Senior Singapore

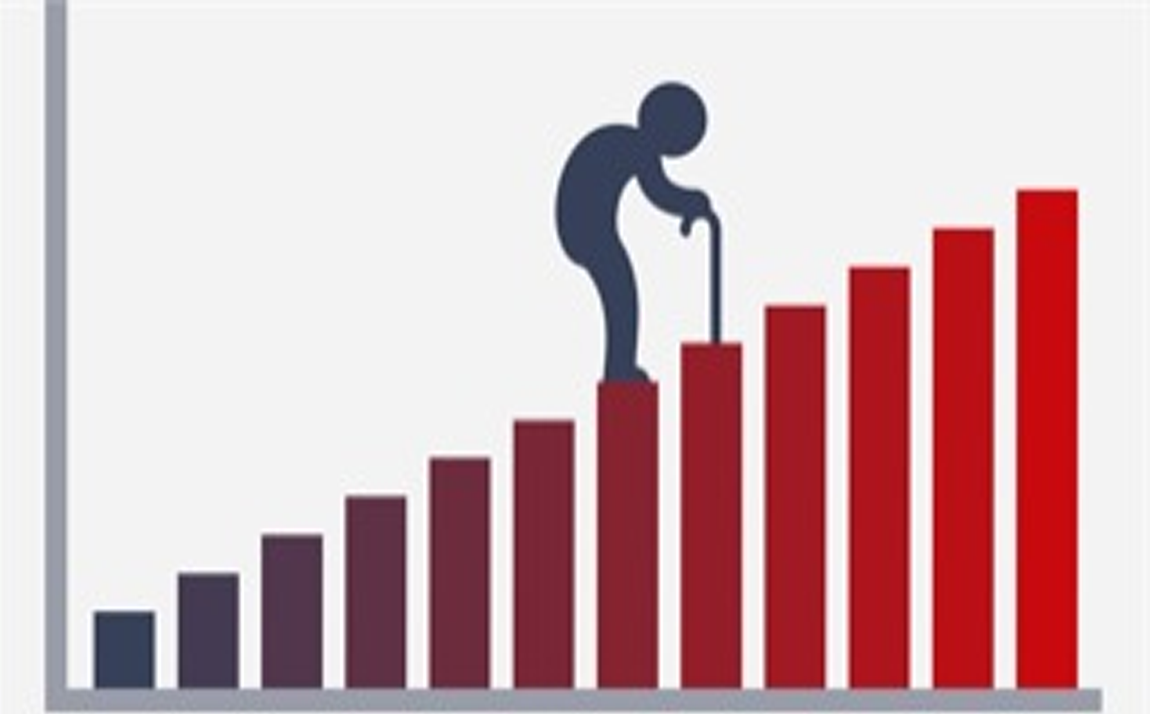

Singapore is leading the way to developing an ageing-positive city. The UN estimates that one in four people in the Asia Pacific region will be aged over 60 by 2050, a total of 1.3 billion people.

Singapore is leading the way to developing an ageing-positive city.

The UN estimates that one in four people in the Asia Pacific region will be aged over 60 by 2050, a total of 1.3 billion people. This will produce a number of challenges and opportunities for the region’s cities.

While Japan remains the region’s (and the world’s) ‘oldest’ nation, Singapore is on a similar trajectory and by 2030, one quarter of its population will be aged over 65. As is typical in the region, families were always the first line of support for elderly people in Singapore, however this is no longer the case.

Speaking at the ULI Asia Pacific Summit earlier this year, Charlene Chang, group director of the Ageing Planning Office in Singapore’s Ministry of Health, said: “Shrinking family sizes and the ageing population mean we will have at least 10% of our elderly living alone by 2030.”

In 2015, Singapore launched the Action Plan for Successful Ageing, which aims not just to create accommodation for older people, but to make the city work for people of all ages. It is set to be refreshed and relaunched next year. An important part of Singapore’s ageing plan is the idea that older people remain part of the community, through work, education or volunteering.

John Liu, associate director, research and consultancy, at Savills Singapore, says: “Singapore’s Urban Redevelopment Authority (URA) has been exploring how design initiatives across the city can create an age-friendly environment. This means not just providing senior living accommodation, but focusing on wider aspects such as: safety, walkability, inclusive transportation, engagement and inclusivity and a therapeutic environment.

“Master planning and residential land tenders requiring concept proposals are required by the URA to incorporate design features which work for all ages.”

In Singapore, the government releases state land to the private sector for development through the Government Land Sales Programme, giving developers some flexibility and discretion in deciding the use and positioning for the land, including elements that cater to senior living. Liu says: “For independent senior living, the authorities have generally undertaken a market-led approach, providing private developers flexibility to determine their product offerings,” he says.

Examples include The Hillford, informally billed as Singapore’s first private retirement housing project and Qingjan Realty’s Jadescape, a 1,206-unit private residential development that promotes multi-generational living, which offers 63 “Gold Standard” units fitted out with active senior living features. On a smaller scale, the three St Bernadette Lifestyle Villages use converted homes to care for a small number of residents, with staff on hand.

“The government has also been more pro-active on the assisted living front, pushing out new concepts such as the Community Care Apartments at Bukit Batok, which integrate senior-friendly housing with care services that can be scaled according to care needs,” Liu adds.

It is often stated that Asia has a huge demand for senior housing. However, research by Singapore’s Ministry of Health found older people overwhelmingly wanted to ‘age in place’, either in their own homes or in their local communities. Similarly, in Europe there is an increasing trend to support elderly people in their own homes, which allows them to remain in their communities and reduces the cost of care.

This perhaps indicates that more adaptable residential developments, which accommodate a range of ages may be a good way for real estate to tap into the growing ‘silver’ market in the region. It is not just Asia’s Millennials who demand flexibility.

Further reading:

Savills Singapore Research

Contact us:

Simon Smith