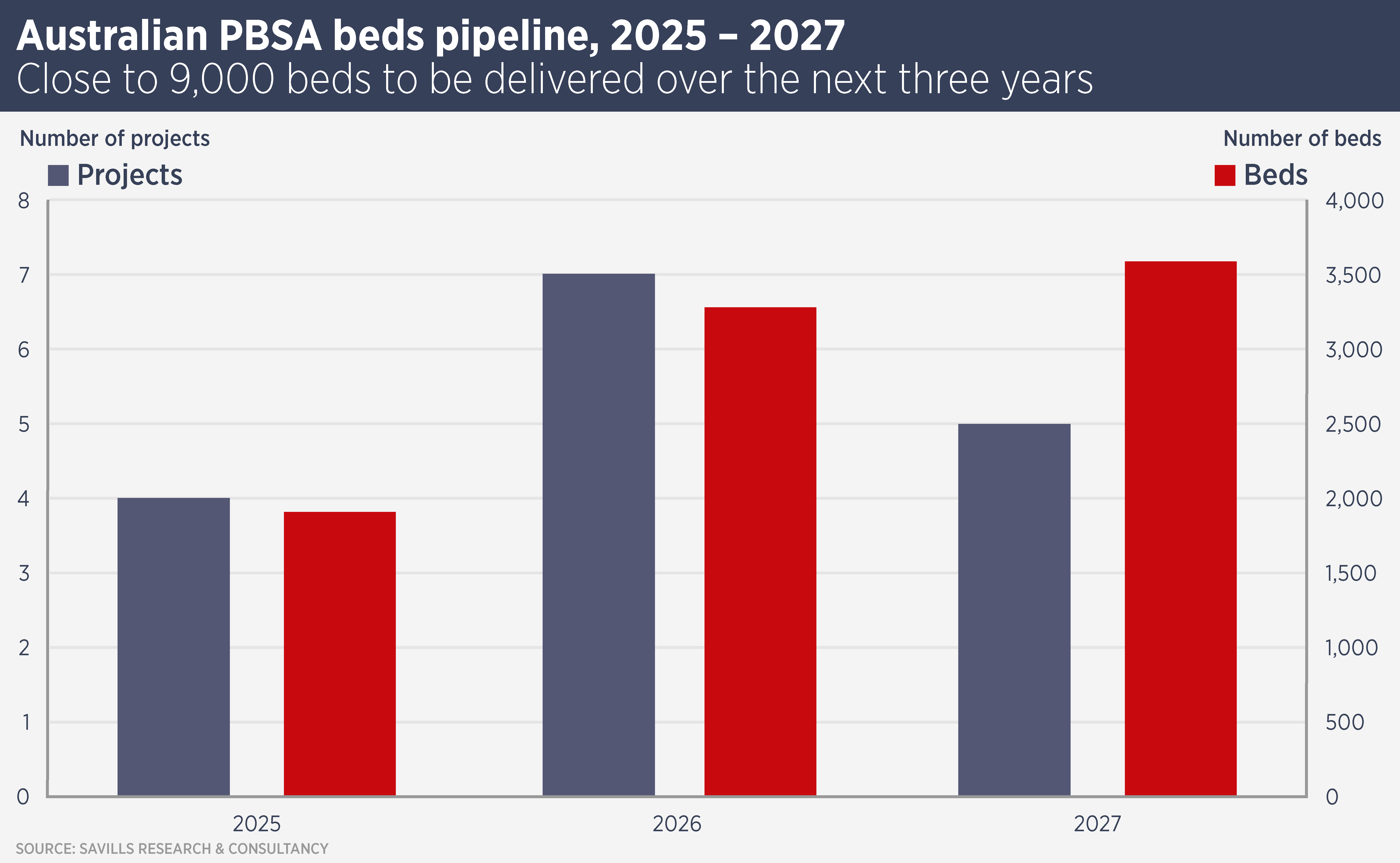

Australia is the largest and most developed PBSA market, where the top 11 operators have a total of more than 80,000 bedrooms in operation and more than 17,000 in the pipeline. The sector has also attracted a range of global investment managers, including Blackstone Group, Brookfield and Nuveen.

Rising student numbers and development costs have driven rising rents across the nation. Savills data show that, since 2022, Perth student accommodation rents have increased by a compound annual growth rate of 19.7%, Brisbane by 16.1%, Sydney by 10.4%, Adelaide by 6.7% and 6.1% in Melbourne.

A sharp rise in international student admissions after the pandemic and rising residential rents have caused political concerns in Australia. Last year, the government proposed capping 2025 foreign enrolments at 270,000 and now the main opposition party has proposed even more strict caps. These proposals come despite the education sector generating A$50 billion for the economy.

Meanwhile, Hong Kong is taking steps to boost overseas student numbers, both from Mainland China and further afield. The city had more than 70,000 non-local students in the 2023/2024 academic year and this is expected to grow. The Hong Kong government has pledged to double the quota of non-local students in government institutions and boosted numbers in the Belt & Road Scholarship scheme. However, there is already a shortfall of suitable accommodation. The city has little PBSA, instead relying on dormitories and some newer co-living style buildings, suggesting scope for expansion.

In October, Hong Kong chief executive John Lee Hong Kong’s leader unveiled measures to increase the supply of student accommodation, encouraging the private sector to convert hotels and commercial buildings.

Japan has substantial numbers of foreign students – 188,555 in 2023 – however numbers are still only 80% of pre-pandemic levels. The majority of foreign students hail from China. Levels of PBSA provision remain small compared with student numbers, nonetheless the sector has attracted foreign investor interest. Buyers in recent years include Singapore’s Ascott Residence Trust and AXA IM Alts – Real Assets.

With huge student numbers and a flurry of start-ups, the student housing market in India is expected to attract more attention from real estate investors, although so far much of the interest in fledging operators has come from private equity companies. While it has fewer students than China, India has a much younger population and students are more inclined to study away from their home town.

Further reading:

Australian Student Accommodation 2024

Contact us:

Simon Smith