Bad news for developers is good news for China debt investors

The prospect of further restrictions on China’s property developers could open up a massive opportunity for real estate investors.

Investors are increasingly looking at debt as an alternative means to gain real estate exposure, however the opportunities to do so in Asia Pacific have been limited. China is by far the biggest opportunity, due to the size of the market and the demand for debt.

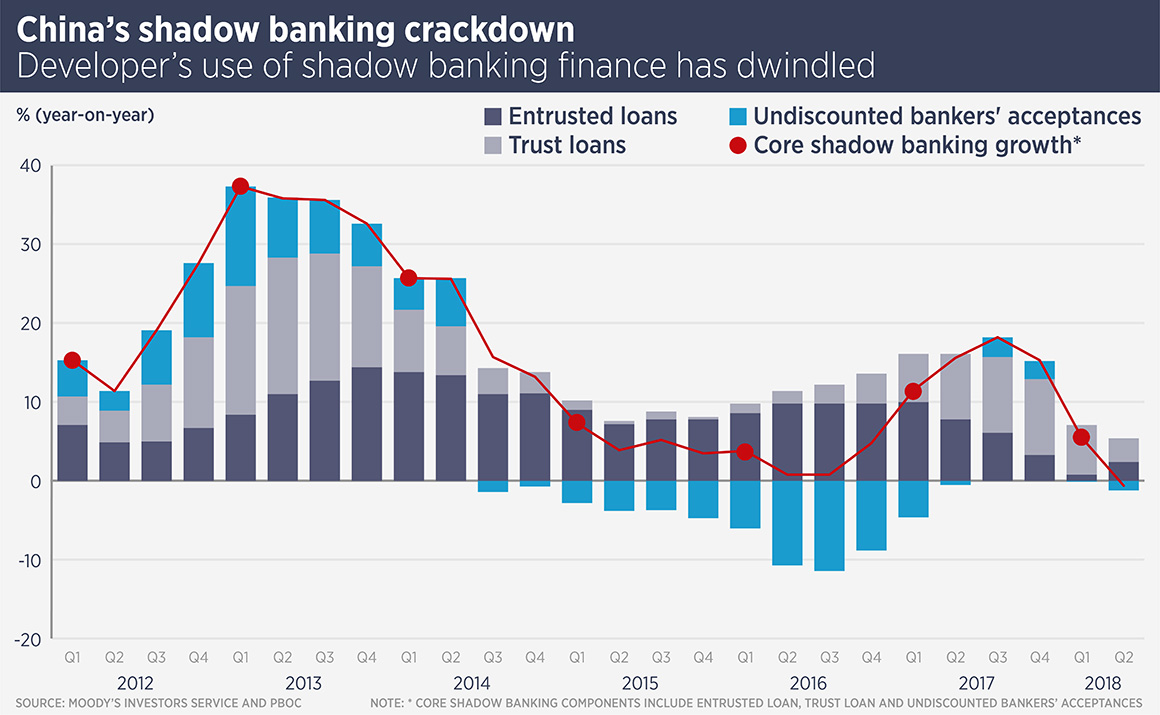

James Macdonald, head of China research at Savills, says: “From the end of 2016, the government started introducing a series of measures to deleverage the economy, including clamping down on the shadow-banking sector and raising the bar on onshore bond issuance.”

These restrictions have forced smaller developers to use more expensive mezzanine and offshore loans. Bloomberg data suggests approximately $70bn of China real estate loans will need refinancing over the next five years.

Some private equity companies have taken advantage; for example, Infrared NF has extended more than $650m of mezzanine finance backed by Chinese assets. Earlier this year, CapitaLand launched a $750m China debt fund, which will target mezzanine lending in China’s first and second-tier cities.

The opportunity may be even larger if bans on pre-sales become more widely implanted. Last year, the Pearl River Delta city of Zhongshan became the first to ban developers from using advance sales of units to fund their construction. If more cities decided to follow suit, or if the measure was imposed nationally, it could blow a hole in developer’s finances. Savvy real estate investors could step up and cash in.

Another potential opportunity, albeit one best suited to specialist investors, is real estate non-performing loans. China had RMB2 trillion of NPLs in 2018, however many banks have even larger totals of “special mention loans”, which are NPLs in all but name. Fitch reckons the real total of NPLs could be RMB19tr and real estate is the collateral for a substantial proportion.

Private equity giants such as Bain Capital, Lone Star, PAG, Oaktree Capital and KKR have already been active in China, spending around $1.5bn in the past two years.

However, China NPL portfolios tend to be small and scale is important to NPL investors. Anecdotal evidence suggests the quality of NPL portfolios is mixed at best; there may be hundreds of loans secured on small assets in lower tier cities, where the headache and cost of debt recovery is a barrier to entry.

It may be that further action from the Chinese government is required to help NPL investors enforce loans and recover assets.

Outside China, the opportunities for debt investment are limited. The traumas of the Asian Financial Crisis meant that the region’s banks had strengthened their balance sheets in the run-up to the Global Financial Crisis. Combined with a low interest rate environment, this has led to a competitive lending market in most of the region, which is good for borrowers, but less good for those who want to lend.

A number of international investors had targeted India, where higher margin lending is available. However, the collapse last year of a non-bank finance company has taken all confidence out of the market.

Australia offered a window of opportunity for real estate investors but that window appears to be rapidly closing. A number of foreign and domestic private equity groups, including Partners Group and Invesco Real Estate, have been writing senior debt and mezzanine loans in Australia and at the beginning of this year, the opportunity looked wide open, as Australia’s big banks were looking to shift out of real estate.

However, Shrabastee Mallik, head of research for Australia and New Zealand at Savills, says a change of sentiment following a surprise win for the business-friendly Liberal Party in the recent Australian general election has changed the market dynamics.

“The indications are that the big banks are going to start lending again to residential real estate and this also means they will start lending more to commercial assets in order to diversify their portfolios.”

Further reading:

Savills China investment report

Contact us:

James Macdonald