City lowdown: Adelaide

One of Australia’s smaller cities, Adelaide still packs a punch as a centre for defence, resources and as a burgeoning tourism destination.

The capital of South Australia, Adelaide is the sixth largest city with a population of 1.33m, out of a total population of 1.73m in the state. It is an important location for defence manufacturing and accounts for 32% of Australia’s defence industry. It is also an important location for the extraction of iron ore and uranium. South Australia is one of the nation’s prime wine areas and this helps attract domestic and foreign tourists, although numbers lag Sydney, Melbourne and Perth.

The city is keen to attract more tourists and continues to develop the Riverbank Precinct, along side the Torrens River. This district also includes areas devoted to the healthcare and education sectors, which the city is keen to expand.

Shrabastee Mallik, head of research at Savills Australia & New Zealand, says: “We are also going to see significant positive flow-on effects to the South Australian economy, with federal government spending on the new ship-building program expected to create thousands of direct and indirect jobs.

“Adelaide has not experienced the same level of compression as the eastern state markets and the wide yield spread which exists between the markets does suggest there is scope for further compression.”

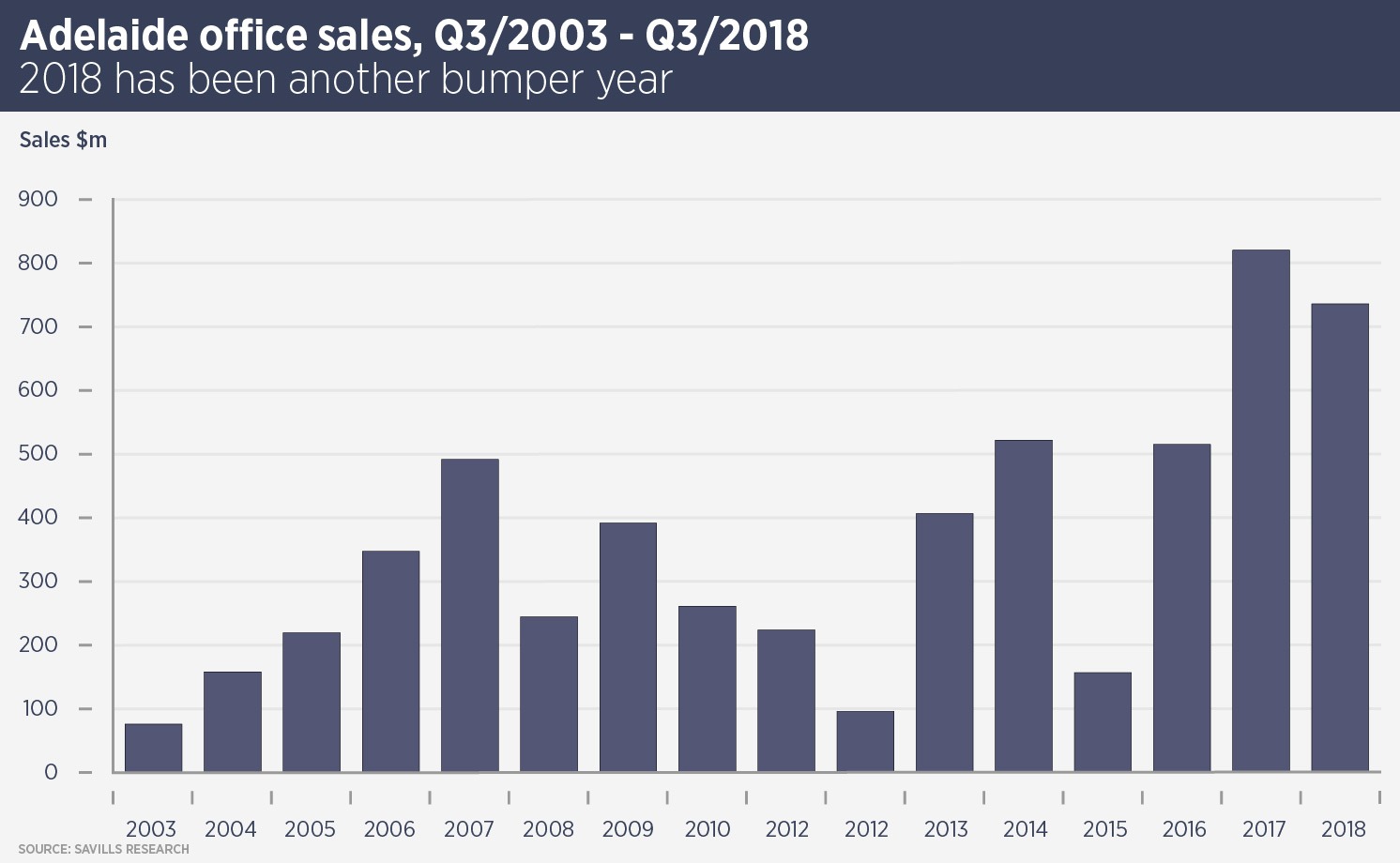

Sales volumes for Adelaide’s CBD markets were the second highest on record in the 12 months to September 2018, with approximately $735m of transactions recorded. Business confidence in South Australia was the highest of all states nationally in September while unemployment continues to fall.

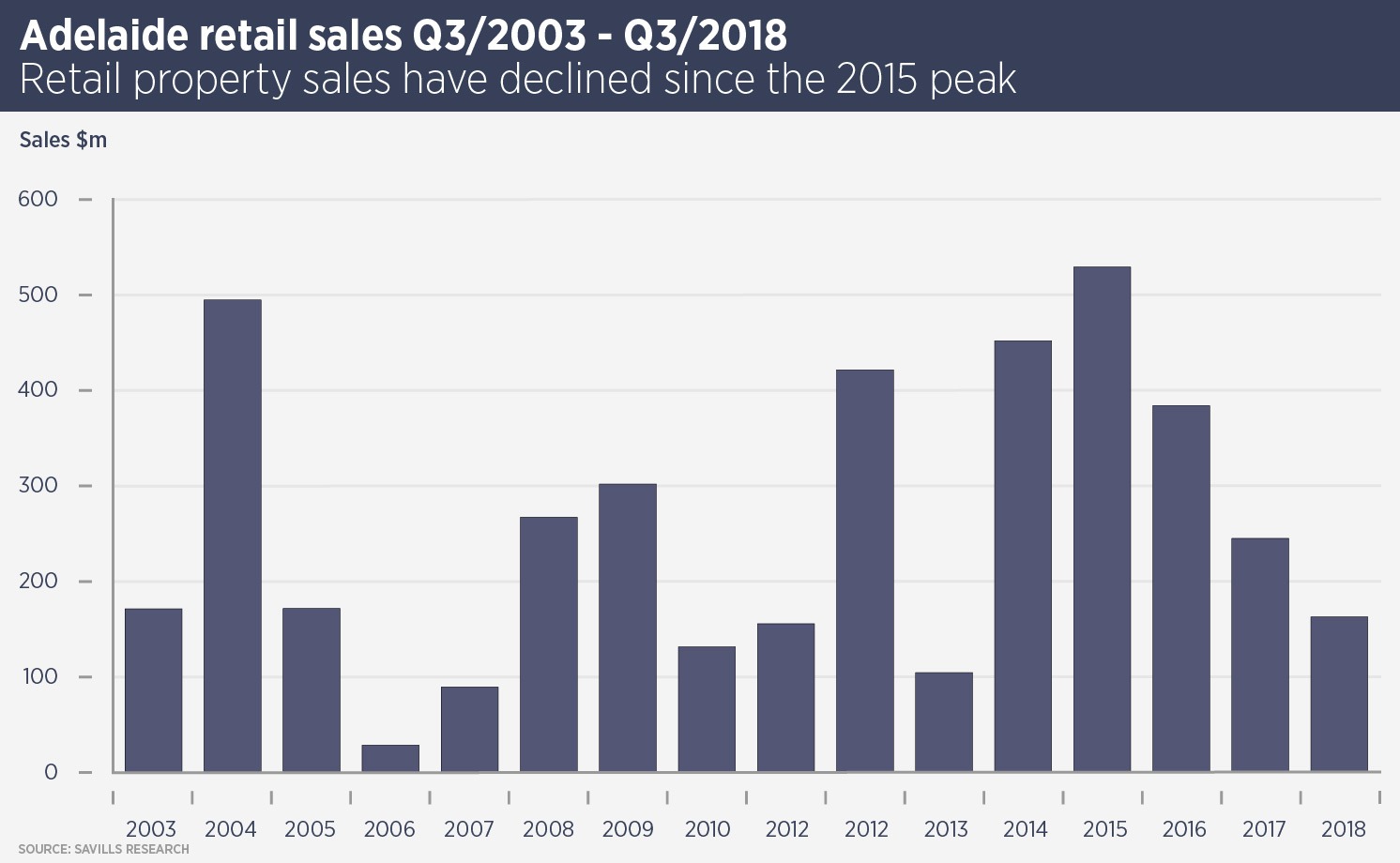

Adelaide’s retail sector is set for a boost with new legislation to extend trading hours. Sales of retail assets have slowed since a peak in 2015, when more than $500m of assets changed hands. Nonetheless, Adelaide retail continues to attract interest from domestic and overseas buyers. Savills is selling a vacant six-storey building at Rundle Mall, which is expected to fetch in excess of A$10m.

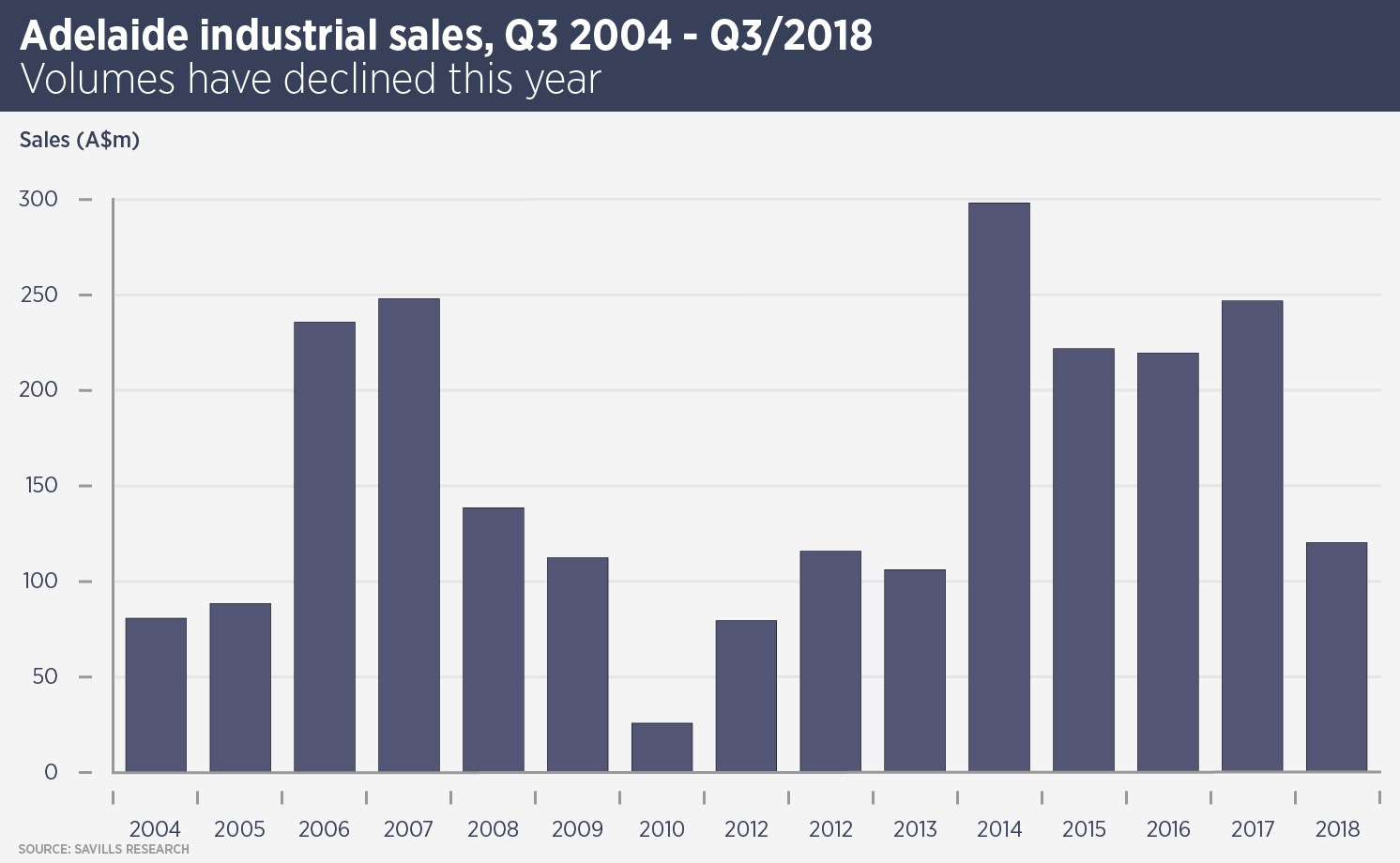

Industrial property sales volumes have declined from their recent peak, while prime industrial yields have compressed 100 basis points over the past two years but are still higher than in larger cities and Mallik says: “There remains scope for further yield compression over the next 12 months.”

Further reading:

Savills Australia

Contact us:

Simon Smith