Investors head to Sydney as Australia economy strengthens

Sydney leads Australia’s real estate boom, driven by strong office demand, rising investment, lower interest rates, and positive economic growth forecasts.

Real estate investors are targeting Sydney, attracted to the scale and liquidity of Australia’s largest market, backed by an improving Australian economy.

Furthermore, rising disposable incomes, moderating inflation and lower interest rates are set to buoy Australia’s economy and wider real estate prospects over the next 18 months. The OECD projects Australia GDP growth rates of 1.8% for 2025 and 2.2% for 2026.

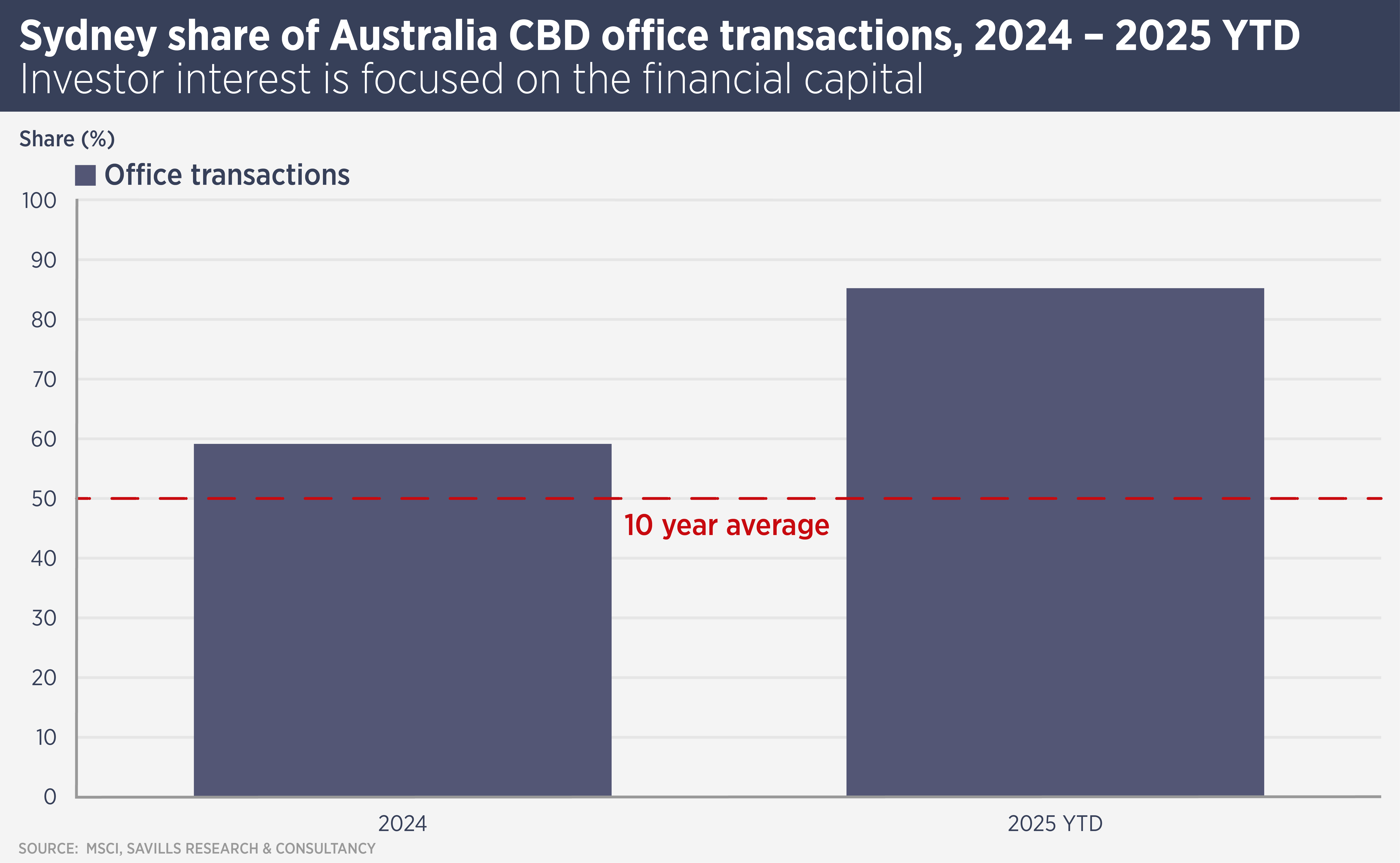

Sydney CBD offices have been a major beneficiary of Australia’s sunny outlook. Confidence in the outlook for Sydney is rising, underpinned by a steady increase in office occupancy and foot traffic in the CBD, as well as the positive impact of enhanced transport linkages. The Sydney CBD accounts for 85% of Australian CBD office deals so far this year, compared with a long-term average of 49%. Cross-border investors have been a key driver of CBD office investment in Sydney, accounting for 73% of investment thus far in 2025.

Ben Schubert, National Head, Capital Transactions & Advisory of Savills Australia & New Zealand, says: “Sydney’s CBD has benefitted from a flight to quality amongst office tenants and from the preference of overseas investors for the largest and most liquid gateway cities globally. Improving transport connectivity also drives footfall in the CBD as does tourism, which makes it a real live/work/play destination.”

The strengthening office occupier market in Sydney is a key attraction for investors such as PGIM Real Estate, BGO, Singapore’s UOL Group, and Japan’s Daibiru, all of which have bought office assets in Australia’s financial capital this year. Savills’ Sydney CBD Prime Office Full Floors report showed significant falls in the amount of prime office space available for lease and face rents rising 5.5% in the 12 months to June 2025.

Chris Naughtin, National Director, Capital Markets Research at Savills Australia, says: “Increasing competition for space and declining availability of premium space, along with rising fit out costs, have driven face rents higher. Tenant demand is broadening across the Prime CBD office market.”

The wider Australia real estate market is set to grow thanks to lower interest rates and rising consumer spending. The retail sector is already benefitting and investors have taken note: the retail sector’s share of investment volume has risen to 29% so far in 2025, up from 22% in 2023 and 27% in 2024.

The key change is lower interest rates; the Reserve Bank of Australia has made three cuts this year, bringing rates down to 3.6%, from 4.35% with the prospect of more cuts this later year and into 2026. Naughtin says: ” Following RBA easing cycles in 1996, 2001, and 2011, total returns for commercial property over the subsequent five years were materially above average: 11.2%, compared with a long-term average of 9%.”

Schubert says: “Lower interest rates will boost real estate returns and make the sector relatively more attractive compared with other asset classes. Australia’s strong economic and population growth prospects and limited real estate development pipeline will continue to attract foreign and domestic investors across all real estate sectors.”

Further reading:

Australia Office Briefing – September 2025

Contact us:

Ben Schubert