Asia real estate no liability for insurers

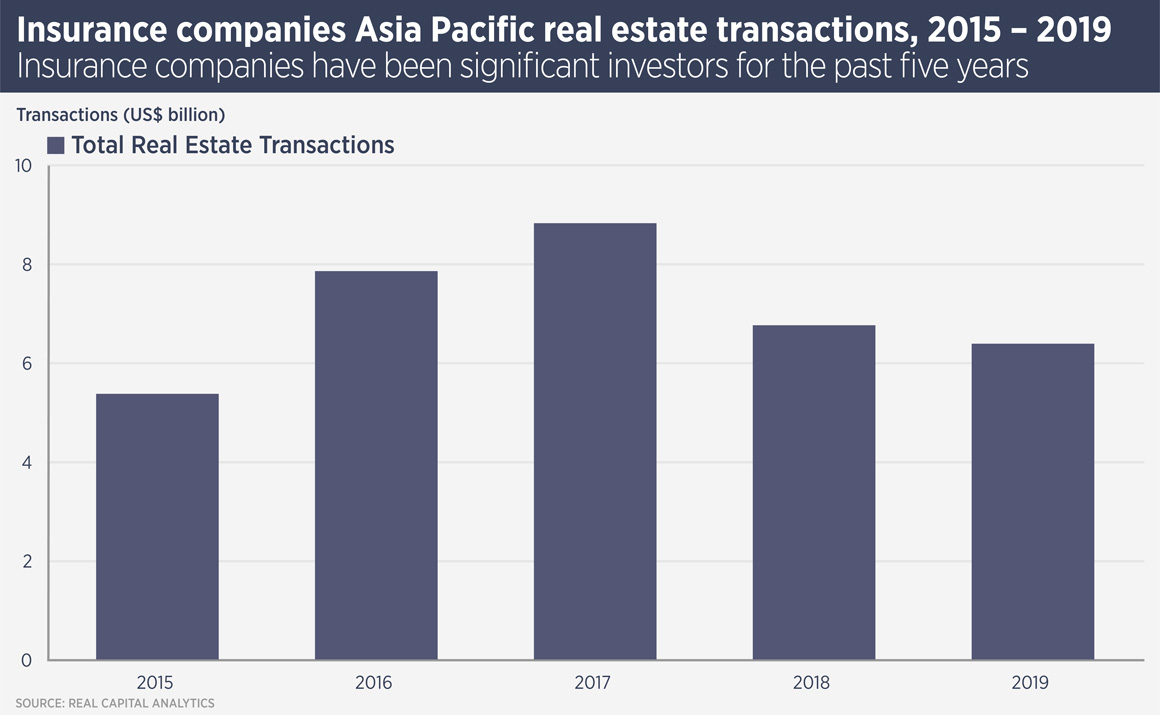

Insurance companies are major investors in real estate worldwide and are gradually increasing their activity in Asia Pacific; the importance of regulation and the long-term view is crucial to understanding them.

Callum Young, executive director, regional investment advisory, at Savills, says: “Insurance companies form a relatively small but significant part of the real estate investment landscape in Asia Pacific.

“International insurers are gradually expanding their portfolios in this region often through fund investments rather than buying assets directly. There is great growth potential in the Asian insurance business, but companies are relatively underexposed to real estate, especially cross-border investments.”

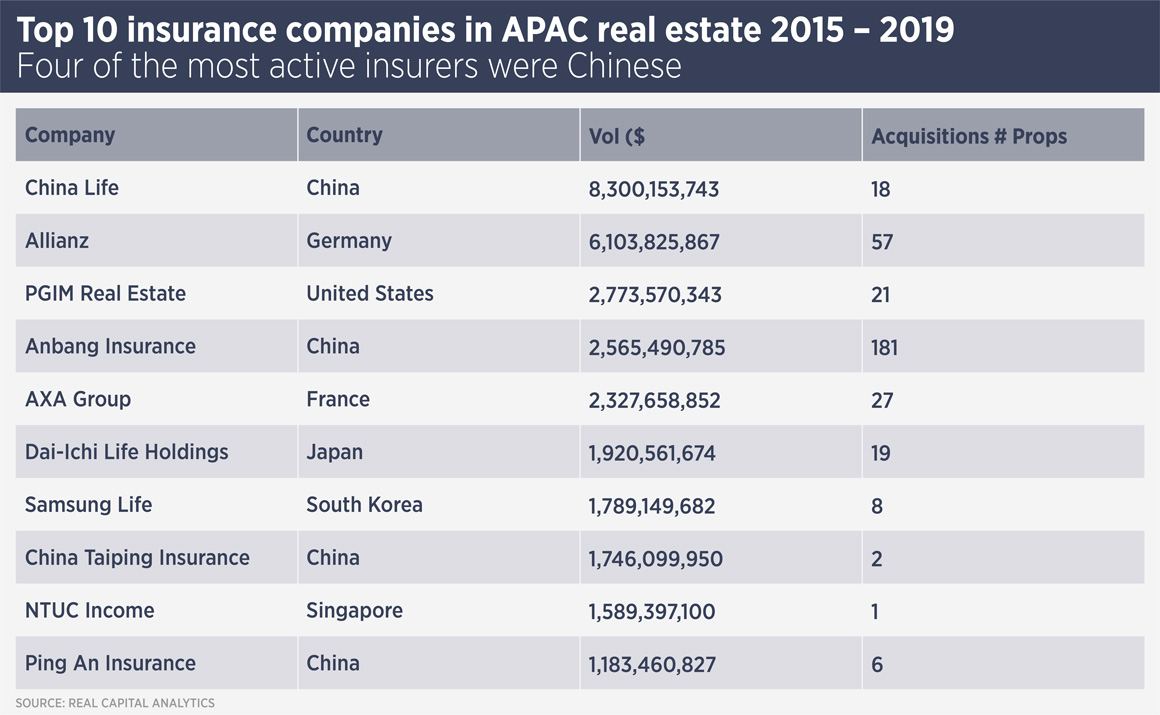

Some of the more active international insurers include Germany’s Allianz, which has invested in direct assets such as the Duo Tower and Galleria in Singapore (pictured above), which it bought for S$1.6 billion in a joint venture with Gaw Capital Partners. It has also invested with a number of real platforms in Asia, including logistics platforms GLP and ESR.

French group Axa has been active, while Zurich Insurance is understood to be keen to expand its Asia real estate holdings. The Prudential insurance groups of both the US and the UK have invested in funds managed by their linked investment management groups.

Chinese groups have been amongst the most active Asian insurers ( see table below) but are currently restricted to investing domestically. South Korean insurance companies have invested overseas, while Taiwanese insurers – which dominate their local real estate market – have made little heady due to onerous regulation. “Insurance companies are strictly regulated and understanding their regulatory restrictions is a key to dealing with them,” says Young. “The shorter lease lengths in Asia can also be a barrier to insurers investing in property here.”

In the longer term, says Young, there is huge potential for Asian insurers in real estate. Currently, insurance companies in Japan are under-allocated to real estate, especially foreign assets, while the fast-growing Indian market is still constrained by regulation. “A lot of this capital is likely to be allocated to pooled funds, but we also expect insurers will be buyers of partial stakes in core assets.” he says.

Eduard Wehry is head of business development Asia Pacific at PGIM Real Estate, whose clients include a number of insurers. “Generally, insurance companies see real estate as a long duration income-generating asset class for liability matching,” he says. “Real estate provides income, low volatility and is capital efficient under different risk-based capital (RBC) regimes.”

Insurance companies tend to target core direct assets in mature markets, as well as core fund investments and – increasingly – real estate debt, says Wehry. “Insurance companies have been key investors in many of the large Asia Pacific core funds set up in recent years.”

“While insurance companies may invest overseas for diversification purposes, they have most flexibility to invest where they have a local business and a local balance sheet,” says Wehry. Thus regional insurance companies have capital to invest in real estate in a number of markets in Asia Pacific, where they have a local insurance business.

“Chinese insurers are still restricted on overseas investments and so are investing domestically, which is good for China real estate, bringing more long-term institutional capital in the market. In the longer term we’d expect substantial overseas real estate investments from Chinese insurance companies.”

Allianz looks to the long term

German insurance group Allianz is a significant investor in real estate equity and debt worldwide and is focused on long term investments and relationships, says Megan Walters, global head of research at Allianz Real Estate. “Our primary focus is holding core, high quality assets in global gateway cities for the long term. As insurers our perspective is the long term which our partners value, and being insurers paying particular attention to the risk profile is in our corporate DNA; this includes assessment of ESG factors, which plays an important part in our long term view.”

The group has remained active this year, announcing debt and equity deals in the US, Europe and Asia Pacific, including the acquisition of a portfolio of 11 newly built residential assets with 275 apartments in Tokyo for €110m and a A$648m logistics portfolio deal.

“Throughout the recent period of market dislocation we have continued to deploy capital in the debt and the equity markets looking for resilient cash flow. One of the opportunities we see is in the sale and leaseback area as organizations look to find a long term partner to work with and raise cash from their real estate assets and focus on their core activity,” says Walters.

Planning for the long term in real estate means paying attention to ESG issues, says Walters. “Another key aspect is our focus on growing our allocation to certified green buildings, increasing use of renewable energy, energy efficient improvements and targeted engagement with tenants. In addition, active asset management is a fundamental part of how we add value to properties on a long-term basis, particularly with regards to the latest environmental standards and innovative technologies.”

Further reading:

Savills Regional Investment

Contact us:

Simon Smith