Tourism and spending growth to spur Australian CBD retail

Retail property in Australia’s CBDs is thriving, driven by rising tourism, stronger household spending, and infrastructure upgrades like Sydney’s metro extension.

Retail property in Australia’s CBDs is set to receive a boost from a growing number of Asian tourists and a rebound in domestic consumer spending.

Chris Naughtin, National Director, Capital Markets Research, at Savills Australia, says: “Retail spending is supported by a growing population, growing disposable household incomes and a strong recovery in international tourism.”

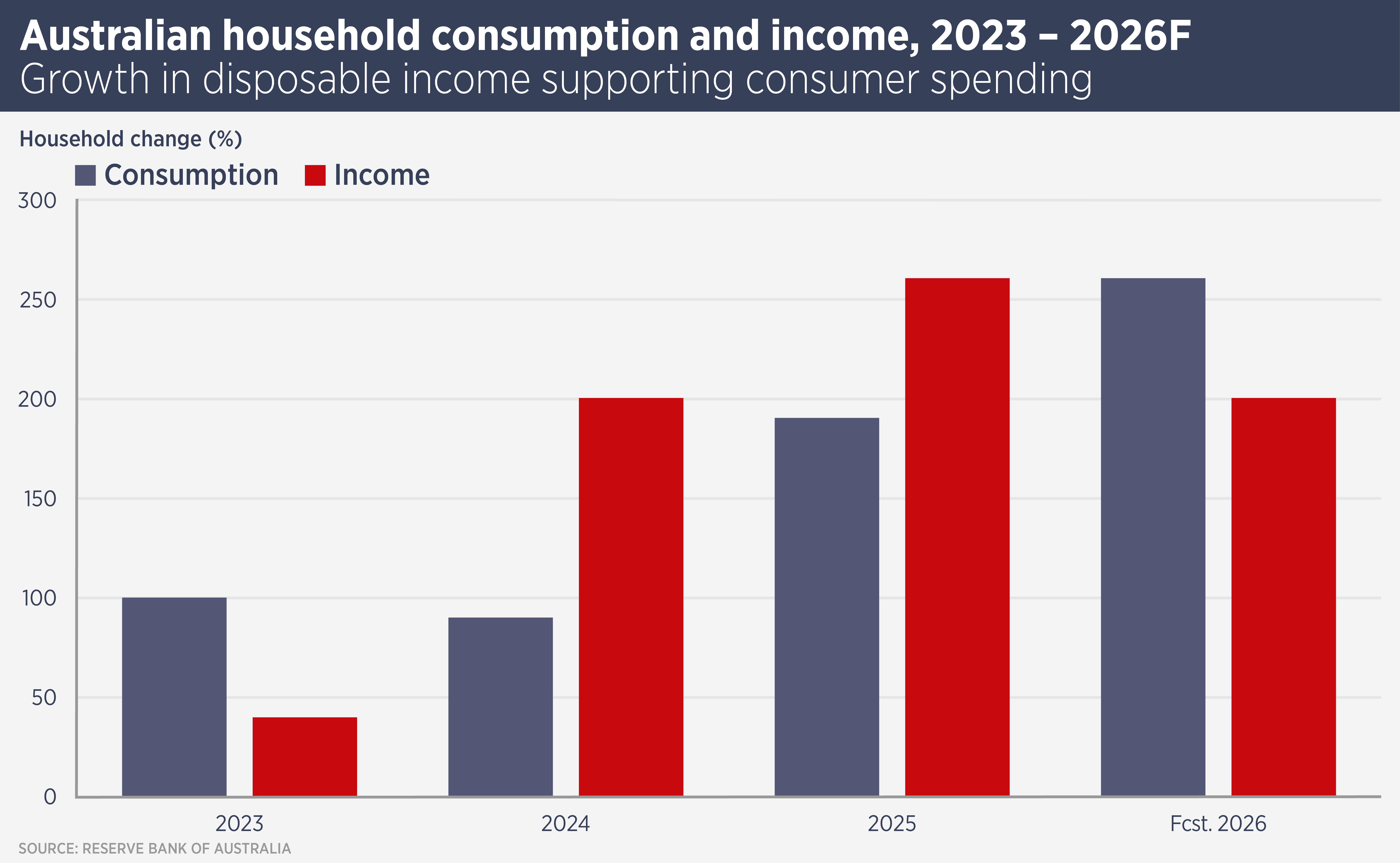

Household consumption is set to rise this year and next on the back of growing household income in 2024 and 2025 (see below). Tourism numbers, which are expected to grow by an average of 7.2% per year between now and 2029, will boost retail and hospitality spending, with most visitors coming from Asia.

Retail is also benefitting from the recovery in office occupancy, meaning more people are in Australia’s CBDs during the day. In recent years, a flight to quality amongst office occupiers has driven more activity in core CBD areas. Infrastructure improvements, such as Sydney’s metro extension, are also bringing customers to CBD retail outlets.

Gary Mason, NSW State Director of Retail Leasing at Savills, points to a number of positive factors driving retail in Sydney’s CBD. “The new Sydney metro extension is making CBD retail more accessible and is driving demand from smaller F&B outlets around stations. New office developments are also activating retail in the surrounding area. Sydney is first stop for most inbound tourists and that is supporting luxury CBD retail too.”

In the post-pandemic period, Australian consumers have chosen to spend more on experiences, such as restaurants and hospitality. Spending at restaurants and hotels has outpaced overall consumer spending since coming out of pandemic era restrictions in 2022. This has particularly benefitted CBD locations and the trend is set to continue: Oxford Economics predicts that restaurant and hotel spending will continue to outpace total consumer spending for the rest of this decade.

The improvement in the fortunes of the retail sector has not escaped investors: in the 12 months to Q1 2025, Australian retail property investment volumes rose by more than half, to A$9.7 billion (US$6.3 billion) from A$6.3 billion (US$4.1 billion) in the previous 12 months.

“Investor confidence in the sector is growing,” says Naughtin. “We expect more interest in CBD retail as domestic consumer spending and tourism grows over the next few years.”

Further reading:

Retail Market In Minutes

Contact us:

Chris Naughtin