Silver linings in Asia Pacific and a sunnier medium-term outlook

Asia Pacific real estate shows resilience in 2025, with rising investments in Australia, India, and Japan, and capital-raising hitting near-record highs.

Real estate transaction data shows a drop in confidence, but not everywhere, and capital-raising data suggest brighter times ahead for Asia Pacific property markets.

Commercial real estate transactions in Asia Pacific fell sharply in the first quarter of 2025, according to MSCI preliminary data for the first quarter, with transaction volumes falling 33% to $24.9 billion, the lowest quarterly total for a decade.

Despite the overall drop in transaction volumes, Savills research identified three markets in particular as still attracting investment: Australia, India and Japan. Australian deal volumes rose year-on-year in the first quarter, with particular interest in the retail sector. Furthermore, the prospect of interest rate cuts is keeping investors positive.

Meanwhile India saw a 35% year-on-year increase in private equity investment flows in the first quarter and a market-boosting interest rate cut. The Indian economy is seen as relatively insulated from the effects of tariffs and trade disagreements and GDP growth remains strong at 6.2%.

The Bank of Japan’s January interest rate hike subdued demand but core-plus funds, family offices and ultra-high net worth individuals remained in the market. Japan also saw two $1 billion-plus transactions, both involving overseas capital. Brookfield spent $1.6 billion on a mixed-use complex in Tokyo and a logistics site in Nagoya, while Gaw Capital bought a shopping centre in Ginza, Tokyo.

“The performance of these markets demonstrate how the diverse nature of this region offers opportunities, even when the overall picture is cloudy,” says Simon Smith, Regional Head of Research & Consultancy at Savills Asia Pacific.

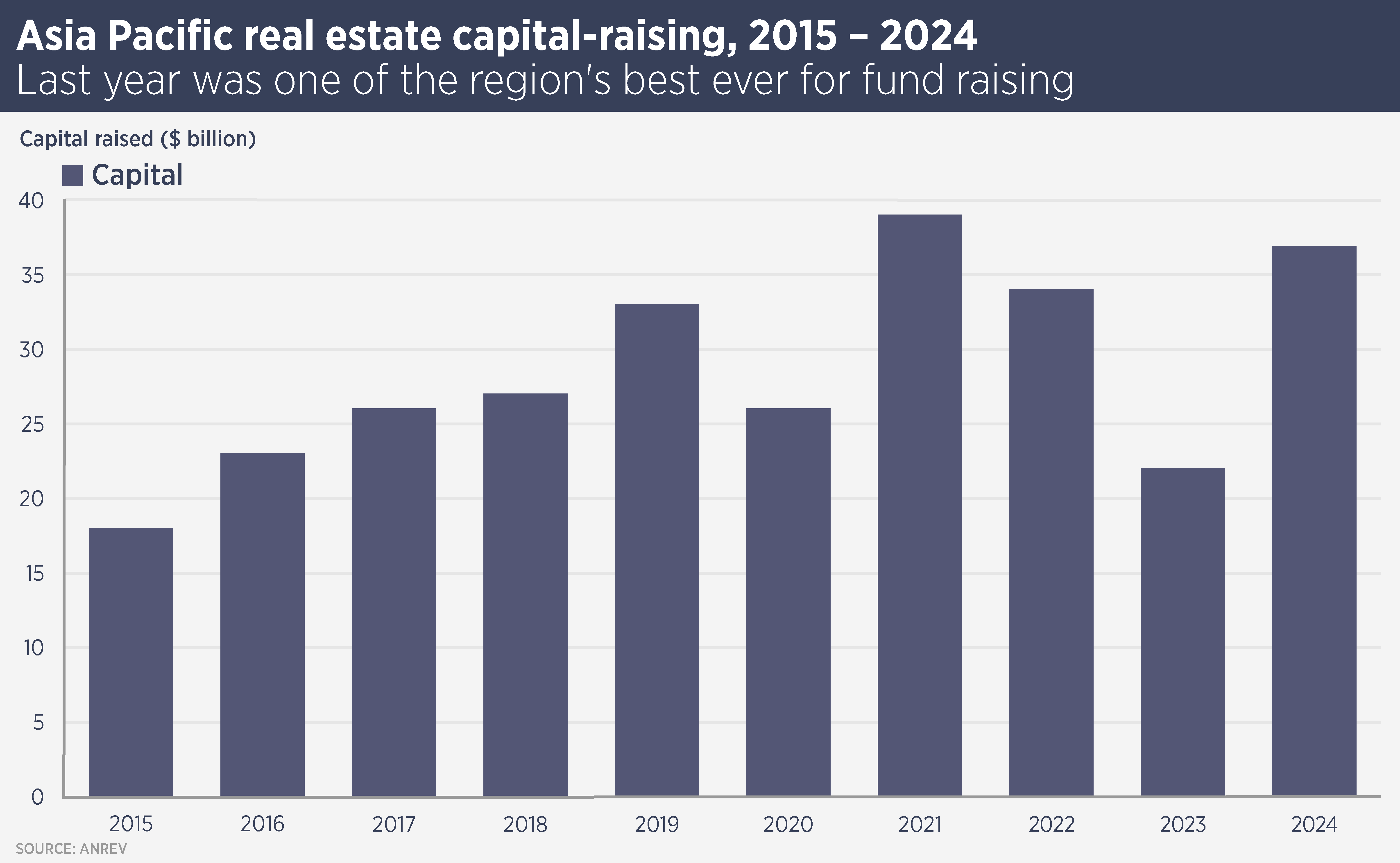

There are also positive signs regarding real estate capital-raising. Asian real estate funds body ANREV last month revealed that Asia Pacific-focused private real estate funds raised a total of $36.9 billion in 2024. Apart from 2021, when $39 billion was raised, this was the highest annual total since ANREV began collecting data.

Nearly half (48%) of the capital was raised by core funds with the remainder almost evenly split between opportunistic vehicles (27%) and value-add funds (25%). ANREV noted that much of the 2024 fund-raising was accounted for by a few large funds.

“With leverage, the equity raised means there is substantial dry powder for investment in Asia Pacific real estate,” says Smith. “While some funds will no doubt seek to delay purchases, we expect to see some significant deals this year, as capital-rich investors make forays into markets such as Australia, India and Japan, as well as to sectors such as data centres.”

Further reading:

Asia Pacific Real Estate Investment Q1 2025

Contact us:

Simon Smith