Go East for growth in Australian offices

If you thought the office markets in Sydney and Melbourne couldn’t get any hotter, Blackstone Group has just proven you wrong.

However, the US private equity giant’s dramatic move is backed by strong market fundamentals.

The world’s biggest real estate investor had its A$3.14bn, A$5.25 per share cash offer for Investa Office Fund (IOF) unanimously recommended by Investa in June. The bid is more than A$500m higher than an unsuccessful bid made by Dexus in 2016, however market rumour has suggested the Australian manager might try again with an even weightier bid.

Not all IOF investors will back the offer. APN Property has said it will vote against the Blackstone proposal when it comes before IOF investors in August. APN said there was “hidden value” in the stock, due to a “roaring” office market in Sydney and Melbourne.

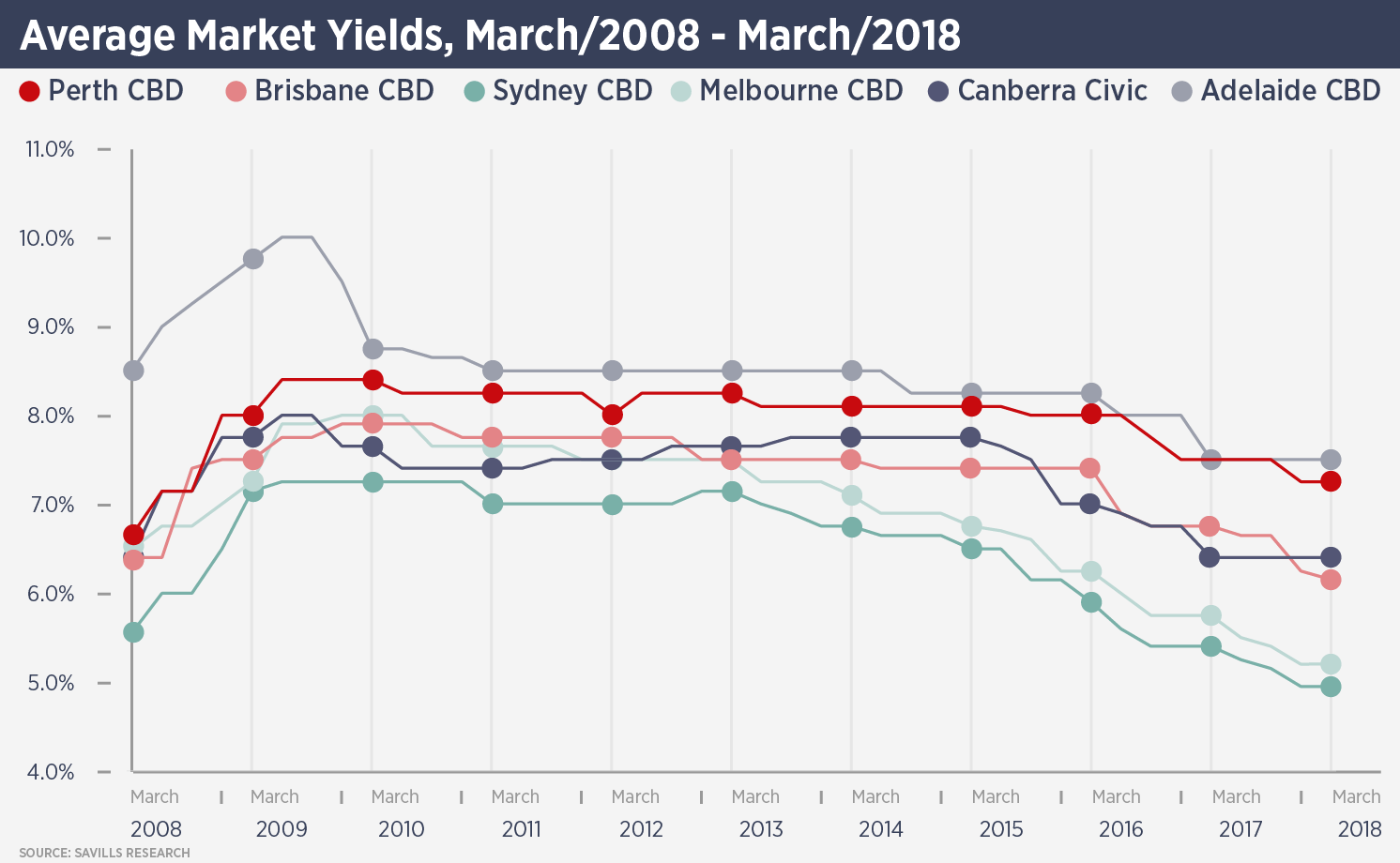

The Blackstone offer price implies a weighted average capitalisation rate of 5.55% for the fund’s $4bn portfolio of office assets. However, the fund’s Sydney CBD and Melbourne assets have implied cap rates of 5% and below, a premium of 100 basis points to assets in other Australian cities.

Savills puts average prime CBD office yields in Sydney at 4.95% and Melbourne at 5.2%, well below the last peak in 2007. Melbourne CBD capital values average A$10,000 per sq m, compared with just over A$6,000 in 2007. In Sydney, capital values are heading towards A$20,000, compared with more than A$12,000 in 2007.

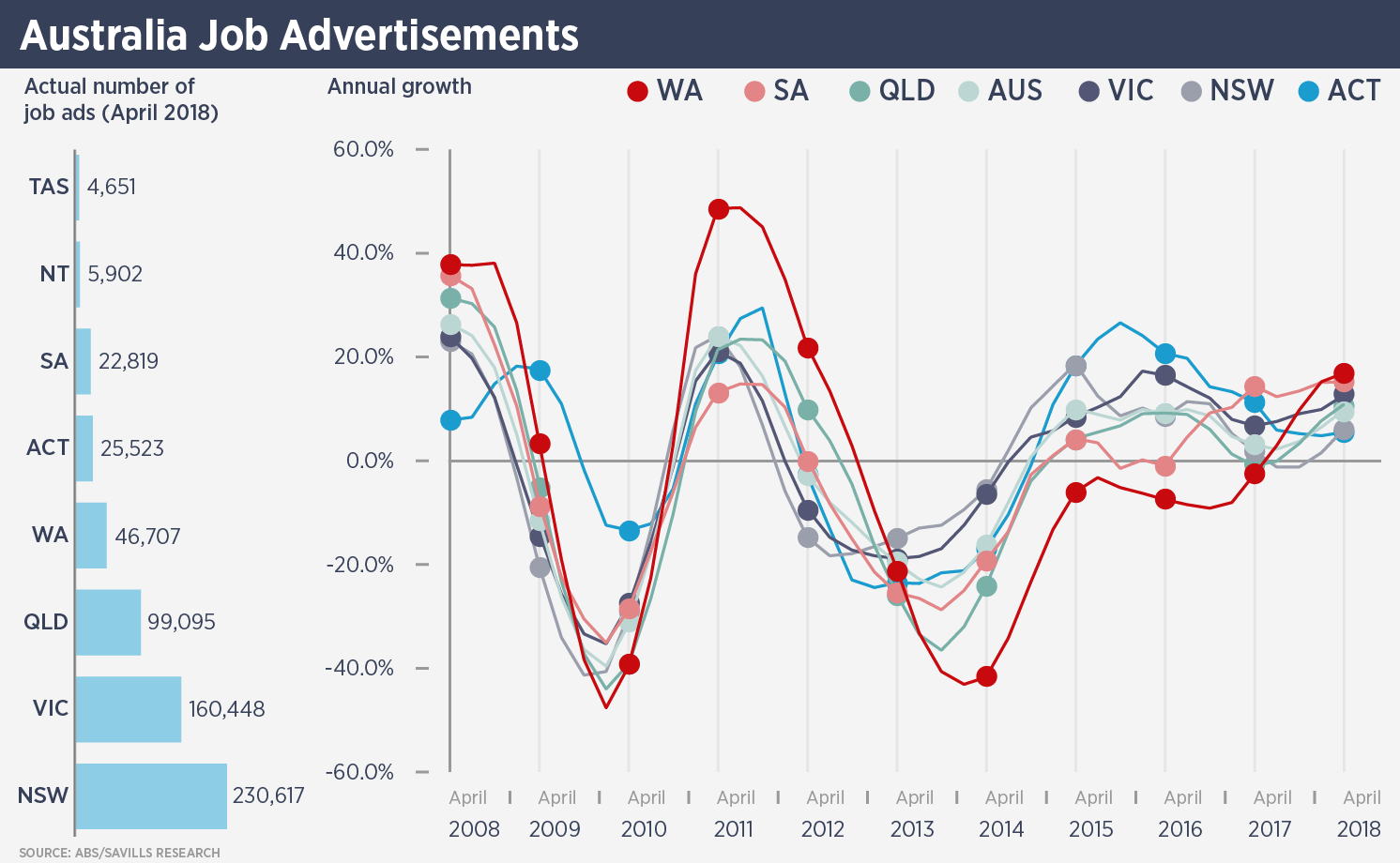

The attraction for Blackstone is the growth prospects for those Sydney and Melbourne assets, which make up 79% of the portfolio by value. In particular Sydney is entering a perfect storm of rising employment and falling vacancy, with little supply between now and 2019.

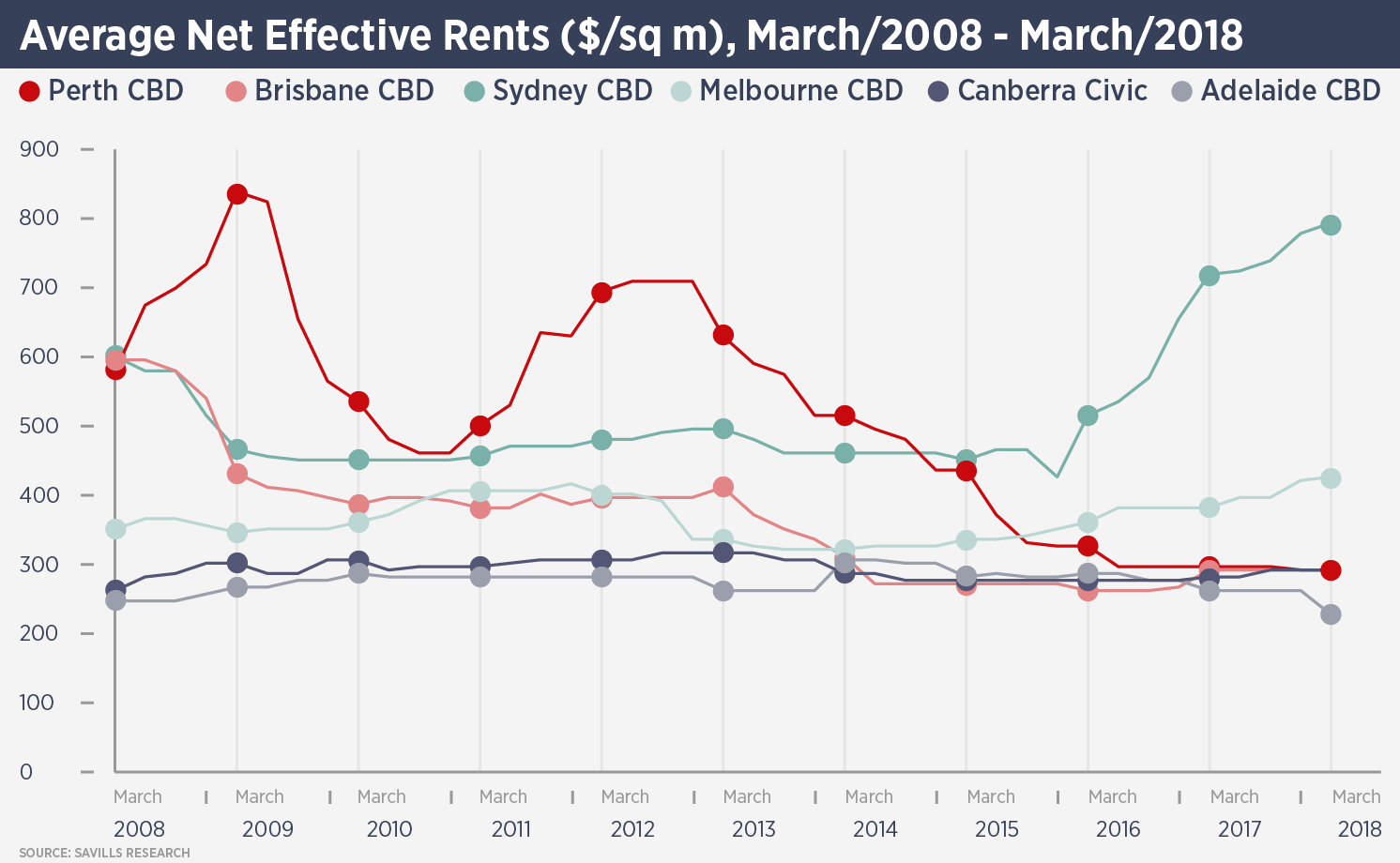

Sydney CBD Grade A net effective rents rose 19.6% in the 12 months to March 2018 and with 230,000 job vacancies being advertised in New South Wales, demand for office space is set to remain strong.

Shrabastee Mallik, associate director, capital strategy at Savills Australia, says: “Whilst it appears that the yield compression cycle in Sydney’s CBD is nearing a floor, we believe that there is still further room for compression given the current spread and positive tenancy outlook.”

Mallik adds that investors are increasingly targeting Sydney CBD’s Grade B office market, driving up values of secondary grade buildings at a more pronounced rate than prime grade buildings in the year to March. Whilst Grade A capital values grew 14% in that time, Grade B capital values rocketed 36.6%.

A similar story prevails in Melbourne. Ben Parkinson, director, capital transactions at Savills Victoria, says: “There is a lack of quality stock currently available in the Melbourne market and thus significant upward pressure on rents across all grades. There is limited new stock to be delivered prior to 2020 so we will see these conditions continue for the foreseeable future.

“There is also significant international capital competing with local capital here” in Melbourne.”

Further reading:

Savills Research Briefing – Sydney CBD Office Q1 2018

Savills Research Briefing – Melbourne CBD Office Q1 2018

Contact us:

Simon Smith