Steady as she goes

Rising US interest rates present little threat to Asian real estate investors.

The US Federal Reserve Bank has raised the federal funds rate range twice this year, to 1.75-2%, and has declared it will raise rates twice again, leaving the rate at 2.25-2.5% by the end of the year. Some forecasters insist there will be only one rate rise and a number of financial institutions, not coincidentally institutions which have benefitted from very low interest rates, have warned that a “hawkish” interest rates policy could threaten growth.

The average US interest rate since 1971 is 5.72%, which demonstrates that the current interest rate environment is historically unusual, despite many suggestions that the ultra-low interest rate environment is “the new normal”.

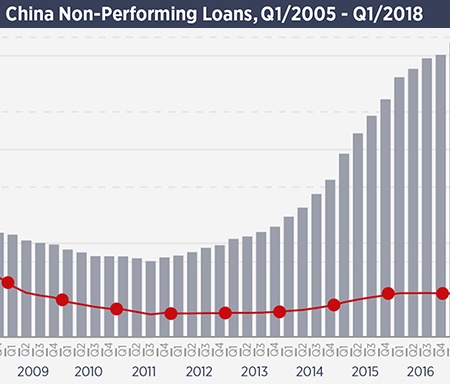

The People’s Bank of China has been following the various Fed rate rises with its own hikes, both to keep pace with the US and separately to lower financial risks in the Chinese economy. In both the US and China, steadily rising rates mean central banks build up firepower to lower them should the economy begin to falter or inflation fall.

So what effect will rising rates have on Asia Pacific real estate?

Simon Smith, head of Asia Pacific research at Savills, says: “One of the factors behind every financial crisis is the cost of money as easy money gives way to much higher costs. This happened in both the Asian Financial Crisis and the Global Financial Crisis, for example. However the current interest rate rises have been modest and well-telegraphed.”

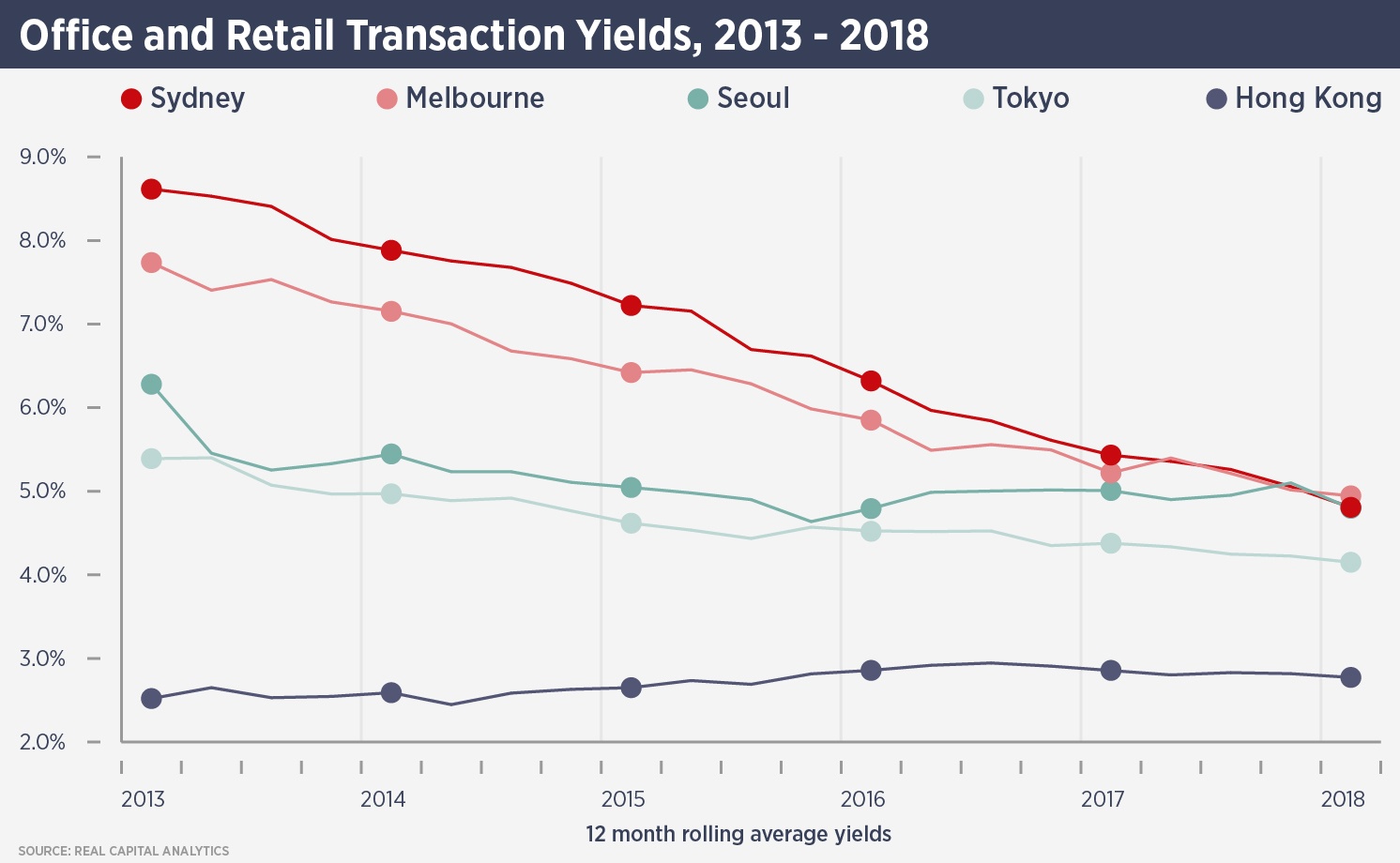

In a number of Asian markets – such as Shanghai and Hong Kong – the cost of borrowing already exceeds the yield on prime real estate. However, investors have the double reassurance of rising rents and substantial equity.

“Developing markets across the region are generating substantial wealth, some of which is being funnelled into the growing Asian pensions and insurance industry. This new institutional capital will target the same prime assets as other core buyers, which will support pricing,” says Smith.

Furthermore, while a risk-free rate of 3% and yields of 2% might discourage Western pension funds, Asian investors, especially private investors, are more concerned with the price per sq ft on entry and exit.

While the US and China are raising rates, other countries are keeping theirs low. The Bank of Japan has no intention of abandoning loose monetary policy, supporting prime yields for assets in Japan’s largest cities.

Australia’s reserve bank has made occasional threats to raise rates from current low levels but has left them unchanged for 20 quarters. This has been a boon for investors in Sydney and Melbourne, where the local economy is booming but interest rates are at a level intended to shore up weaker sectors.

The biggest losers are set to be emerging Asian economies, which will lose out to dollar-denominated assets. The Fed’s actions have already strengthened the dollar relative to emerging market currencies, bad news for investors in real estate in those locations.

Contact us:

Simon Smith