Asian investors target UAE real estate

Asian investors are driving UAE real estate growth, led by deals in Dubai & Abu Dhabi amid rising demand, wealth inflows & mega developments.

Real estate investors from Asia are acquiring assets in the United Arab Emirates, attracted by a booming property market and the nation’s growing status as a wealth hub.

Asian institutional investors and managers are buying assets in Dubai and Abu Dhabi while retail and high net-worth investors are acquiring residential assets in the UAE.

In May, Rava Partners – the real asset arm of Hillhouse Investments – made its debut investment in Dubai by acquiring the real estate of Hartland International School in a deal valued at $100 million. The news was swiftly followed by Hong Kong’s Gaw Capital Partners buying a $150 million residential complex on Saadiyat Island, Abu Dhabi.

Last year, Temasek-owned Mapletree Investments opened an office in Abu Dhabi and recent media reports suggest it plans to deploy around $2 billion in the Gulf region. These Asia-based investors are following firms such as Ares Management and Goldman Sachs, which have also invested in Middle Eastern real estate.

The lion’s share of interest in the UAE is in Dubai and Abu Dhabi, says Rachael Kennerly, Director of Middle East Research at Savills.

“The growing expat and HNW population in Dubai and Abu Dhabi is driving the real estate market and also demand for education. The population is set to hit four million this year, which means it has doubled in 14 years.” This growth is reflected in the economy: UAE annual GDP growth has averaged nearly five percent since the pandemic.

Dubai has become a global wealth hub, attracting thousands of millionaires each year, as well as others looking to take advantage of low taxes and a growing economy. The Savills Dynamic Wealth Index for individuals ranks Dubai as the top global city for attracting and developing individual wealth.

The number of Asian residents is growing too. In 2023, the Chinese ambassador to the UAE estimated 400,000 Chinese citizens were living there. The UAE also attracts interest from Indian investors and expats, aided by being less than four hours from Mumbai.

“The market is very international,” say Kennerly. “Savills recently marketed a residential development in Abu Dhabi and there were 37 different nationalities amongst the buyers.”

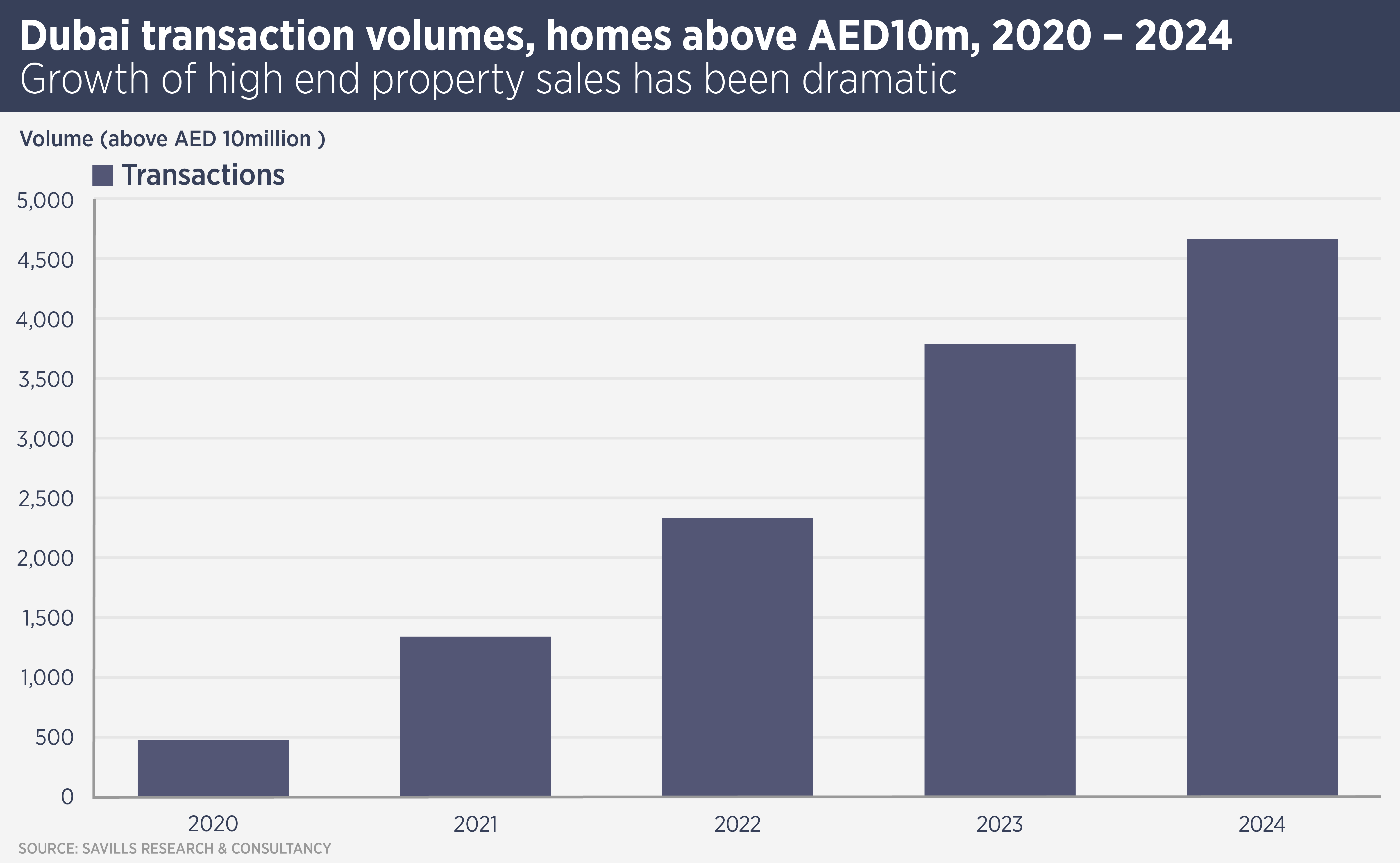

Dubai’s residential market is booming, with values rising for the past four years. The number of AED10 million (US$2.7 million) transactions has risen tenfold since 2021. However, as a consequence of this boom, there is a huge amount of supply on the horizon, with 250,000 units set to be delivered by 2027.

Meanwhile, Abu Dhabi is bolstering its appeal to the expat community by securing several international schools, including Harrow, Kings College Wimbledon and Gordonstoun, and the development of master planned villa communities. Tourism numbers are set to be boosted by the announcement of a new Disneyland.

A significant area of growth in UAE real estate is branded residences, with names such as Fairmont, Four Seasons and Asia’s Rosewood appearing on luxury residential developments. Savills predicts the Middle East & Africa to show the strongest growth in branded residences between now and 2031, and the UAE will account for 40% of the market, with more than 60 developments completed and close to 100 in the pipeline.

A lesser-known emirate attracting investor attention is Ras Al-Khaimah, which is growing as a both a tourist destination, thanks to its coastal location, and as a trading hub for Chinese goods, with associated logistics. Ras Al-Khaimah is also set to be home to the UAE’s first integrated casino resort, operated by Wynn and set to appeal to Asian gamblers.

“There is a lot of interest in development around the casino, which is set to open in 2027,” says Kennerly.

Further reading:

Savills UAE

Contact us:

Rachael Kennerly